Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 19-30 (Algorithmic) (LO. 8) During the current year, Gnatcatcher, Inc., (E & P of $1,150,000) distributed $840,000 each to Brandi and Yuen in

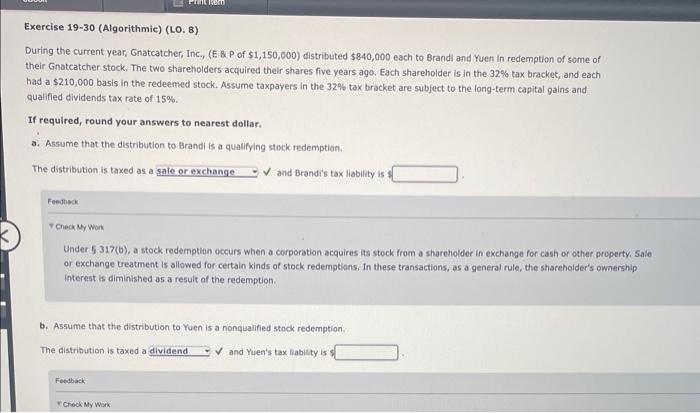

Exercise 19-30 (Algorithmic) (LO. 8) During the current year, Gnatcatcher, Inc., (E & P of $1,150,000) distributed $840,000 each to Brandi and Yuen in redemption of some of their Gnatcatcher stock. The two shareholders acquired their shares five years ago. Each shareholder is in the 32% tax bracket, and each had a $210,000 basis in the redeemed stock. Assume taxpayers in the 32% tax bracket are subject to the long-term capital gains and qualified dividends tax rate of 15%. If required, round your answers to nearest dollar. a. Assume that the distribution to Brandi is a qualifying stock redemption. The distribution is taxed as a sale or exchange Vand Brandi's tax liability is $ Feedback Check My Work Under 5 317(b), a stock redemption occurs when a corporation acquires its stock from a shareholder in exchange for cash or other property. Sale or exchange treatment is allowed for certain kinds of stock redemptions. In these transactions, as a general rule, the shareholder's ownership interest is diminished as a result of the redemption. b. Assume that the distribution to Yuen is a nonqualified stock redemption. The distribution is taxed a dividend Feedback Check My Work and Yuen's tax liability is $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started