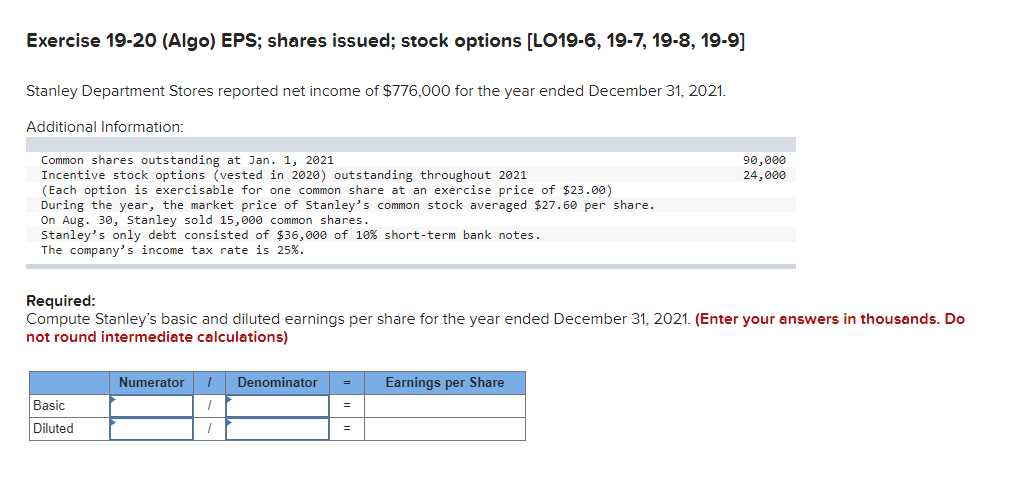

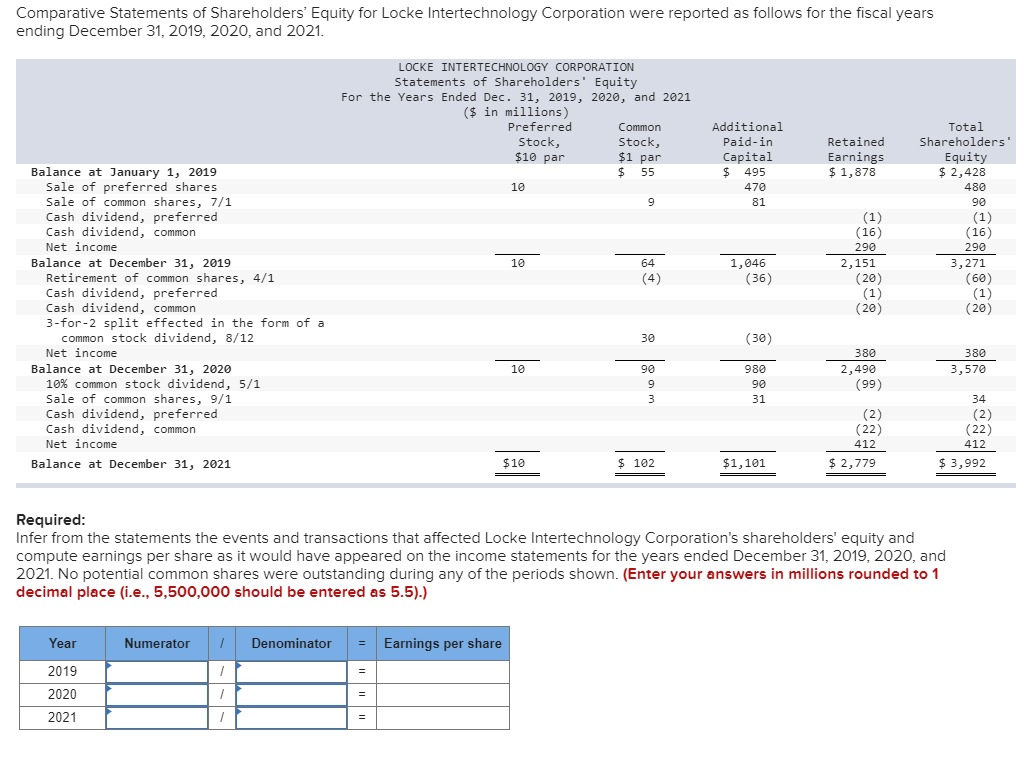

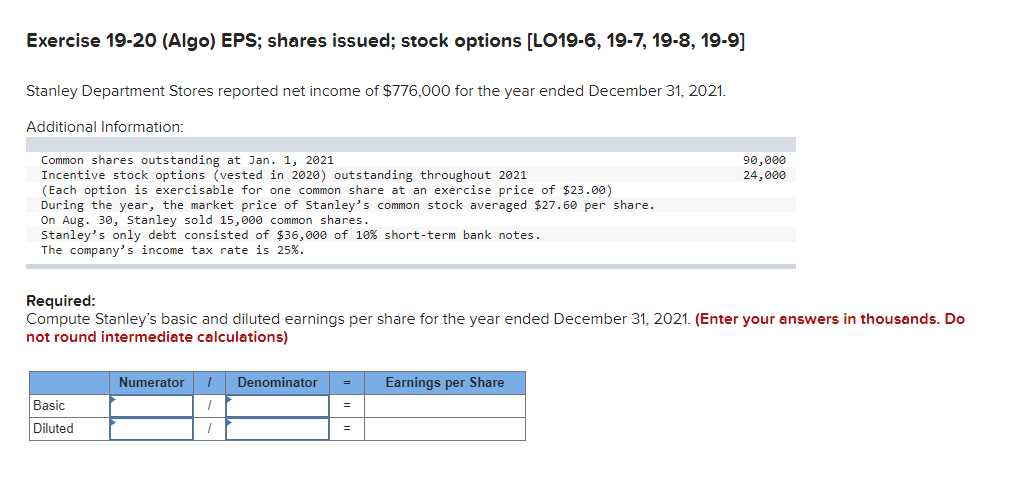

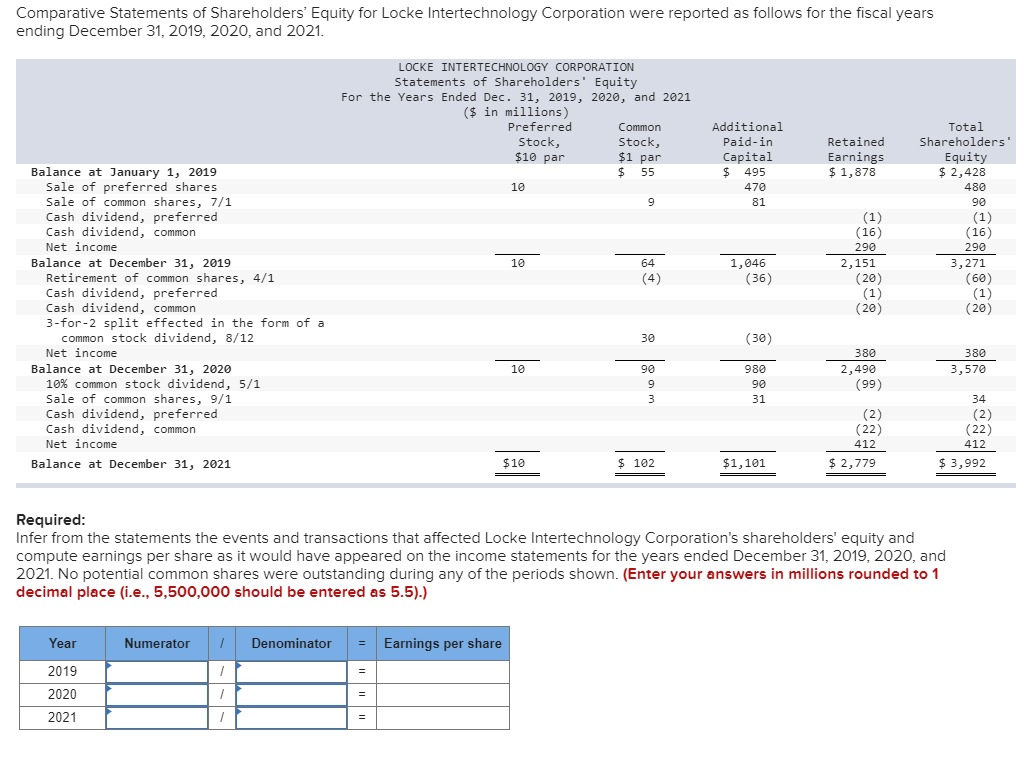

Exercise 19-20 (Algo) EPS; shares issued; stock options [LO19-6, 19-7, 19-8, 19-9] Stanley Department Stores reported net income of $776,000 for the year ended December 31, 2021. Additional Information: 90,000 24,000 Common shares outstanding Jan. 1, 2021 Incentive stock options (vested in 2020) outstanding throughout 2021 (Each option is exercisable for one common share at an exercise price of $23.00) During the year, the market price of Stanley's common stock averaged $27.60 per share. On Aug. 30, Stanley sold 15,000 common shares. Stanley's only debt consisted of $36,000 of 10% short-term bank notes. The company's income tax rate is 25%. Required: Compute Stanley's basic and diluted earnings per share for the year ended December 31, 2021. (Enter your answers in thousands. Do not round intermediate calculations) Numerator 1 Denominator Earnings per Share 1 Basic Diluted Comparative Statements of Shareholders' Equity for Locke Intertechnology Corporation were reported as follows for the fiscal years ending December 31, 2019, 2020, and 2021. LOCKE INTERTECHNOLOGY CORPORATION Statements of Shareholders' Equity For the Years Ended Dec. 31, 2019, 2020, and 2021 ($ in millions) Preferred Common Stock, Stock, $10 par $ 55 10 $1 par Additional Paid-in Capital $ 495 470 81 Retained Earnings $ 1,878 9 Total Shareholders' Equity $ 2,428 480 90 (1) (16) 290 3,271 (60) (1) (20) 10 64 (4) (1) (16) 290 2,151 (20) (1) (20) 1,046 (36) Balance at January 1, 2019 Sale of preferred shares Sale of common shares, 7/1 Cash dividend, preferred Cash dividend, common Net income Balance at December 31, 2019 Retirement of common shares, 4/1 Cash dividend, preferred Cash dividend, common 3-for-2 split effected in the form of a common stock dividend, 8/12 Net income Balance at December 31, 2020 10% common stock dividend, 5/1 Sale of common shares, 9/1 Cash dividend, preferred Cash dividend, common Net income Balance at December 31, 2021 30 (30) 380 3,570 10 90 9 3 380 2,490 (99) 980 90 31 (2) (22) 412 $ 2,779 34 (2) (22) 412 $ 3,992 $10 $ 102 $1,101 Required: Infer from the statements the events and transactions that affected Locke Intertechnology Corporation's shareholders' equity and compute earnings per share as it would have appeared on the income statements for the years ended December 31, 2019, 2020, and 2021. No potential common shares were outstanding during any of the periods shown. (Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) Year Numerator 1 Denominator = Earnings per share / 2019 2020 1 1 2021 = Exercise 19-20 (Algo) EPS; shares issued; stock options [LO19-6, 19-7, 19-8, 19-9] Stanley Department Stores reported net income of $776,000 for the year ended December 31, 2021. Additional Information: 90,000 24,000 Common shares outstanding Jan. 1, 2021 Incentive stock options (vested in 2020) outstanding throughout 2021 (Each option is exercisable for one common share at an exercise price of $23.00) During the year, the market price of Stanley's common stock averaged $27.60 per share. On Aug. 30, Stanley sold 15,000 common shares. Stanley's only debt consisted of $36,000 of 10% short-term bank notes. The company's income tax rate is 25%. Required: Compute Stanley's basic and diluted earnings per share for the year ended December 31, 2021. (Enter your answers in thousands. Do not round intermediate calculations) Numerator 1 Denominator Earnings per Share 1 Basic Diluted Comparative Statements of Shareholders' Equity for Locke Intertechnology Corporation were reported as follows for the fiscal years ending December 31, 2019, 2020, and 2021. LOCKE INTERTECHNOLOGY CORPORATION Statements of Shareholders' Equity For the Years Ended Dec. 31, 2019, 2020, and 2021 ($ in millions) Preferred Common Stock, Stock, $10 par $ 55 10 $1 par Additional Paid-in Capital $ 495 470 81 Retained Earnings $ 1,878 9 Total Shareholders' Equity $ 2,428 480 90 (1) (16) 290 3,271 (60) (1) (20) 10 64 (4) (1) (16) 290 2,151 (20) (1) (20) 1,046 (36) Balance at January 1, 2019 Sale of preferred shares Sale of common shares, 7/1 Cash dividend, preferred Cash dividend, common Net income Balance at December 31, 2019 Retirement of common shares, 4/1 Cash dividend, preferred Cash dividend, common 3-for-2 split effected in the form of a common stock dividend, 8/12 Net income Balance at December 31, 2020 10% common stock dividend, 5/1 Sale of common shares, 9/1 Cash dividend, preferred Cash dividend, common Net income Balance at December 31, 2021 30 (30) 380 3,570 10 90 9 3 380 2,490 (99) 980 90 31 (2) (22) 412 $ 2,779 34 (2) (22) 412 $ 3,992 $10 $ 102 $1,101 Required: Infer from the statements the events and transactions that affected Locke Intertechnology Corporation's shareholders' equity and compute earnings per share as it would have appeared on the income statements for the years ended December 31, 2019, 2020, and 2021. No potential common shares were outstanding during any of the periods shown. (Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) Year Numerator 1 Denominator = Earnings per share / 2019 2020 1 1 2021 =