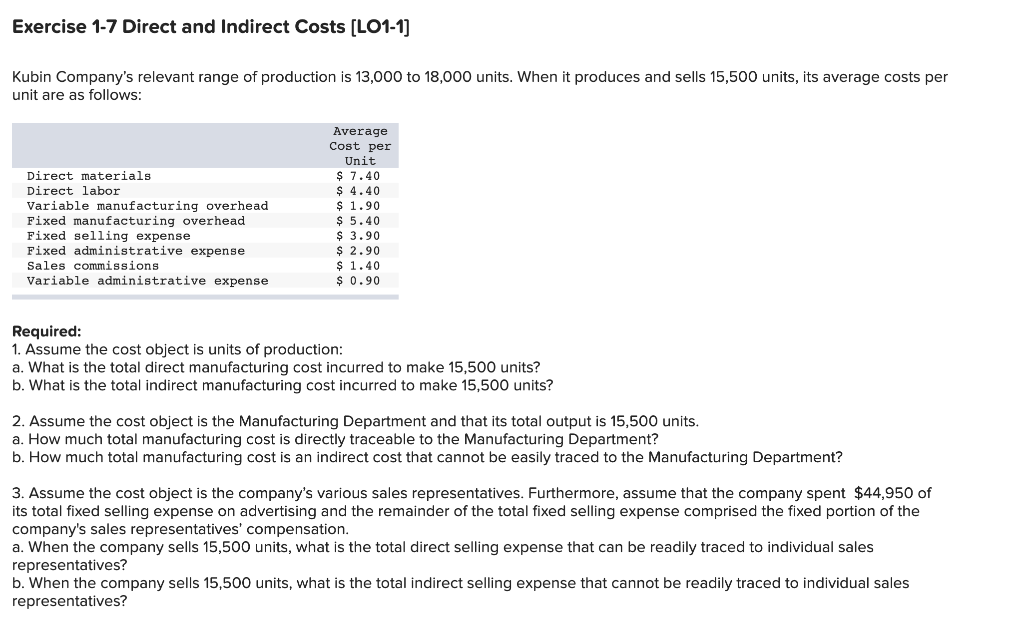

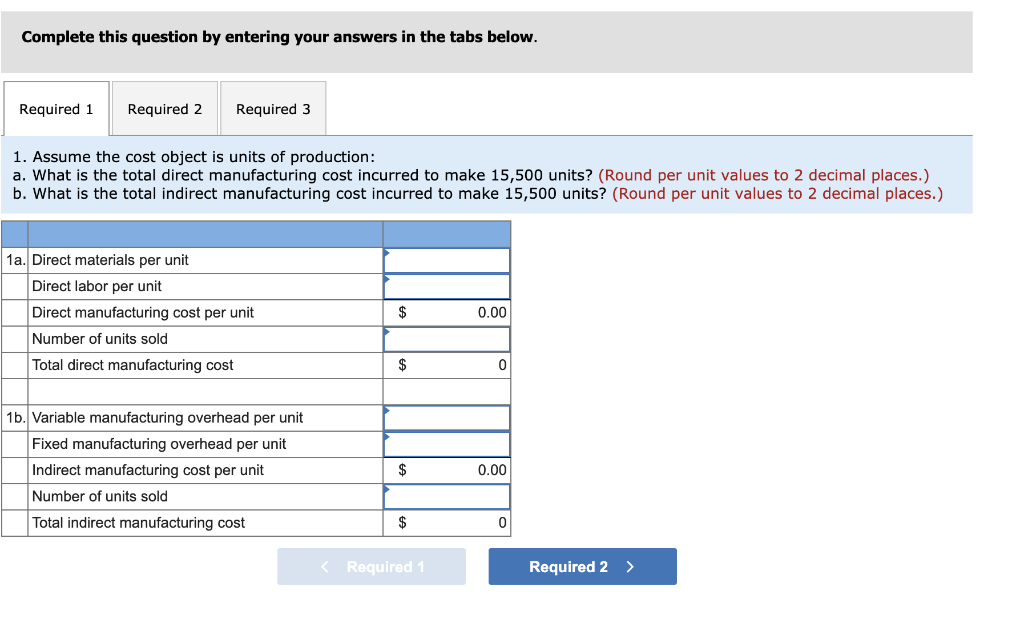

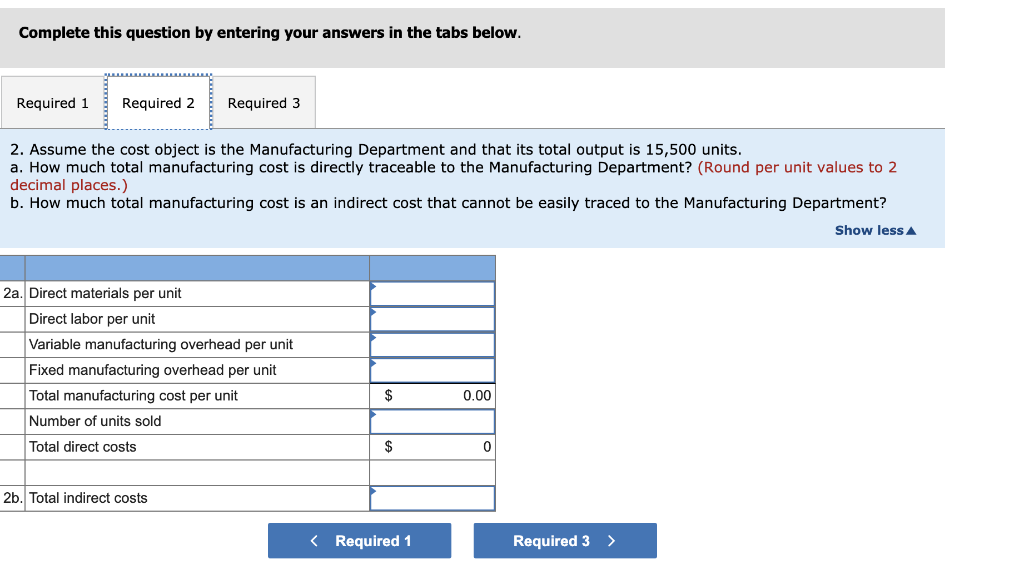

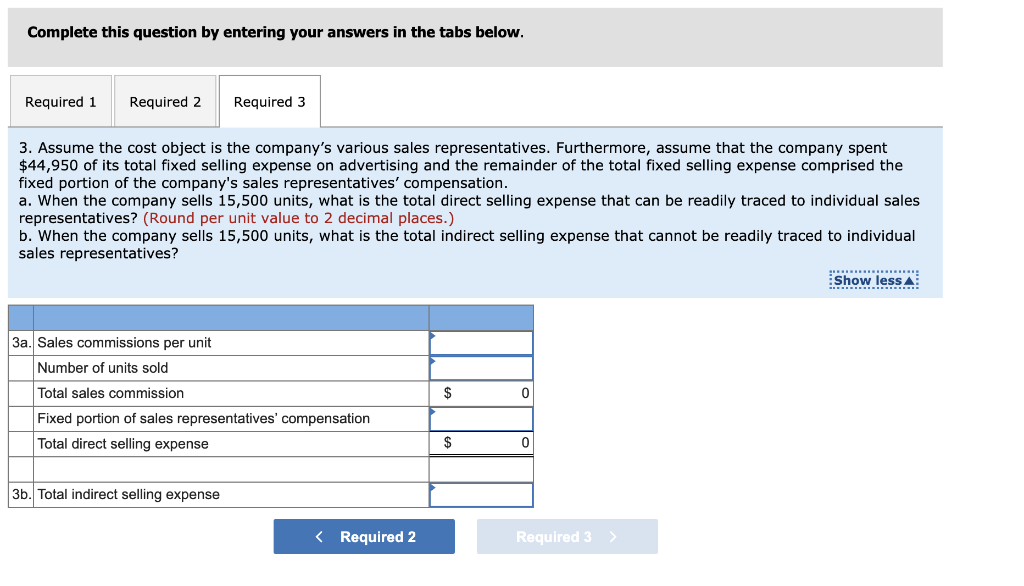

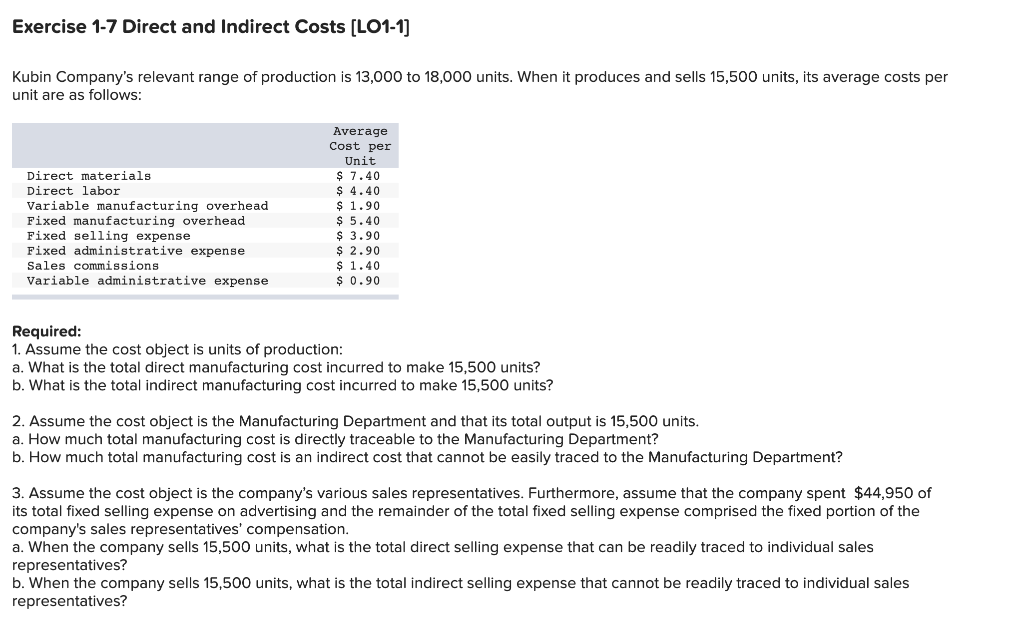

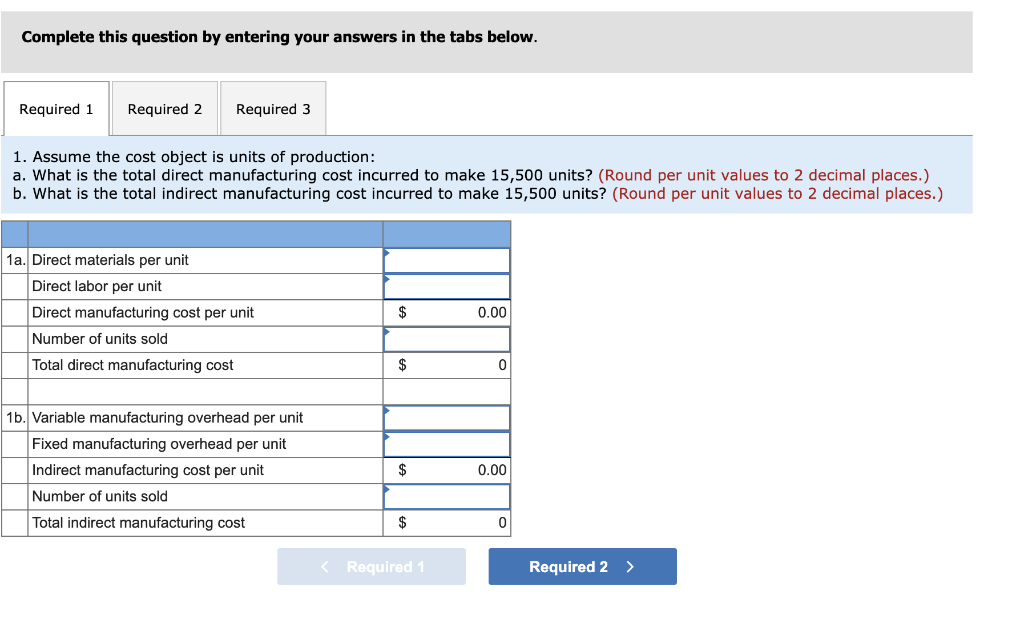

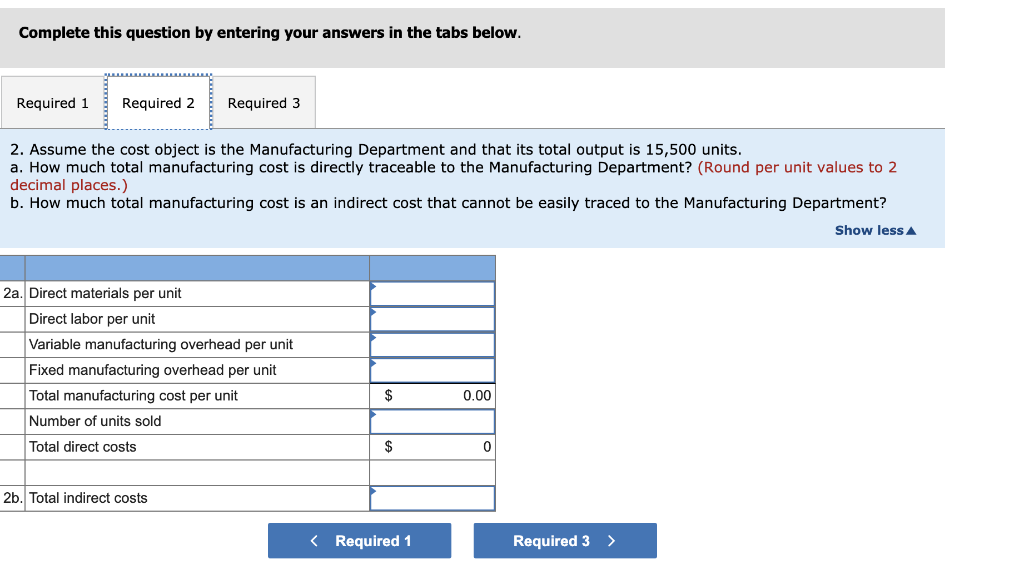

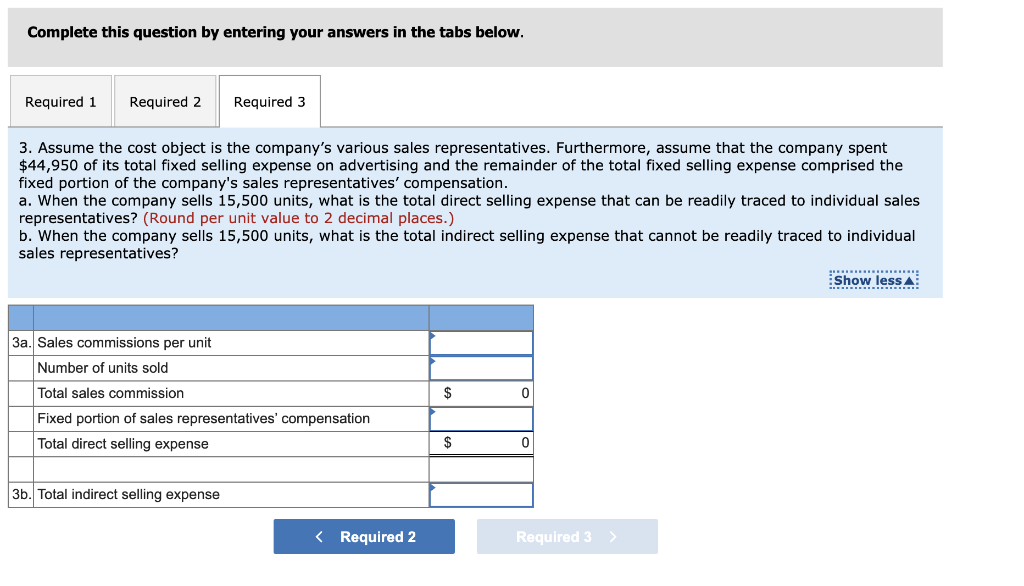

Exercise 1-7 Direct and Indirect Costs [LO1-1) Kubin Company's relevant range of production is 13,000 to 18,000 units. When it produces and sells 15,500 units, its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Average Cost per Unit $ 7.40 $ 4.40 $ 1.90 $ 5.40 $ 3.90 $ 2.90 $ 1.40 $ 0.90 Required: 1. Assume the cost object is units of production: a. What is the total direct manufacturing cost incurred to make 15,500 units? b. What is the total indirect manufacturing cost incurred to make 15,500 units? 2. Assume the cost object is the Manufacturing Department and that its total output is 15,500 units. a. How much total manufacturing cost is directly traceable to the Manufacturing Department? b. How much total manufacturing cost is an indirect cost that cannot be easily traced to the Manufacturing Department? 3. Assume the cost object is the company's various sales representatives. Furthermore, assume that the company spent $44,950 of its total fixed selling expense on advertising and the remainder of the total fixed selling expense comprised the fixed portion of the company's sales representatives' compensation. a. When the company sells 15,500 units, what is the total direct selling expense that can be readily traced to individual sales representatives? b. When the company sells 15,500 units, what is the total indirect selling expense that cannot be readily traced to individual sales representatives? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 1. Assume the cost object is units of production: a. What is the total direct manufacturing cost incurred to make 15,500 units? (Round per unit values to 2 decimal places.) b. What is the total indirect manufacturing cost incurred to make 15,500 units? (Round per unit values to 2 decimal places.) 1a. Direct materials per unit Direct labor per unit Direct manufacturing cost per unit Number of units sold Total direct manufacturing cost $ 0.00 $ 0 16. Variable manufacturing overhead per unit Fixed manufacturing overhead per unit Indirect manufacturing cost per unit Number of units sold Total indirect manufacturing cost $ 0.00 $ 0 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 2. Assume the cost object is the Manufacturing Department and that its total output is 15,500 units. a. How much total manufacturing cost is directly traceable to the Manufacturing Department? (Round per unit values to 2 decimal places.) b. How much total manufacturing cost is an indirect cost that cannot be easily traced to the Manufacturing Department? Show less 2a. Direct materials per unit Direct labor per unit Variable manufacturing overhead per unit Fixed manufacturing overhead per unit Total manufacturing cost per unit Number of units sold $ 0.00 Total direct costs $ 0 2b. Total indirect costs Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 3. Assume the cost object is the company's various sales representatives. Furthermore, assume that the company spent $44,950 of its total fixed selling expense on advertising and the remainder of the total fixed selling expense comprised the fixed portion of the company's sales representatives' compensation. a. When the company sells 15,500 units, what is the total direct selling expense that can be readily traced to individual sales representatives? (Round per unit value to 2 decimal places.) b. When the company sells 15,500 units, what is the total indirect selling expense that cannot be readily traced to individual sales representatives? Show less 3a. Sales commissions per unit Number of units sold Total sales commission Fixed portion of sales representatives' compensation Total direct selling expense $ 0 $ 0 3b. Total indirect selling expense