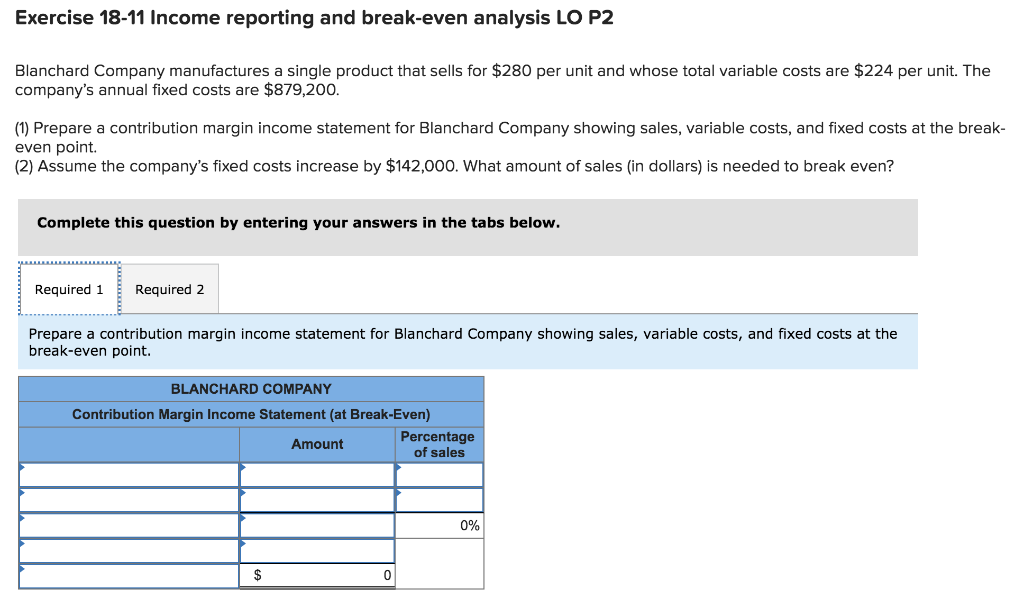

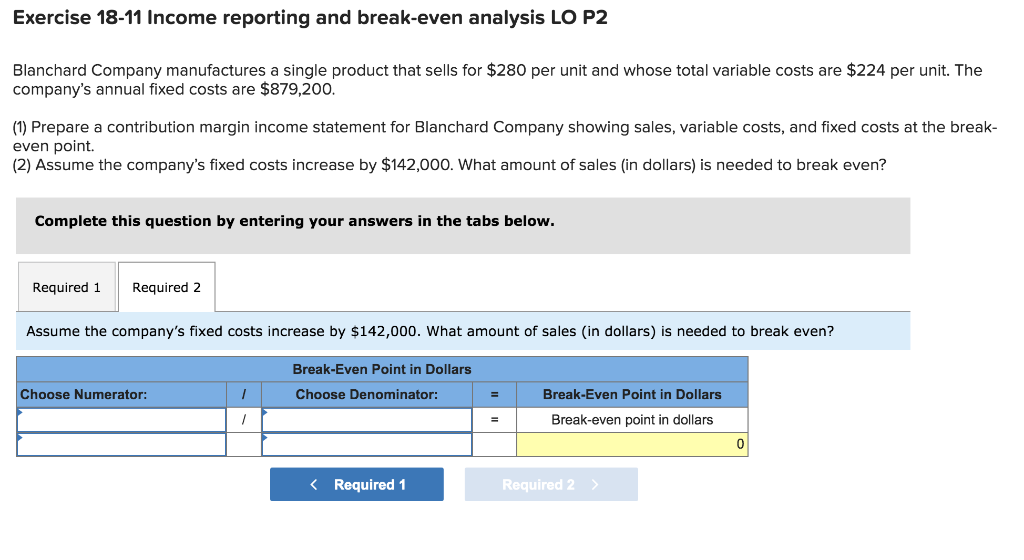

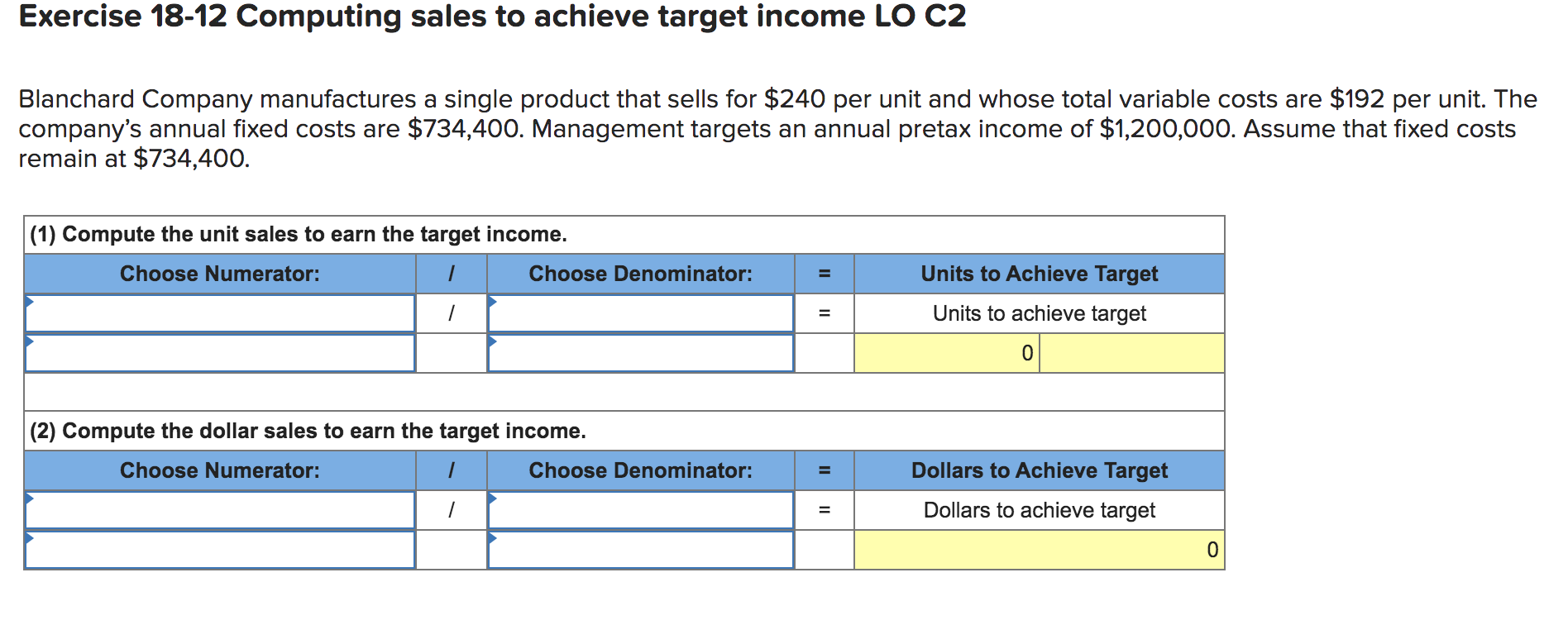

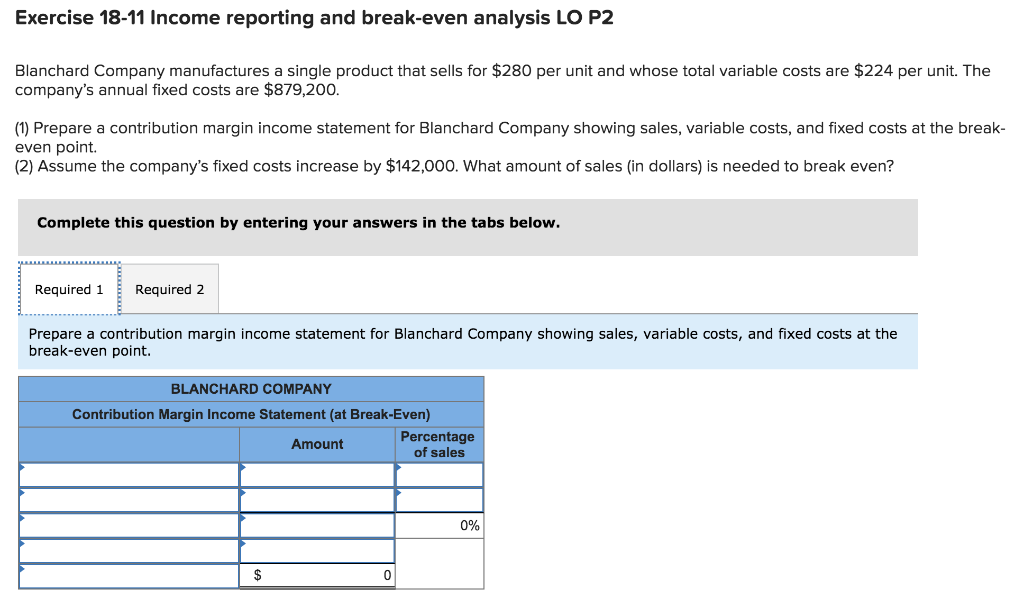

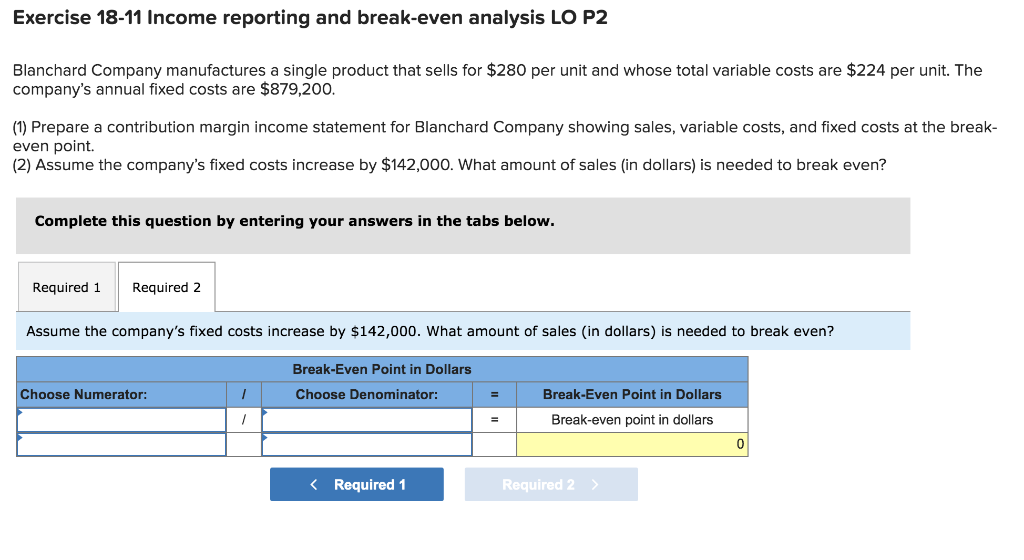

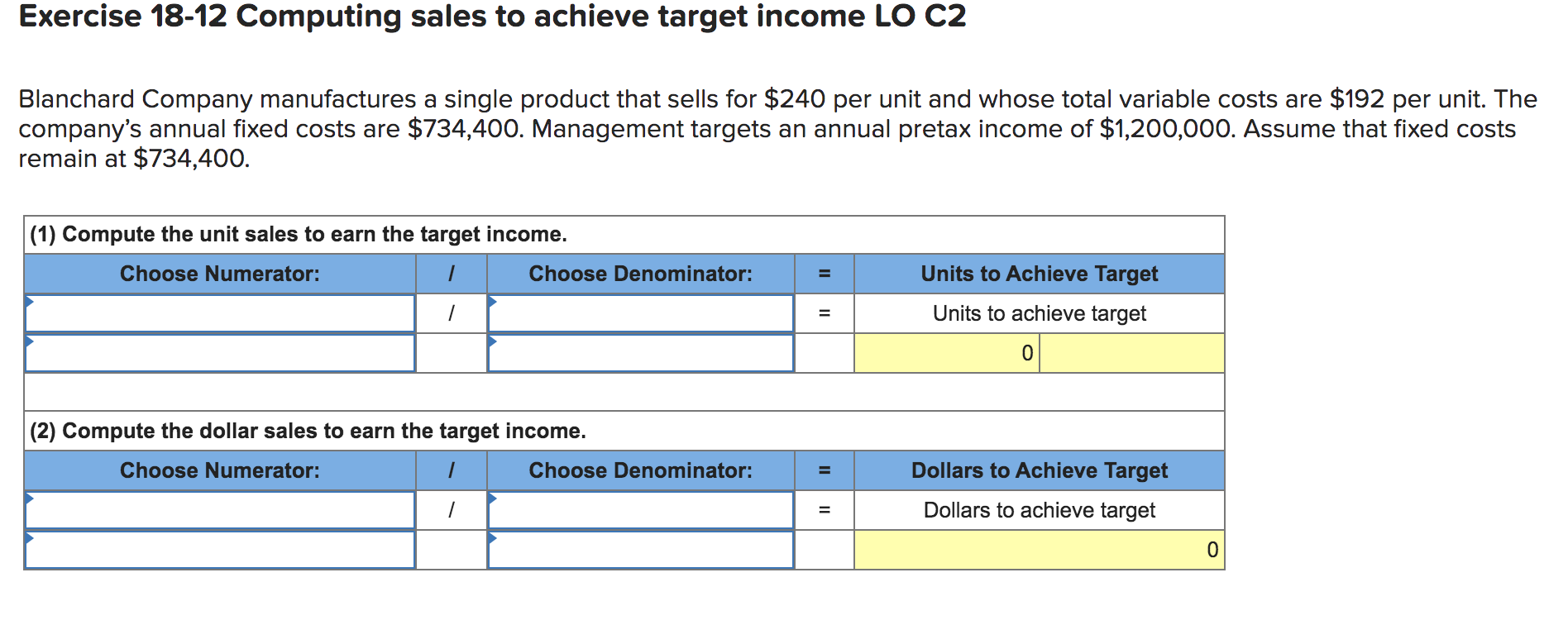

Exercise 18-11 Income reporting and break-even analysis LO P2 Blanchard Company manufactures a single product that sells for $280 per unit and whose total variable costs are $224 per unit. The company's annual fixed costs are $879,200. (1) Prepare a contribution margin income statement for Blanchard Company showing sales, variable costs, and fixed costs at the break- even point. (2) Assume the company's fixed costs increase by $142,000. What amount of sales (in dollars) is needed to break even? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a contribution margin income statement for Blanchard Company showing sales, variable costs, and fixed costs at the break-even point. BLANCHARD COMPANY Contribution Margin Income Statement (at Break-Even) Percentage Amount of sales 0% $ 0 Exercise 18-11 Income reporting and break-even analysis LO P2 Blanchard Company manufactures a single product that sells for $280 per unit and whose total variable costs are $224 per unit. The company's annual fixed costs are $879,200. (1) Prepare a contribution margin income statement for Blanchard Company showing sales, variable costs, and fixed costs at the break- even point. (2) Assume the company's fixed costs increase by $142,000. What amount of sales (in dollars) is needed to break even? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume the company's fixed costs increase by $142,000. What amount of sales in dollars) is needed to break even? Break-Even Point in Dollars Choose Denominator: Choose Numerator: = Break-Even Point in Dollars Break-even point in dollars 0 Exercise 18-12 Computing sales to achieve target income LO C2 Blanchard Company manufactures a single product that sells for $240 per unit and whose total variable costs are $192 per unit. The company's annual fixed costs are $734,400. Management targets an annual pretax income of $1,200,000. Assume that fixed costs remain at $734,400. (1) Compute the unit sales to earn the target income. Choose Numerator: Choose Denominator: II Units to Achieve Target Units to achieve target 0 (2) Compute the dollar sales to earn the target income. Choose Numerator: Choose Denominator: II Dollars to Achieve Target Dollars to achieve target 0