Answered step by step

Verified Expert Solution

Question

1 Approved Answer

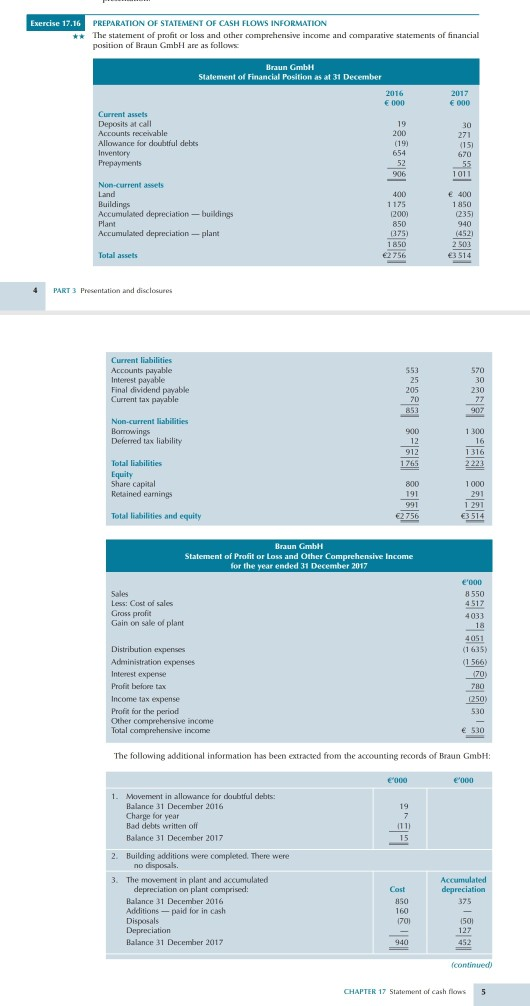

Exercise 17.16 PREPARATION OF STATEMENT OF CASH FLOWS INFORMATION ** The statement of profit or loss and other comprehensive income and comparative statements of financial

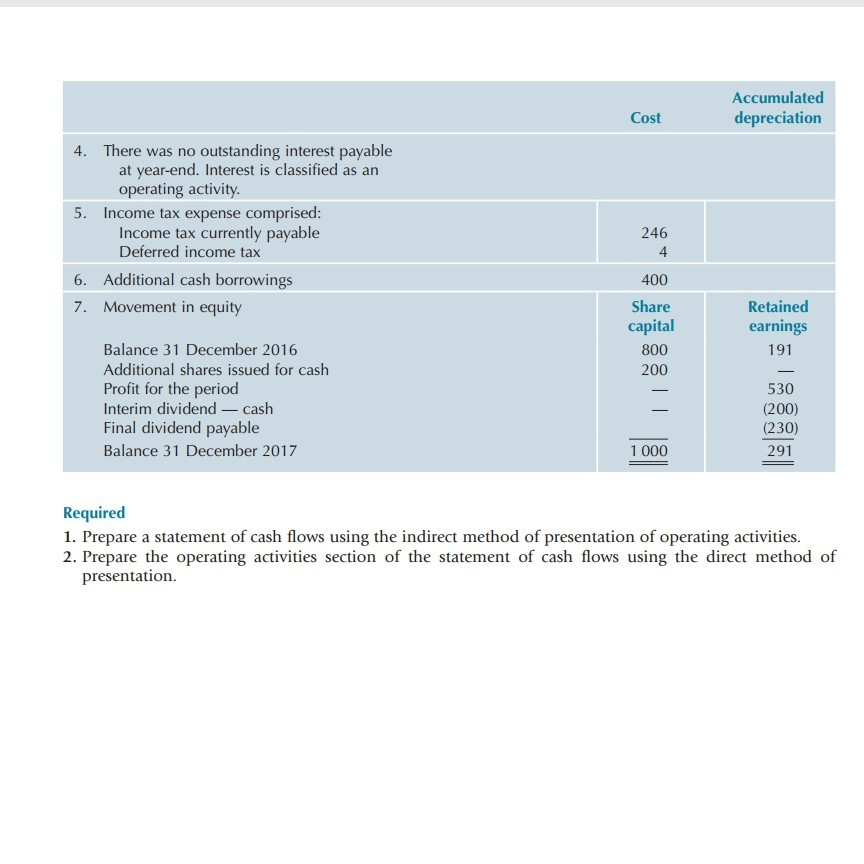

Exercise 17.16 PREPARATION OF STATEMENT OF CASH FLOWS INFORMATION ** The statement of profit or loss and other comprehensive income and comparative statements of financial position of Braun Gmbll are as follows: Braun GmbH Statement of Financial Position as at 31 December 2016 000 2017 000 Current assets Deposits at call Accounts receivable Allowance for doubtful debts Inventory Prepayments 19 200 (19) 654 52 906 30 271 151 670 55 1011 Non-current assets Land Buildings Accumulated depreciation - buildings Plant Accumulated depreciation - plant 400 1175 1200) 850 (375) 1850 2756 400 1850 (2357 940 (452) 2503 63 514 31 Total assets 4 PART 3 Presentation and disclosures Current liabilities Accounts payable Interest payable Final dividend payable Current tax payable 553 25 205 70 853 570 30 230 77 907 Non-current liabilities Borrowings Deferred tax liability 900 12 912 1 765 1.300 16 1316 2223 Total liabilities Equity Share capital Retained earnings 800 191 991 2756 1000 291 1 291 63514 Total liabilities and equity Braun GmbH Statement of Profit or loss and Other Comprehensive Income for the year ended 31 December 2017 Sales Less: Cost of sales Gross profit Gain on sale of plant Distribution expenses Administration expenses Interest expense Profit before tax Income tax expense Profit for the period Other comprehensive income Total comprehensive income E'000 8550 4517 4033 18 4051 (1 635) (1 566) 70 780 (250) 530 530 The following additional information has been extracted from the accounting records of Braun GmbH: 000 e'000 19 7 1111 15 - 1. Movement in allowance for doubtful debts: Balance 31 December 2016 Charge for year Bad debts written oll Balance 31 December 2017 2. Building additions were completed. There were no disposals. 3. The movement in plant and accumulated depreciation on plant comprised: Balance 31 December 2016 Additions -paid for in cash Disposals Depreciation Balance 31 December 2017 Accumulated depreciation 375 Cost 250 160 1701 1501 127 452 940 continued CHAPTER 17 Statement of cash flows 5 Cost Accumulated depreciation 4. There was no outstanding interest payable at year-end. Interest is classified as an operating activity. 5. Income tax expense comprised: Income tax currently payable Deferred income tax 6. Additional cash borrowings 7. Movement in equity 246 4 400 Share capital 800 200 Retained earnings 191 Balance 31 December 2016 Additional shares issued for cash Profit for the period Interim dividend cash Final dividend payable Balance 31 December 2017 530 (200) (230) 291 1 000 Required 1. Prepare a statement of cash flows using the indirect method of presentation of operating activities. 2. Prepare the operating activities section of the statement of cash flows using the direct method of presentation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started