Answered step by step

Verified Expert Solution

Question

1 Approved Answer

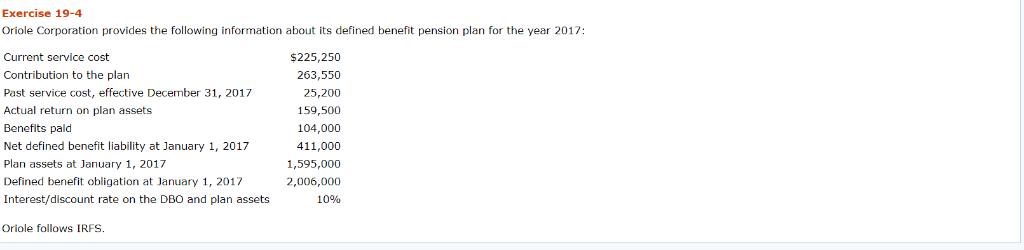

Exercise 19-4 Oriole Corporation provides the following information about its defined benefit pension plan for the year 2017: Current service cost Contribution to the

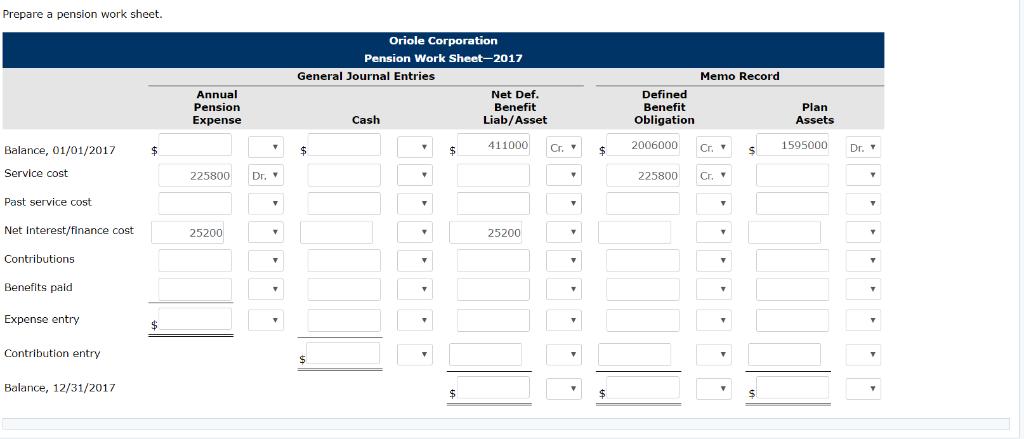

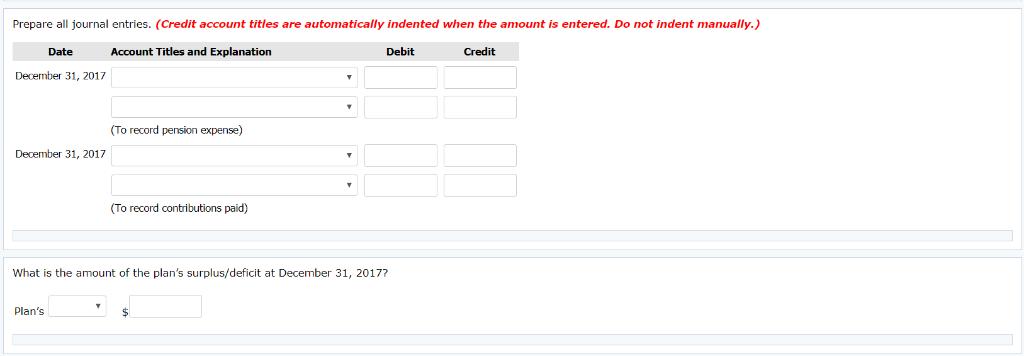

Exercise 19-4 Oriole Corporation provides the following information about its defined benefit pension plan for the year 2017: Current service cost Contribution to the plan. Past service cost, effective December 31, 2017 Actual return on plan assets Benefits pald Net defined benefit liability at January 1, 2017 Plan assets at January 1, 2017 Defined benefit obligation at January 1, 2017 Interest/discount rate on the DBO and plan assets Oriole follows IRFS. $225,250 263,550 25,200 159,500 104,000 411,000 1,595,000 2,006,000 10% Prepare a pension work sheet. Balance, 01/01/2017 Service cost Past service cost Net Interest/finance cost Contributions Benefits paid Expense entry Contribution entry Balance, 12/31/2017 $ Annual Pension Expense T 225800 Dr. Y 25200 Oriole Corporation Pension Work Sheet-2017 General Journal Entries $ Cash $ $ Net Def. Benefit Liab/Asset 411000 25200 Cr. Y Y $ Defined Benefit Obligation 2006000 225800 Memo Record Cr. T T Y S Plan Assets 1595000 Dr. T Y T T T T Prepare all journal entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Credit Date December 31, 2017 December 31, 2017 Plan's (To record pension expense) (To record contributions paid) T Y Debit What is the amount of the plan's surplus/deficit at December 31, 2017?

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer Requirements1 compute pension expenses Service cost 225250 Interes...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started