Answered step by step

Verified Expert Solution

Question

1 Approved Answer

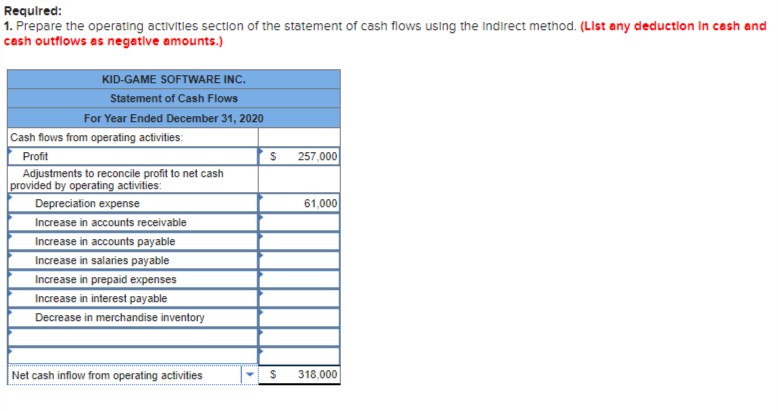

Exercise 16-3 Calculating cash flows from operating activities (indirect method) LO5 The account balances for the non-cash current assets and current liabilities of Kid-game Software

Exercise 16-3 Calculating cash flows from operating activities (indirect method) LO5

The account balances for the non-cash current assets and current liabilities of Kid-game Software Inc. are as follows:

| December 31 | ||||||

| 2020 | 2019 | |||||

| Accounts receivable | $ | 131,000 | $ | 110,100 | ||

| Inventory | 93,100 | 125,100 | ||||

| Prepaid expenses | 55,200 | 50,600 | ||||

| Totals | $ | 279,300 | $ | 285,800 | ||

| Accounts payable | $ | 89,000 | $ | 68,400 | ||

| Salaries payable | 26,700 | 38,900 | ||||

| Interest payable | 50,600 | 41,700 | ||||

| Totals | $ | 166,300 | $ | 149,000 | ||

During 2020, Kid-game Software Inc. reported depreciation expense of $61,000. All purchases and sales are on account. Profit for 2020 was $257,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started