Answered step by step

Verified Expert Solution

Question

1 Approved Answer

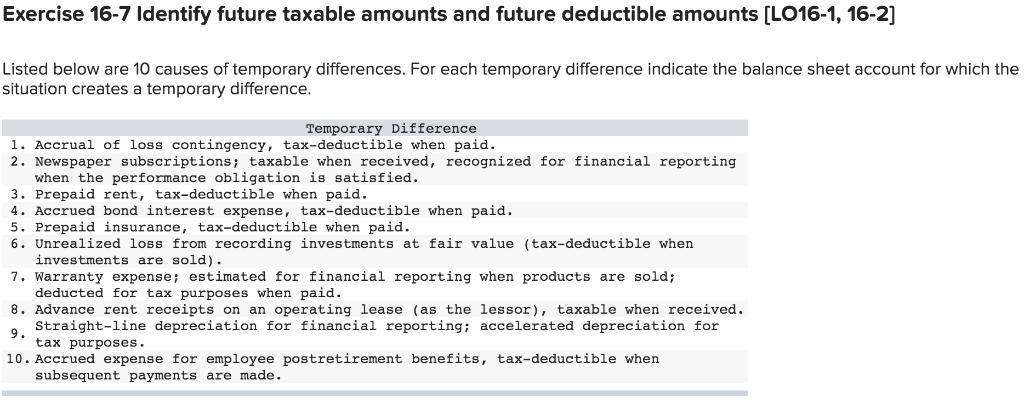

Exercise 16-7 ldentify future taxable amounts and future deductible amounts [LO016-1, 16-2] Listed below are 10 causes of temporary differences. For each temporary difference indicate

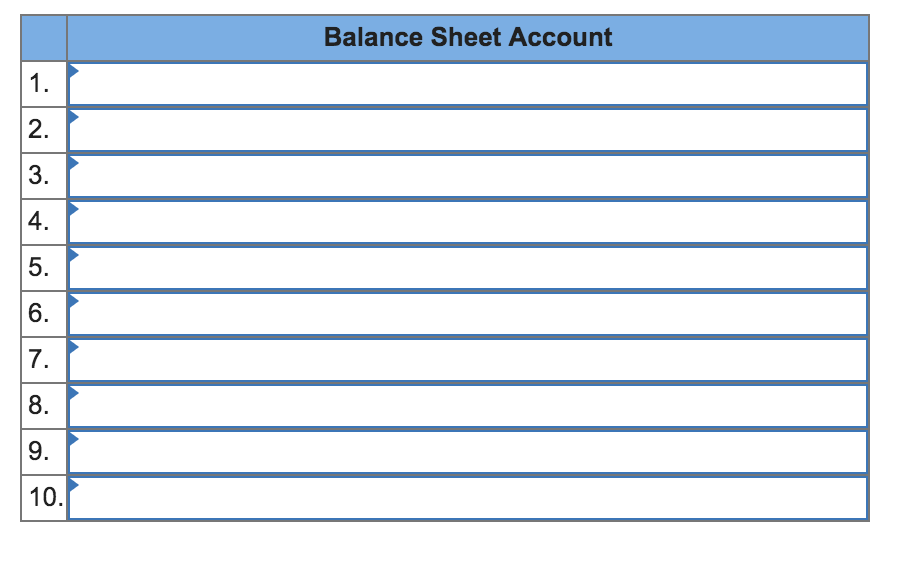

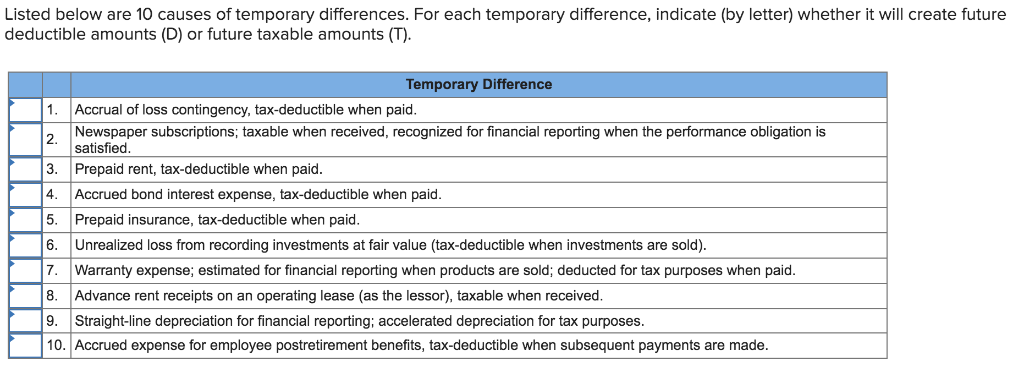

Exercise 16-7 ldentify future taxable amounts and future deductible amounts [LO016-1, 16-2] Listed below are 10 causes of temporary differences. For each temporary difference indicate the balance sheet account for which the situation creates a temporary difference Temporary Difference 1. Accrual of loss contingency, tax-deductible when paid. 2. Newspaper subscriptions; taxable when received, recognized for financial reporting when the performance obligation is satisfied. 3. Prepaid rent, tax-deductible when paid. 4. Accrued bond interest expense, tax-deductible when paid. 5. Prepaid insurance, tax-deductible when paid. 6. Unrealized loss from recording investments at fair value (tax-deductible when investments are sold). deducted for tax purposes when paid. Straight-line depreciation for financial reporting; accelerated depreciation for 7. Warranty expense; estimated for financial reporting when products are sold; 8. Advance rent receipts on an operating lease (as the lessor), taxable when received. tax purposes. 10. Accrued expense for employee postretirement benefits, tax-deductible when subsequent payments are made. Balance Sheet Account 1. 2. 3. 4 5. 6. 7. 8. 9. 10. Listed below are 10 causes of temporary differences. For each temporary difference, indicate (by letter) whether it will create future deductible amounts (D) or future taxable amounts (T) Temporary Difference 1. Accrual of loss contingency, tax-deductible when paid Newspaper subscriptions taxable when received, recognized for financial reporting when the performance obligation is 2.satisfied. 3. Prepaid rent, tax-deductible when paid. 4. Accrued bond interest expense, tax-deductible when paid 5. Prepaid insurance, tax-deductible when paid 6. Unrealized loss from recording investments at fair value (tax-deductible when investments are sold) 7. Warranty expense; estimated for financial reporting when products are sold; deducted for tax purposes when paid. 8. Advance rent receipts on an operating lease (as the lessor), taxable when received. 9. Straight-line depreciation for financial reporting; accelerated depreciation for tax purposes. 10. Accrued expense for employee postretirement benefits, tax-deductible when subsequent payments are made

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started