Answered step by step

Verified Expert Solution

Question

1 Approved Answer

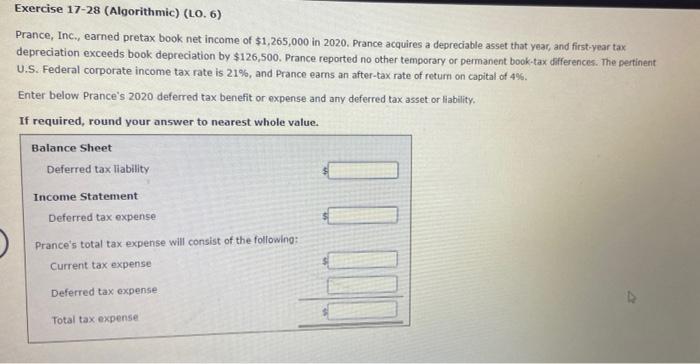

Exercise 17-28 (Algorithmic) (LO. 6) Prance, Inc., earned pretax book net income of $1,265,000 in 2020. Prance acquires a depreciable asset that year, and

Exercise 17-28 (Algorithmic) (LO. 6) Prance, Inc., earned pretax book net income of $1,265,000 in 2020. Prance acquires a depreciable asset that year, and first-year tax depreciation exceeds book depreciation by $126,500. Prance reported no other temporary or permanent book-tax differences. The pertinent U.S. Federal corporate income tax rate is 21%, and Prance earns an after-tax rate of return on capital of 4%. Enter below Prance's 2020 deferred tax benefit or expense and any deferred tax asset or liability. If required, round your answer to nearest whole value. Balance Sheet Deferred tax liability Income Statement Deferred tax expense Prance's total tax expense will consist of the following: Current tax expense Deferred tax expense Total tax expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started