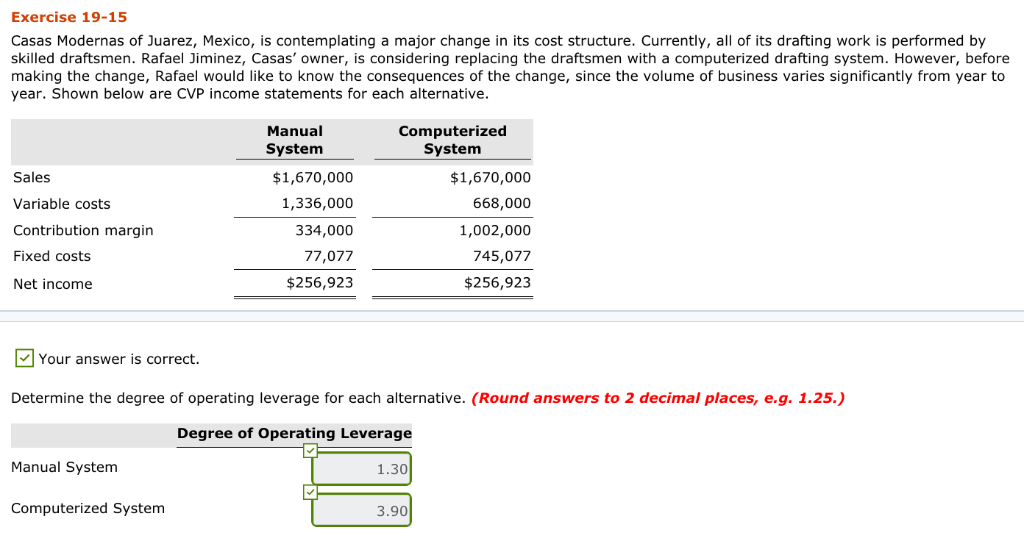

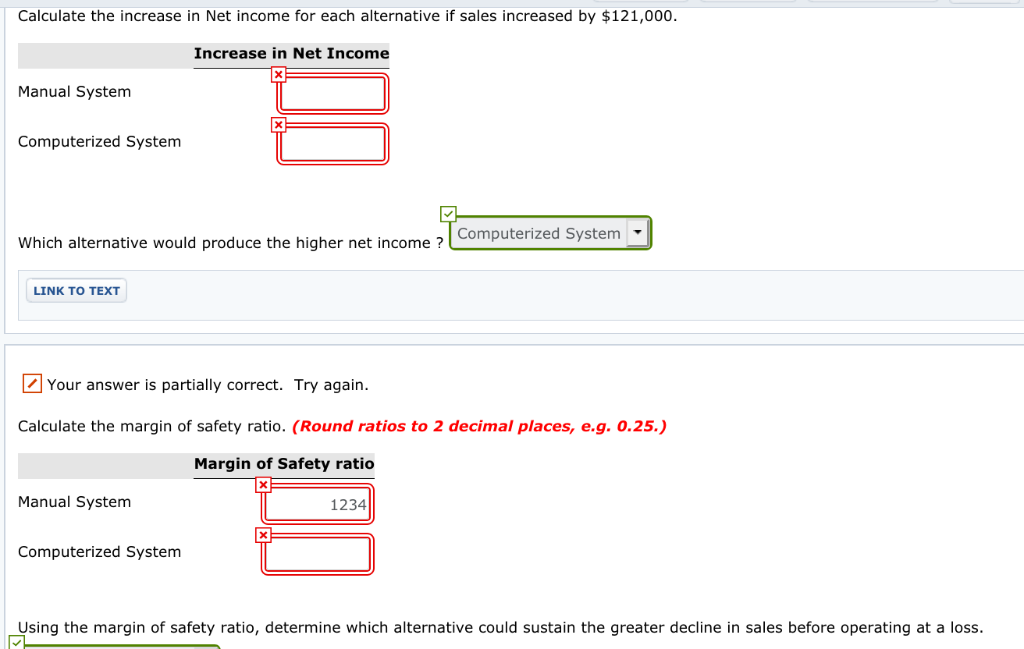

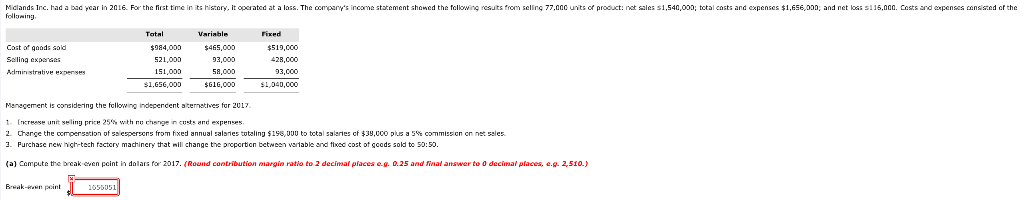

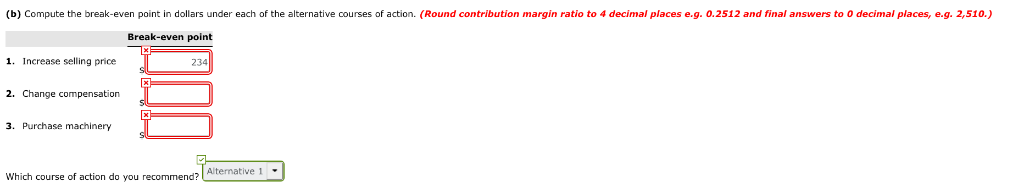

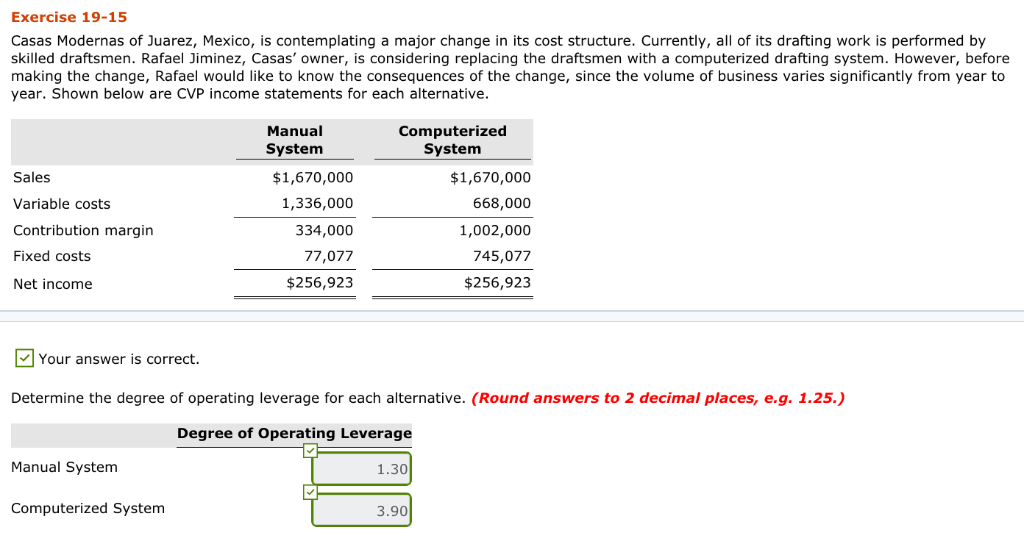

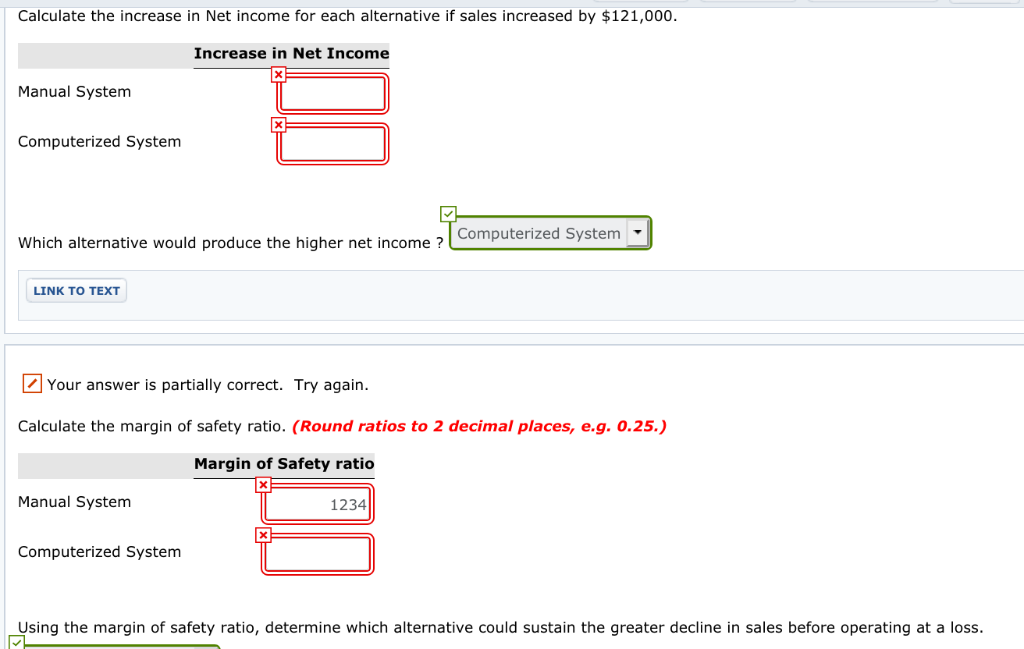

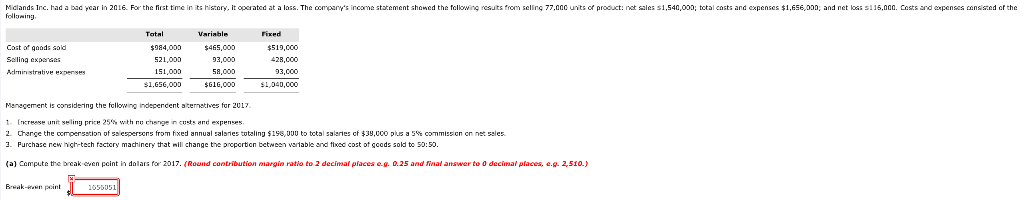

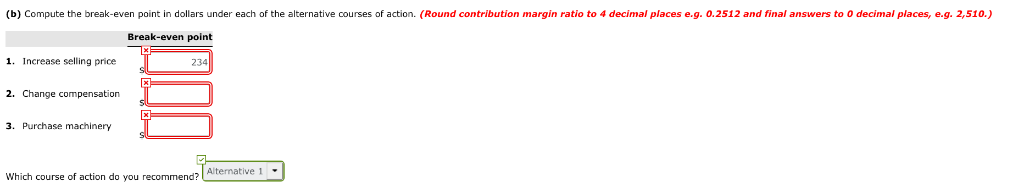

Exercise 19-15 Casas Modernas of Juarez, Mexico, is contemplating a major change in its cost structure. Currently, all of its drafting work is performed by skilled draftsmen. Rafael Jiminez, Casas' owner, is considering replacing the draftsmen with a computerized drafting system. However, before making the change, Rafael would like to know the consequences of the change, since the volume of business varies significantly from year to year. Shown below are CVP income statements for each alternative Manual System Computerized System Sales Variable costs Contribution margin Fixed costs Net income $1,670,000 1,336,000 334,000 77,077 $256,923 $1,670,000 668,000 1,002,000 745,077 $256,923 Your answer is correct Determine the degree of operating leverage for each alternative. (Round answers to 2 decimal places, e.g. 1.25.) Degree of Operating Leverage Manual System 1.30 Computerized System 3.90 Calculate the increase in Net income for each alternative if sales increased by $121,000 Increase in Net Income Manual System Computerized System Winich afternative would produce the higher net income Computerized System LINK TO TEXT Your answer is partially correct. Try again. Calculate the margin of safety ratio. (Round ratios to 2 decimal places, e.g. 0.25.) Margin of Safety ratio Manual System 1234 Computerized System Using the margin of safety ratio, determine which alternative could sustain the greater decline in sales before operating at a loss. tctal cn Midlands Inc. had a bad year in 2016. For the first ti e in its history follawing to c ated at a lass. The pa s inco e statement sh ed the llowing es ts t om seli 9 77 and its of product: net sales sl 540 000; total casts and expenses 1,656 oon; and net kas s 115 naa Costs arda penses cansa ed 984,00 $465,000 521,000 Cost ogoods soid 51.636.,09 ,040,000 Management is considering the following indepencent stemetves for 2017 1. [ncrease unt veling price 25% with "" Chenge n (ust, and expenses. 2. cerge the moersstion of s espersons from fxed annual sal37es toteling $196, uuu to total saleries cf3B,UCO pus 5% commission cn net sales. 3 Purchase new hghrtech fectery machinery that mill change tne prcpcrtion beteen iable and fixed cost of gcads sold to 5D:50 (a) Compute the break cven pcint in dolarsfo 2017. (Round contriDution aargin ratio to 2 decimaf pfaces e-g. 0.25 aad iaal answer to 0 decimai places, e.g. 2,510.) Break-en peint (b) Compute the break-even point in dollars under each of the alternative courses of action. (Round contribution margin ratio to 4 decimal places e.g. 0.2512 and final answers to 0 decimal places, e.g. 2,510.) Break-even point 1. Increase selling price 234 2. Change compensation 3. Purchase machinery Which course of action do you recommend? lternative 1