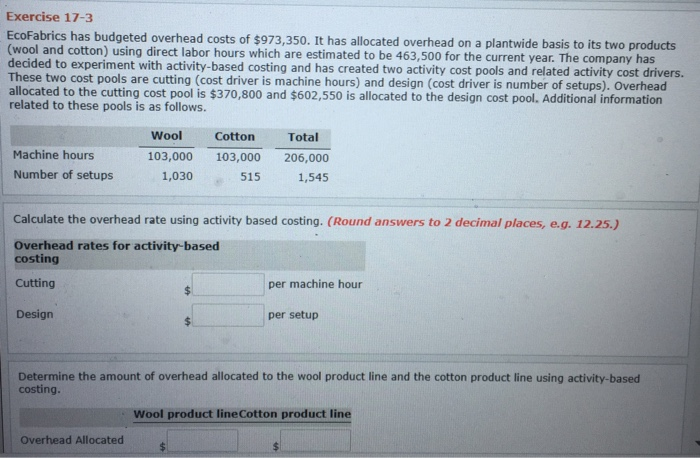

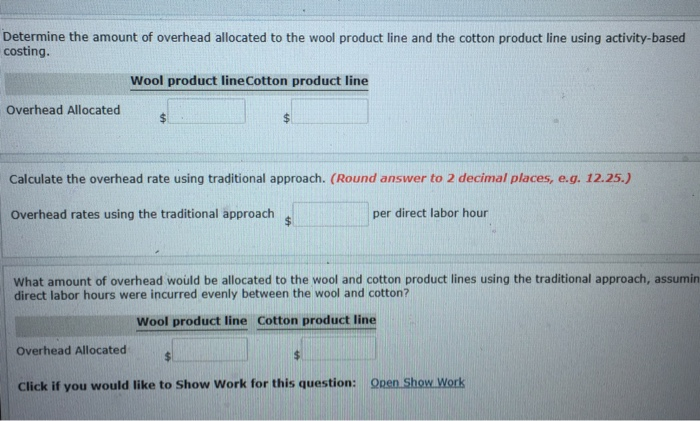

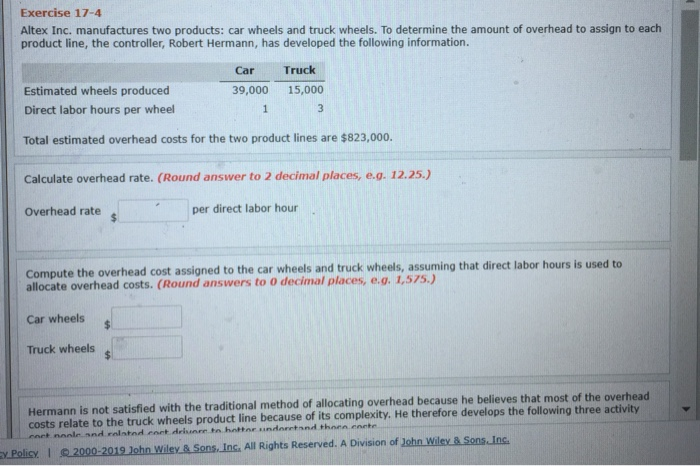

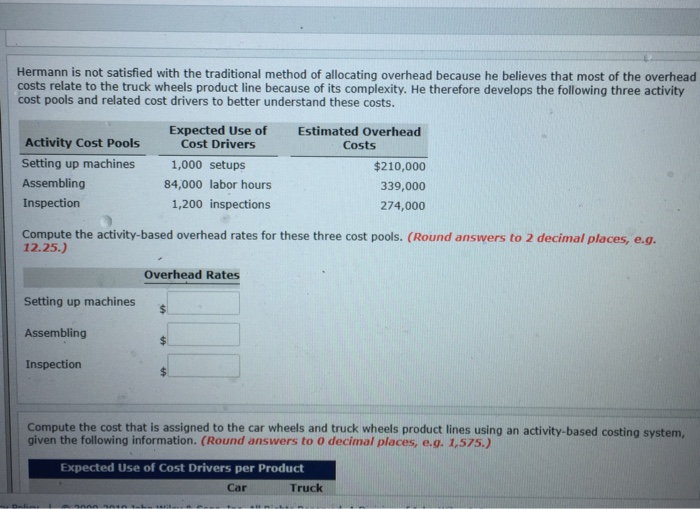

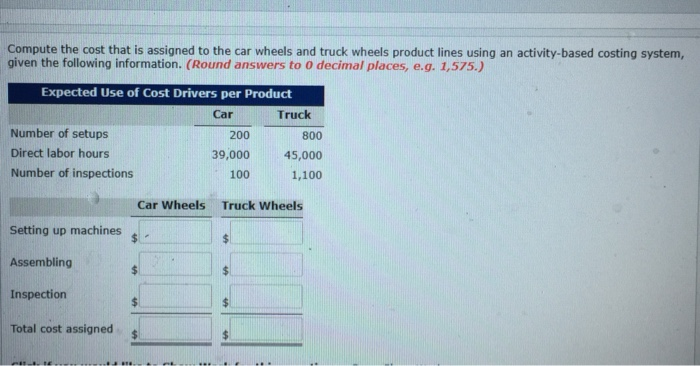

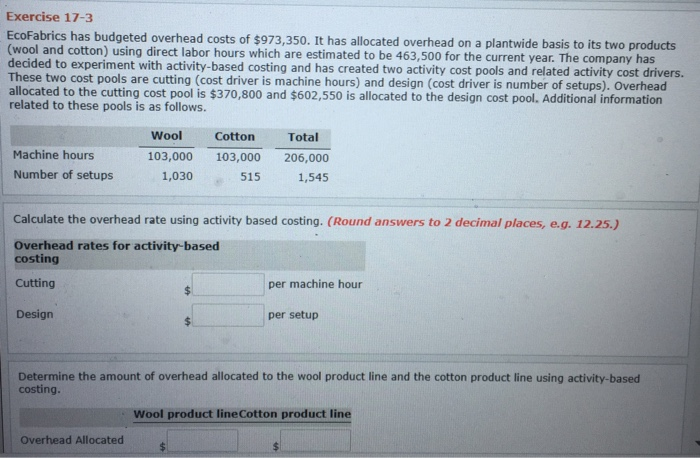

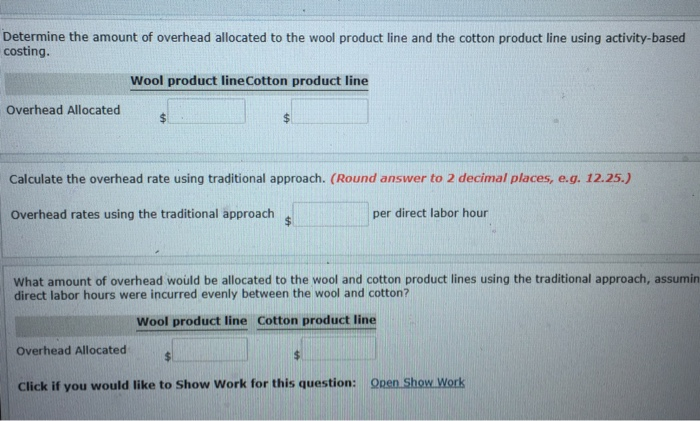

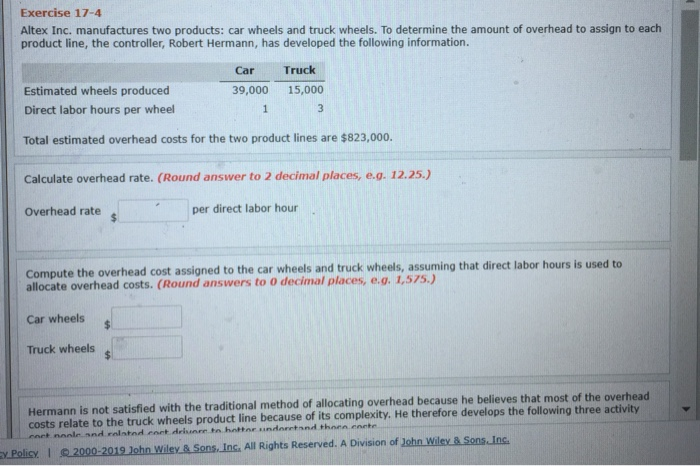

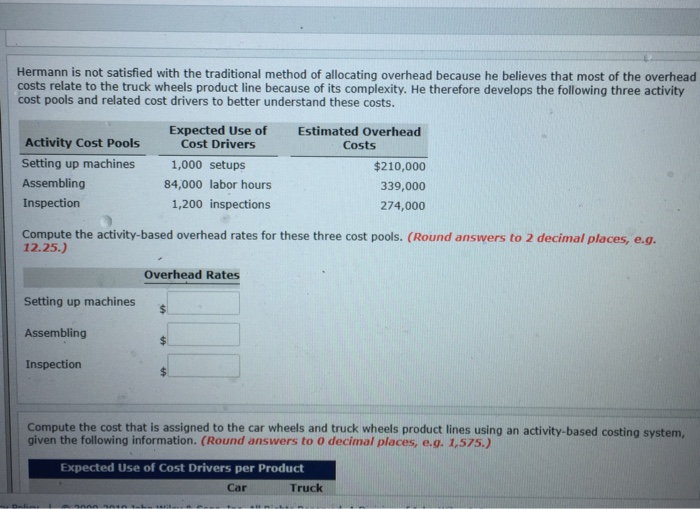

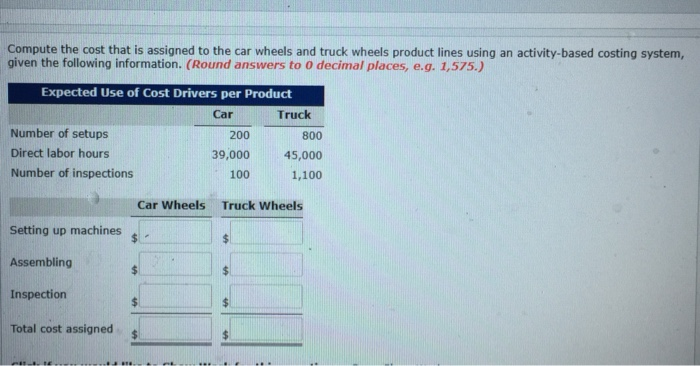

Exercise 17-3 EcoFabrics has budgeted overhead costs of $973,350. It has allocated overhead on a plantwide basis to its two products (wool and cotton) using direct labor hours which are estimated to be 463,500 for the current year. The company has decided to experiment with activity-based costing and has created two activity cost pools and related activity cost drivers. These two cost pools are cutting (cost driver is machine hours) and design (cost driver is number of setups). Overhead allocated to the cutting cost pool is $370,800 and $602,550 is allocated to the design cost pool. Additional information related to these pools is as follows. Wool Cotton Total Machine hours Number of setups 103,000 103,000 206,000 1,030 515 1,545 Calculate the overhead rate using activity based costing. (Round answers to 2 decimal places, e.g. 12.25.) Overhead rates for activity-based costing Cutting Design per machine hour per setup Determine the amount of overhead allocated to the wool product line and the cotton product line using activity-based costing ool product lineCotton product line Overhead Allocated Determine the amount of overhead allocated to the wool product line and the cotton product line using activity-based costing. Wool product lineCotton product line Overhead Allocated Calculate the overhead rate using traditional approach. (Round answer to 2 decimal places, e.g. 12.25.) Overhead rates using the traditional approach per direct labor hour What amount of overhead would be allocated to the wool and cotton product lines using the traditional approach, assumin direct labor hours were incurred evenly between the wool and cotton? Wool product line Cotton product line Overhead Allocated Click if you would like to Show Work for this question: Open Show Work Exercise 17-4 Altex Inc. manufactures two products: car wheels and truck wheels. To determine the amount of overhead to assign to each product line, the controller, Robert Hermann, has developed the following information. Car Truck Estimated wheels produced Direct labor hours per wheel 39,000 15,000 Total estimated overhead costs for the two product lines are $823,000. Calculate overhead rate. (Round answer to 2 decimal places, e.g. 12.25.) Overhead rate per direct labor hour Compute the overhead cost assigned to the car wheels and truck wheels, assuming that direct labor hours is used to allocate overhead costs. (Round answers to o decimal places, e.g. 1,575.) Car wheels Truck wheels Hermann is not satisfied with the traditional method of allocating overhead because he believes that most of the costs relate to the truck wheels product line because of its complexity. He therefore develops the following three activity overhead All Rights Reserved. A Division of NEolio I 2000-2019John Hermann is not satisfied with the traditional method of allocating overhead because he believes that most of the overhead costs relate to the truck wheels product line because of its complexity. He therefore develops the following three activity cost pools and related cost drivers to better understand these costs. Expected Use of Cost Drivers Estimated Overhead Activity Cost Pools Setting up machines Assembling Inspection Costs 1,000 setups 84,000 labor hours 1,200 inspections $210,000 339,000 274,000 Compute the activity-based overhead rates for these three cost pools. (Round answers to 2 decimal places, e.g. 12.25.) Overhead Rates Setting up machines Assembling Inspectiorn Compute the cost that is assigned to the car wheels and truck wheels product lines using an activity-based costing system, given the following information. (Round answers to O decmal places, e.g. 1,575.) Expected Use of Cost Drivers per Product Car Truck Compute the cost that is assigned to the car wheels and truck wheels product lines using an activity-based costing system, given the following information. (Round answers to o decimal places, e.g. 1,575.) Expected Use of Cost Drivers per Product Car Truck Number of setups Direct labor hours Number of inspections 200 800 045,000 1,100 39,00 100 Car Wheels Truck Wheels Setting up machines Assembling Inspection Total cost assigned s