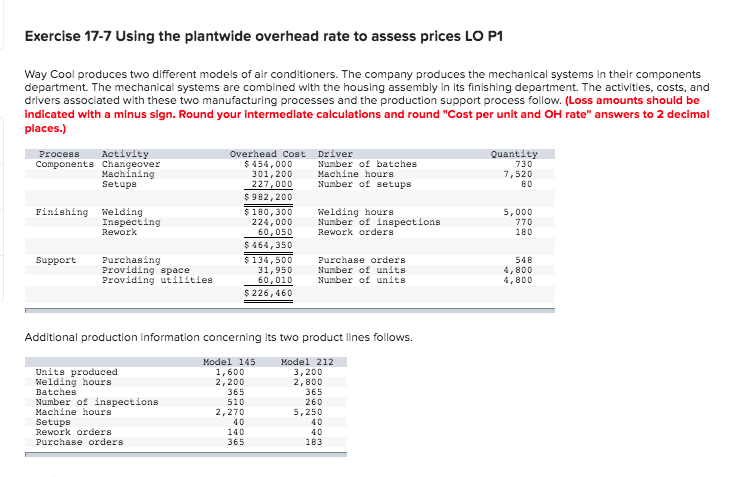

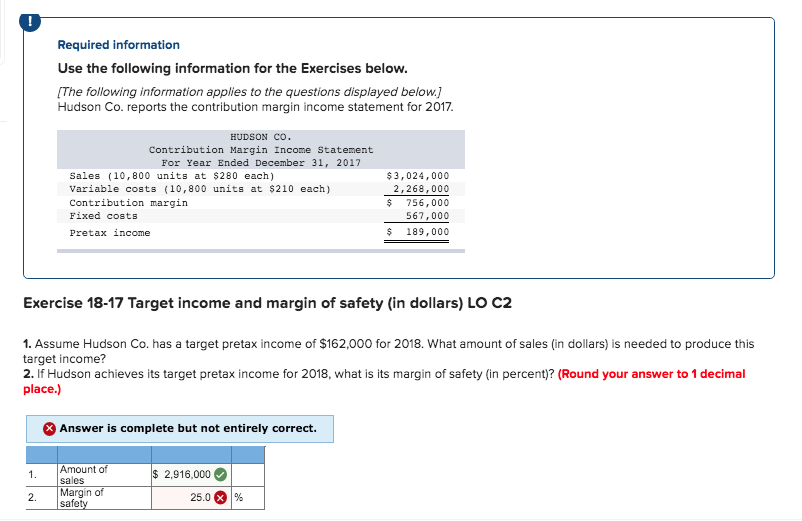

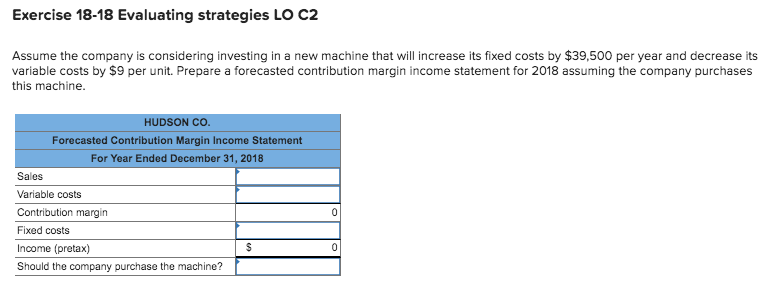

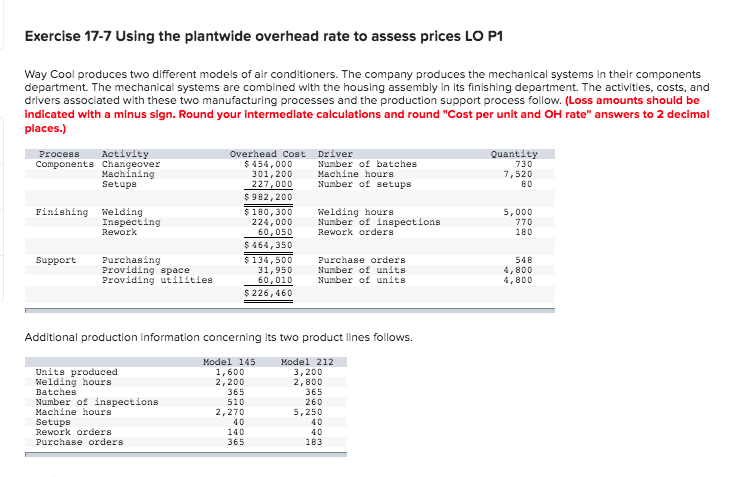

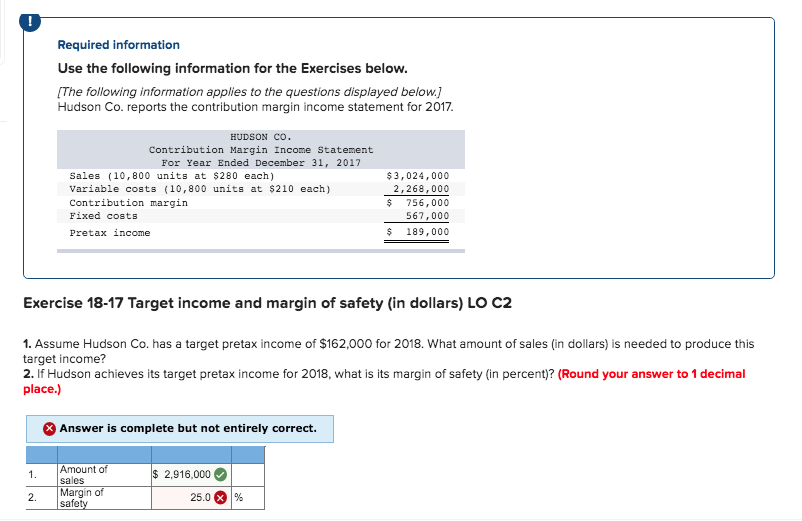

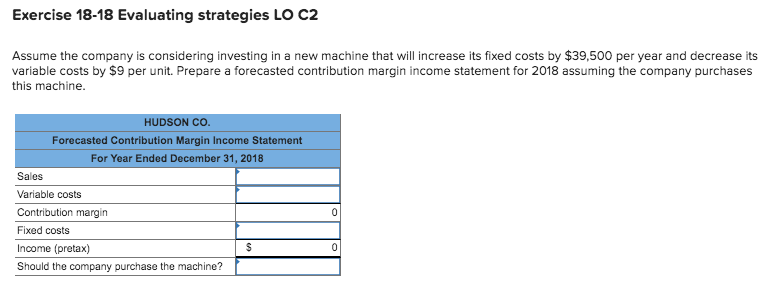

Exercise 17-7 Using the plantwide overhead rate to assess prices LO P1 Way Cool produces two different models of air conditioners. The company produces the mechanical systems in their components department. The mechanical systems are combined with the hous ing assembly in its finishing department. The actlvities, costs, and drivers associated with these two manufacturing processes and the production support process follow. (Loss amounts should be indicated with a minus sign. Round your intermediate calculations and round "Cost per unit and OH rate" answers to 2 decimal places.) Activity Components Changeover Machining Setups Overhead Cost Driver Number of batches Machine hours Quantity Process $ 454,000 301.200 730 7,520 227,000 Number of setups B0 $982,200 $180,300 224,000 60,050 Finishing Welding Inspecting Rework Welding hours Number of inspections Rework orders 5,000 770 180 $464,350 Purchasing Providing space Providing utilities $134,500 31,950 60,010 Support Purchase orders Number of units Number of units 54B 4,800 4,800 $226,460 Additional production information concerning its two product lines follows. T Model 212 Model 145 Units produced. Welding hours 1,600 2,200 3,200 2,800 Batches 365 365 Number of inspections Machine hours 510 260 2,270 5,250 Setups 40 40 Rework orders 140 40 Purchase orders 183 365 Required information Use the following information for the Exercises below [The following information applies to the questions displayed below Hudson Co. reports the contribution margin income statement for 2017 HUDSON Co. Contribution Margin Income Statement For Year Ended December 31, 2017 Sales (10,800 units at $280 each) Variable costs (10,800 units at $210 each) Contribution margin $3,024,000 2,268,000 756,000 Fixed costs 567,000 189,000 Pretax income Exercise 18-17 Target income and margin of safety (in dollars) LO C2 1. Assume Hudson Co. has a target pretax income of $162,000 for 2018. What amount of sales (in dollars) is needed to produce this target income? 2. If Hudson achieves its target pretax income for 2018, what is its margin of safety (in percent)? (Round your answer to 1 decimal place.) Answer is complete but not entirely correct. Amount of sales Margin of $ 2,916,000 1. % 2. safety 25.0 Exercise 18-18 Evaluating strategies LO C2 Assume the company is considering investing in a new machine that will increase its fixed costs by $39,500 per year and decrease its variable costs by $9 per unit. Prepare a forecasted contribution margin income statement for 2018 assuming the company purchases this machine. HUDSON CO. Forecasted Contribution Margin Income Statement For Year Ended December 31, 2018 Sales Variable costs Contribution margin 0 Fixed costs S Income (pretax) Should the company purchase the machine? Exercise 17-7 Using the plantwide overhead rate to assess prices LO P1 Way Cool produces two different models of air conditioners. The company produces the mechanical systems in their components department. The mechanical systems are combined with the hous ing assembly in its finishing department. The actlvities, costs, and drivers associated with these two manufacturing processes and the production support process follow. (Loss amounts should be indicated with a minus sign. Round your intermediate calculations and round "Cost per unit and OH rate" answers to 2 decimal places.) Activity Components Changeover Machining Setups Overhead Cost Driver Number of batches Machine hours Quantity Process $ 454,000 301.200 730 7,520 227,000 Number of setups B0 $982,200 $180,300 224,000 60,050 Finishing Welding Inspecting Rework Welding hours Number of inspections Rework orders 5,000 770 180 $464,350 Purchasing Providing space Providing utilities $134,500 31,950 60,010 Support Purchase orders Number of units Number of units 54B 4,800 4,800 $226,460 Additional production information concerning its two product lines follows. T Model 212 Model 145 Units produced. Welding hours 1,600 2,200 3,200 2,800 Batches 365 365 Number of inspections Machine hours 510 260 2,270 5,250 Setups 40 40 Rework orders 140 40 Purchase orders 183 365 Required information Use the following information for the Exercises below [The following information applies to the questions displayed below Hudson Co. reports the contribution margin income statement for 2017 HUDSON Co. Contribution Margin Income Statement For Year Ended December 31, 2017 Sales (10,800 units at $280 each) Variable costs (10,800 units at $210 each) Contribution margin $3,024,000 2,268,000 756,000 Fixed costs 567,000 189,000 Pretax income Exercise 18-17 Target income and margin of safety (in dollars) LO C2 1. Assume Hudson Co. has a target pretax income of $162,000 for 2018. What amount of sales (in dollars) is needed to produce this target income? 2. If Hudson achieves its target pretax income for 2018, what is its margin of safety (in percent)? (Round your answer to 1 decimal place.) Answer is complete but not entirely correct. Amount of sales Margin of $ 2,916,000 1. % 2. safety 25.0 Exercise 18-18 Evaluating strategies LO C2 Assume the company is considering investing in a new machine that will increase its fixed costs by $39,500 per year and decrease its variable costs by $9 per unit. Prepare a forecasted contribution margin income statement for 2018 assuming the company purchases this machine. HUDSON CO. Forecasted Contribution Margin Income Statement For Year Ended December 31, 2018 Sales Variable costs Contribution margin 0 Fixed costs S Income (pretax) Should the company purchase the machine