Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 2 At the beginning of year 1, a sum of money is to be invested for the next 4 years. There are five possible

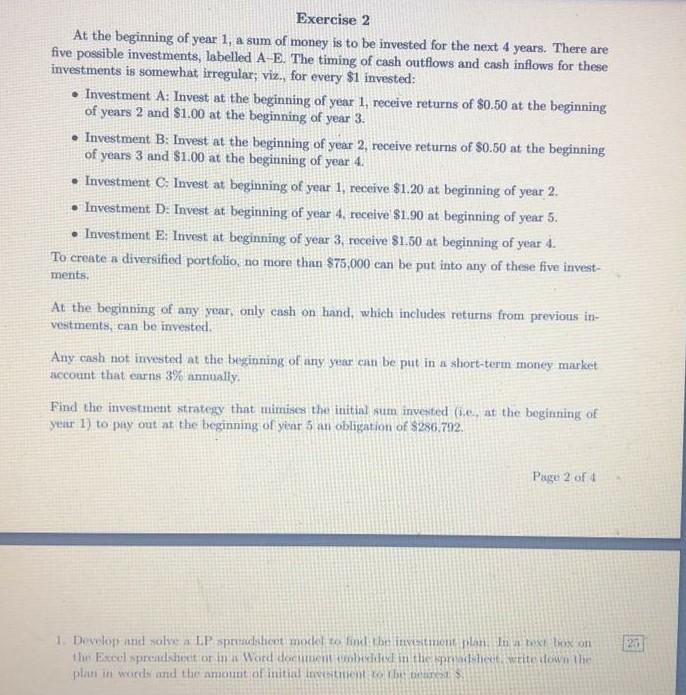

Exercise 2 At the beginning of year 1, a sum of money is to be invested for the next 4 years. There are five possible investments, labelled A-E. The timing of cash outflows and cash inflows for these investments is somewhat irregular; viz., for every $1 invested: Investment A: Invest at the beginning of year 1, receive returns of $0.50 at the beginning of years 2 and $1.00 at the beginning of year 3. Investment B: Invest at the beginning of year 2, receive returns of $0.50 at the beginning of years 3 and $1.00 at the beginning of year 4. Investment C. Invest at beginning of year 1, receive $1.20 at beginning of year 2. Investment D. Invest at beginning of year 4. receive $1.90 at beginning of year 5. Investment E: Invest at beginning of year 3, receive 81.50 at beginning of year 4. To create a diversified portfolio, na more than $75,000 can be put into any of these five invest- ments, At the beginning of any year, only cash on hand, which includes returns from previous in- vestments can be invested. Any cash not invested at the beginning of any year enn be put in a short-term money market account that earns 3% annually. Find the investment strategy that mimises the initial sum invested (1.0, at the beginning of year 1) to pay out at the beginning of year 5 an obligation of $280.792. Page 2 of 4 20 1 Develop and solve a LP sprutaleet model to find bevestimientplan In xox on the Excel spreadsheet or in i Word documented in the wet wtitetown the plan in work and the amount of initialement the bar Exercise 2 At the beginning of year 1, a sum of money is to be invested for the next 4 years. There are five possible investments, labelled A-E. The timing of cash outflows and cash inflows for these investments is somewhat irregular; viz., for every $1 invested: Investment A: Invest at the beginning of year 1, receive returns of $0.50 at the beginning of years 2 and $1.00 at the beginning of year 3. Investment B: Invest at the beginning of year 2, receive returns of $0.50 at the beginning of years 3 and $1.00 at the beginning of year 4. Investment C. Invest at beginning of year 1, receive $1.20 at beginning of year 2. Investment D. Invest at beginning of year 4. receive $1.90 at beginning of year 5. Investment E: Invest at beginning of year 3, receive 81.50 at beginning of year 4. To create a diversified portfolio, na more than $75,000 can be put into any of these five invest- ments, At the beginning of any year, only cash on hand, which includes returns from previous in- vestments can be invested. Any cash not invested at the beginning of any year enn be put in a short-term money market account that earns 3% annually. Find the investment strategy that mimises the initial sum invested (1.0, at the beginning of year 1) to pay out at the beginning of year 5 an obligation of $280.792. Page 2 of 4 20 1 Develop and solve a LP sprutaleet model to find bevestimientplan In xox on the Excel spreadsheet or in i Word documented in the wet wtitetown the plan in work and the amount of initialement the bar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started