Answered step by step

Verified Expert Solution

Question

1 Approved Answer

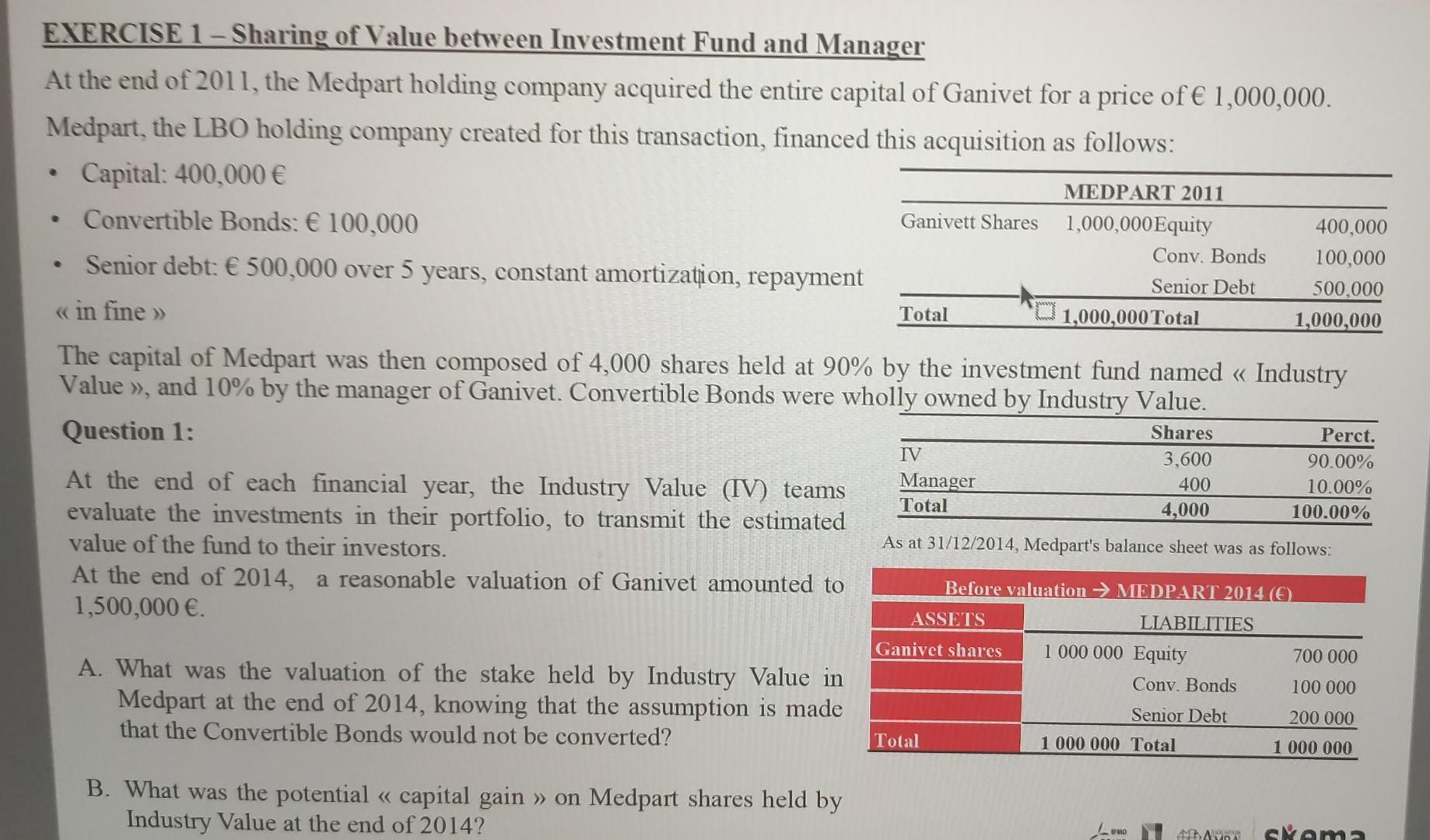

EXERCISE 1-Sharing of Value between Investment Fund and Manager At the end of 2011, the Medpart holding company acquired the entire capital of Ganivet for

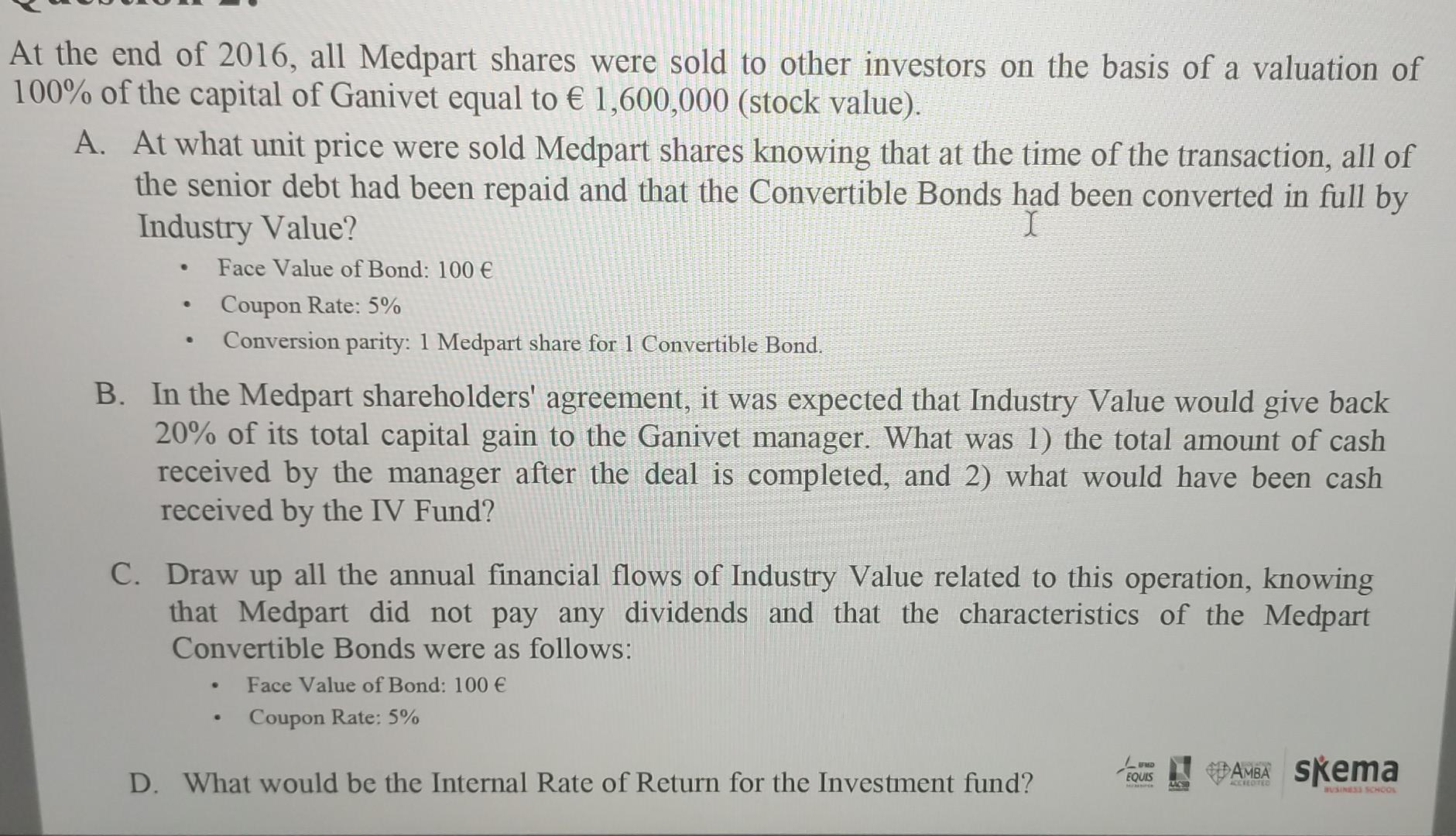

EXERCISE 1-Sharing of Value between Investment Fund and Manager At the end of 2011, the Medpart holding company acquired the entire capital of Ganivet for a price of 1,000,000. Medpart, the LBO holding company created for this transaction, financed this acquisition as follows: Capital: 400,000 Convertible Bonds: 100,000 Ganivett Shares 1,000,000 Equity 400,000 Conv. Bonds 100,000 Senior debt: 500,000 over 5 years, constant amortization, repayment Senior Debt 500,000 > 1,000,000 Total 1,000,000 MEDPART 2011 . Total The capital of Medpart was then composed of 4,000 shares held at 90% by the investment fund named Industry Value , and 10% by the manager of Ganivet. Convertible Bonds were wholly owned by Industry Value. Shares Perct. Question 1: IV 3,600 90.00% Manager 400 10.00% At the end of each financial year, the Industry Value (IV) teams Total 4,000 100.00% evaluate the investments in their portfolio, to transmit the estimated As at 31/12/2014, Medpart's balance sheet was as follows: value of the fund to their investors. At the end of 2014, a reasonable valuation of Ganivet amounted to Before valuation MEDPART 2014 (). 1,500,000 ASSETS LIABILITIES Ganivet shares 1 000 000 Equity 700 000 A. What was the valuation of the stake held by Industry Value in Conv. Bonds 100 000 Medpart at the end of 2014, knowing that the assumption is made Senior Debt 200 000 that the Convertible Bonds would not be converted? Total 1 000 000 1 000 000 Total B. What was the potential capital gain on Medpart shares held by Industry Value at the end of 2014? MO MAR skama At the end of 2016, all Medpart shares were sold to other investors on the basis of a valuation of 100% of the capital of Ganivet equal to 1,600,000 (stock value). A. At what unit price were sold Medpart shares knowing that at the time of the transaction, all of the senior debt had been repaid and that the Convertible Bonds had been converted in full by Industry Value? I Face Value of Bond: 100 Coupon Rate: 5% Conversion parity: 1 Medpart share for 1 Convertible Bond. B. In the Medpart shareholders' agreement, it was expected that Industry Value would give back 20% of its total capital gain to the Ganivet manager. What was 1) the total amount of cash received by the manager after the deal is completed, and 2) what would have been cash received by the IV Fund? . C. Draw up all the annual financial flows of Industry Value related to this operation, knowing that Medpart did not pay any dividends and that the characteristics of the Medpart Convertible Bonds were as follows: Face Value of Bond: 100 Coupon Rate: 5% USD EQUIS D. What would be the Internal Rate of Return for the Investment fund? PAMBA skema EXERCISE 1-Sharing of Value between Investment Fund and Manager At the end of 2011, the Medpart holding company acquired the entire capital of Ganivet for a price of 1,000,000. Medpart, the LBO holding company created for this transaction, financed this acquisition as follows: Capital: 400,000 Convertible Bonds: 100,000 Ganivett Shares 1,000,000 Equity 400,000 Conv. Bonds 100,000 Senior debt: 500,000 over 5 years, constant amortization, repayment Senior Debt 500,000 > 1,000,000 Total 1,000,000 MEDPART 2011 . Total The capital of Medpart was then composed of 4,000 shares held at 90% by the investment fund named Industry Value , and 10% by the manager of Ganivet. Convertible Bonds were wholly owned by Industry Value. Shares Perct. Question 1: IV 3,600 90.00% Manager 400 10.00% At the end of each financial year, the Industry Value (IV) teams Total 4,000 100.00% evaluate the investments in their portfolio, to transmit the estimated As at 31/12/2014, Medpart's balance sheet was as follows: value of the fund to their investors. At the end of 2014, a reasonable valuation of Ganivet amounted to Before valuation MEDPART 2014 (). 1,500,000 ASSETS LIABILITIES Ganivet shares 1 000 000 Equity 700 000 A. What was the valuation of the stake held by Industry Value in Conv. Bonds 100 000 Medpart at the end of 2014, knowing that the assumption is made Senior Debt 200 000 that the Convertible Bonds would not be converted? Total 1 000 000 1 000 000 Total B. What was the potential capital gain on Medpart shares held by Industry Value at the end of 2014? MO MAR skama At the end of 2016, all Medpart shares were sold to other investors on the basis of a valuation of 100% of the capital of Ganivet equal to 1,600,000 (stock value). A. At what unit price were sold Medpart shares knowing that at the time of the transaction, all of the senior debt had been repaid and that the Convertible Bonds had been converted in full by Industry Value? I Face Value of Bond: 100 Coupon Rate: 5% Conversion parity: 1 Medpart share for 1 Convertible Bond. B. In the Medpart shareholders' agreement, it was expected that Industry Value would give back 20% of its total capital gain to the Ganivet manager. What was 1) the total amount of cash received by the manager after the deal is completed, and 2) what would have been cash received by the IV Fund? . C. Draw up all the annual financial flows of Industry Value related to this operation, knowing that Medpart did not pay any dividends and that the characteristics of the Medpart Convertible Bonds were as follows: Face Value of Bond: 100 Coupon Rate: 5% USD EQUIS D. What would be the Internal Rate of Return for the Investment fund? PAMBA skema

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started