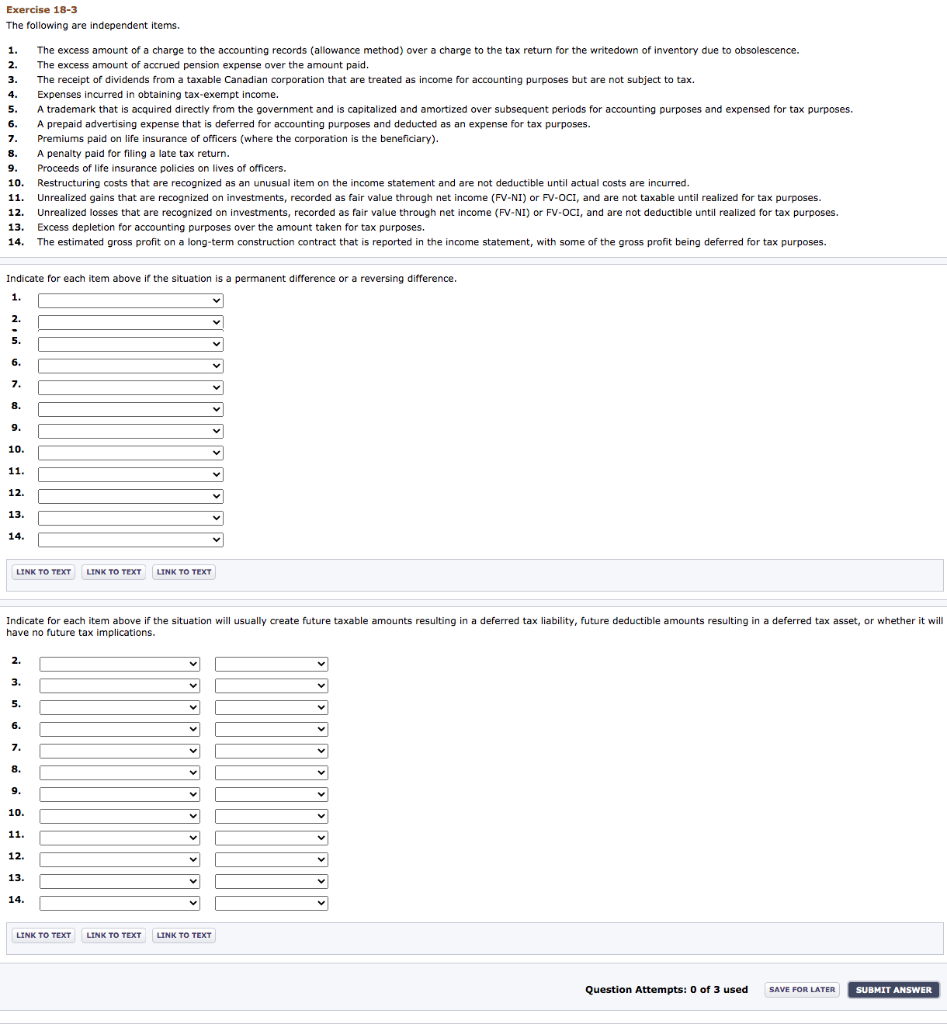

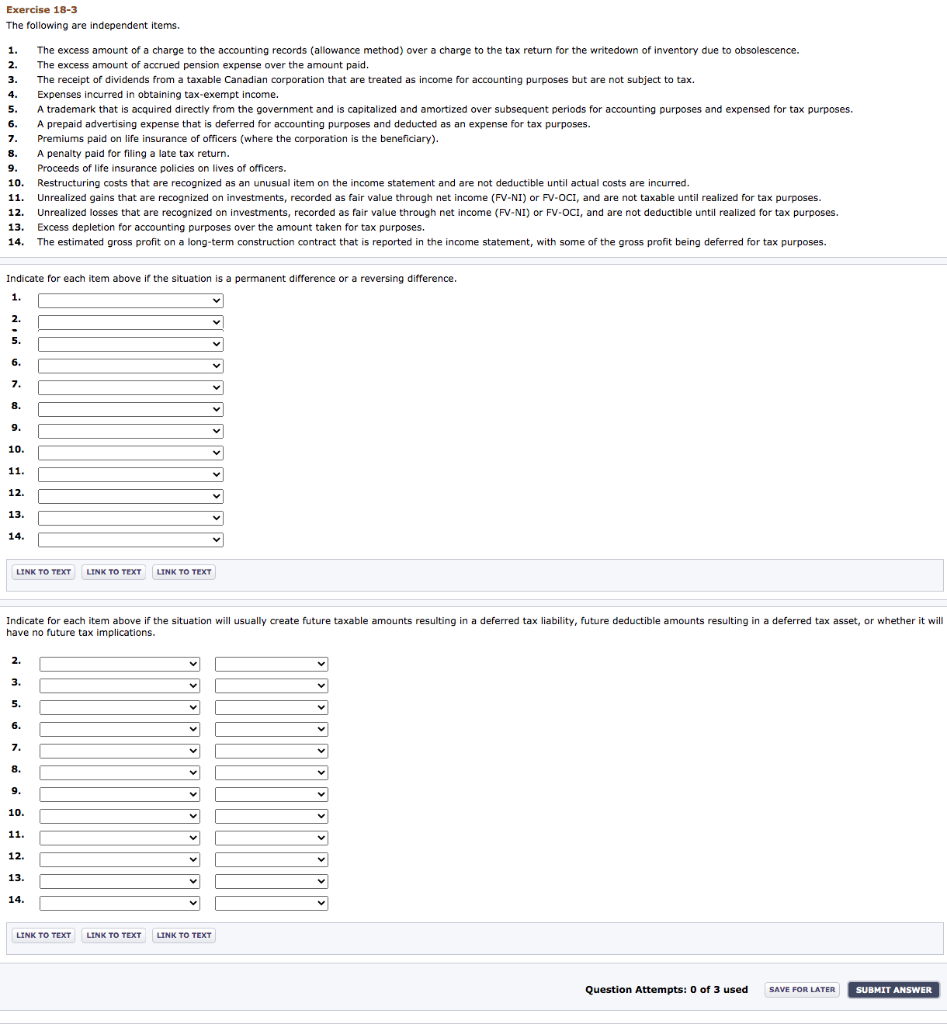

Exercise 18-3 The following are independent items. 1. The excess amount of a charge to the accounting records (allowance method) over a charge to the tax return for the writedown of inventory due to obsolescence. 2. The excess amount of accrued pension expense over the amount paid. 3. The receipt of dividends from a taxable Canadian corporation that are treated as income for accounting purposes but are not subject to tax. 4. Expenses incurred in obtaining tax-exempt income. 5. A trademark that is acquired directly from the government and is capitalized and amortized over subsequent periods for accounting purposes and expensed for tax purposes. 6. A prepaid advertising expense that is deferred for accounting purposes and deducted as an expense for tax purposes. 7. Premiums paid on life insurance of officers (where the corporation is the beneficiary). 8. A penalty paid for filing a late tax return. 9. Proceeds of life insurance policies on lives of officers. 10. Restructuring costs that are recognized as an unusual item on the income statement and are not deductible until actual costs are incurred. Unrealized gains that are recognized on investments, recorded as fair value through net income (FV-NI) or FV-OCI, and are not taxable until realized for tax purposes. 12. Unrealized losses that are recognized on investments, recorded as fair value through net income (FV-NI) or FV-OCI, and are not deductible until realized for tax purposes. 13. Excess depletion for accounting purposes over the amount taken for tax purposes. 14. The estimated gross profit on a long-term construction contract that is reported in the income statement, with some of the gross profit being deferred for tax purposes. 11. Indicate for each item above if the situation is a permanent difference or a reversing difference. 1. 2. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. LINK TO TEXT LINK TO TEXT LINK TO TEXT Indicate for each item above if the situation will usually create future taxable amounts resulting in a deferred tax liability, future deductible amounts resulting in a deferred tax asset, or whether it will have no future tax implications. 2. 3. 5. 6. 7. 8. 10. 11. 12. 13. 14. LINK TO TEXT LINK TO TEXT LINK TO TEXT Question Attempts: 0 of 3 used