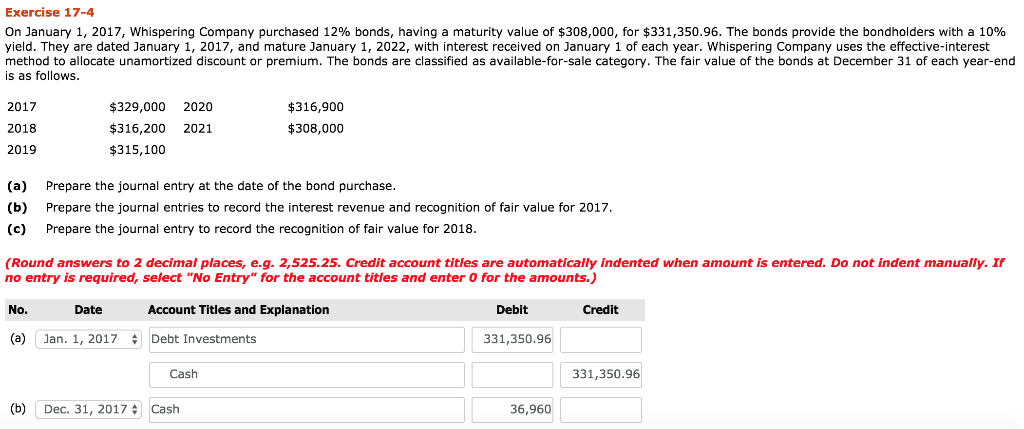

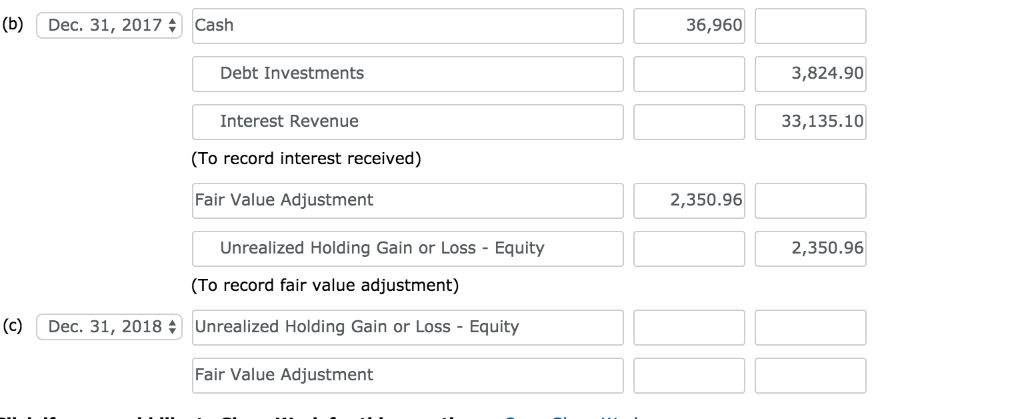

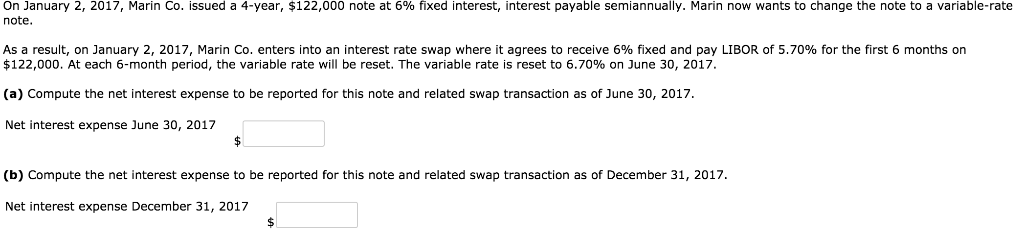

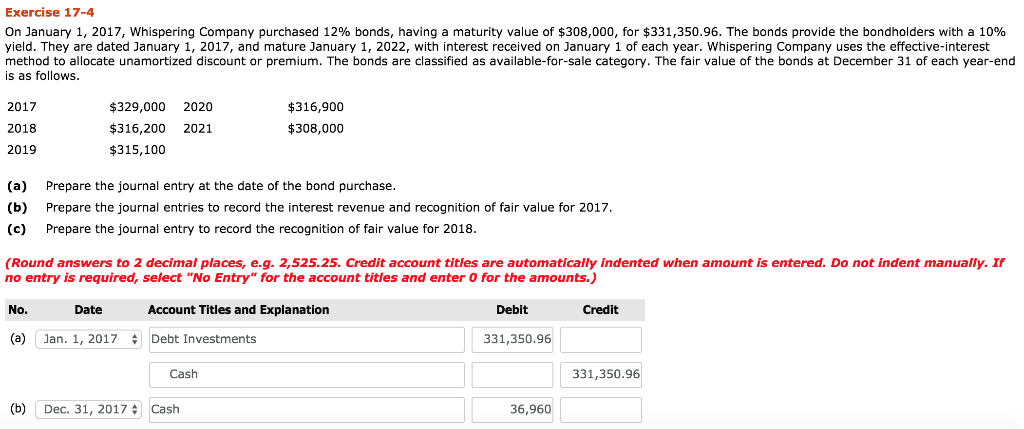

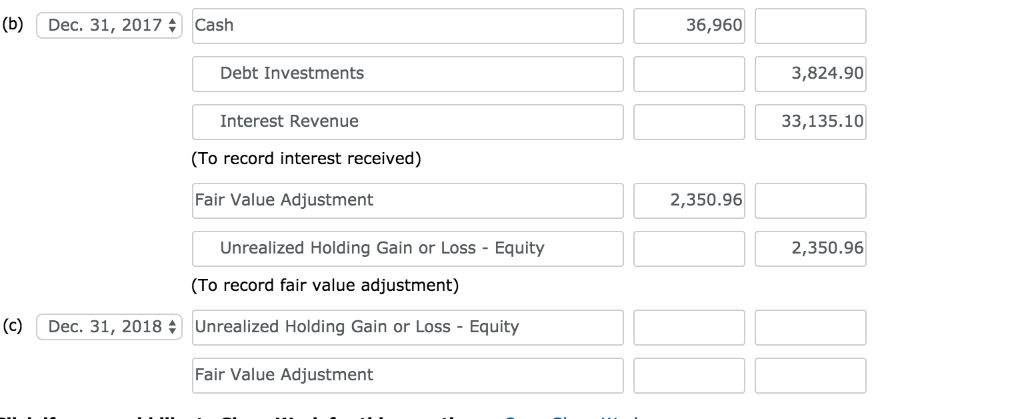

Exercise 17-4 On January 1, 2017, whispering Company purchased 12% bonds, having a maturity value of $308,000, for $331,350.96. The bonds provide the bondholders with a 10% yield. They are dated January 1, 2017, and mature January 1, 2022, with interest received on January 1 of each year. Whispering Company uses the effectiveinterest method to allocate unamortized discount or premium. The bonds are classified as available-for-sale category. The fair value of the bonds at December 31 of each year-end is as follows 2017 2018 2019 $329,000 2020 $316,200 2021 $315,100 $316,900 $308,000 (a) (b) (c) Prepare the journal entry at the date of the bond purchase Prepare the journal entries to record the interest revenue and recognition of fair value for 2017 Prepare the journal entry to record the recognition of fair value for 2018 (Round answers to 2 decimal places, e.g. 2,525.25. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) No (a) ]an. 1, 2017 Debt Investments Date Account Titles and Explanation Debit Credit 331,350.96 Cash 331,350.96 (b) Dec. 31, 2017 Cash 36,960 (b) Dec. 31, 2017 Cash 36,960 Debt Investments 3,824.90 33,135.10 Interest Revenue (To record interest received) Fair Value Adjustment 2,350.96 Unrealized Holding Gain or Loss Equity (To record fair value adjustment) Unrealized Holding Gain or Loss - Equity 2,350.96 (c)Dec. 31, 2018 Fair Value Adjustment On January 2, 2017, Marin Co. issued a 4-year, $122,000 note at 6% fixed interest, interest payable semiannually. Marin now wants to change the note to a variable-rate note. As a result on January 2 2017, Marin Co. enters into an interest rate swap where it agrees to receive 6% e and pay LIBO of 5 %, O he irst months on $122,000. At each 6-month period, the variable rate will be reset. The variable rate is reset to 6.70% on June 30, 2017 (a) Compute the net interest expense to be reported for this note and related swap transaction as of June 30, 2017, Net interest expense June 30, 2017 (b) Compute the net interest expense to be reported for this note and related swap transaction as of December 31, 2017 Net interest expense December 31, 2017