Answered step by step

Verified Expert Solution

Question

1 Approved Answer

exercise 2 both pitcures are the question 1: Use the following information to do your analysis. 350 units; rents 100 studio units renting for $1,200

exercise 2

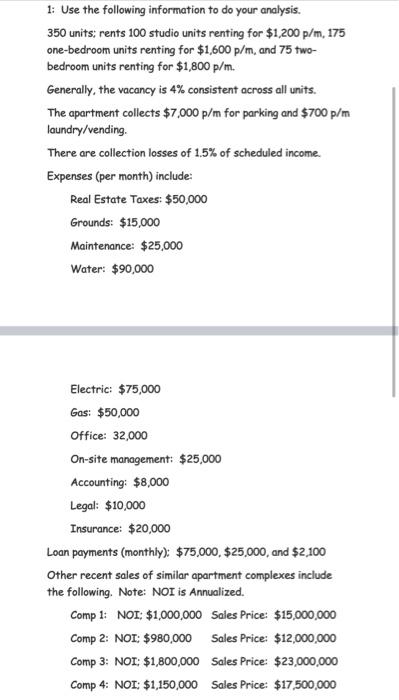

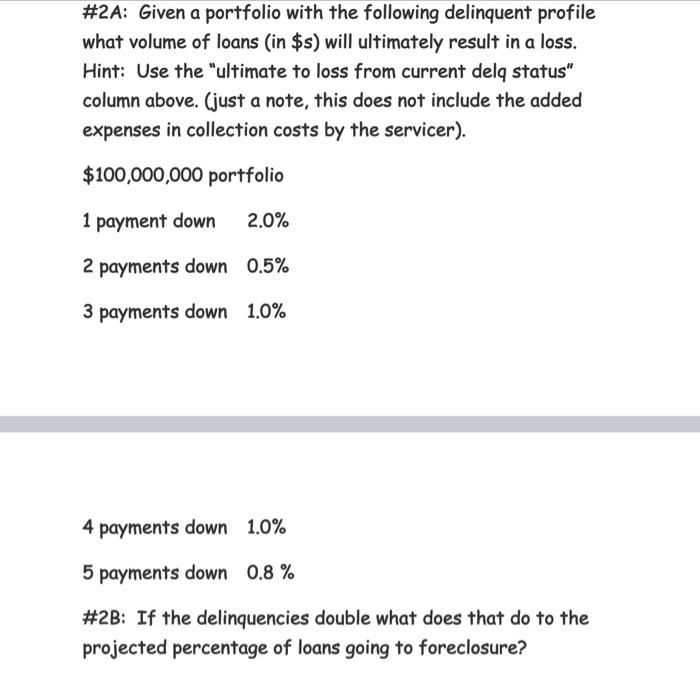

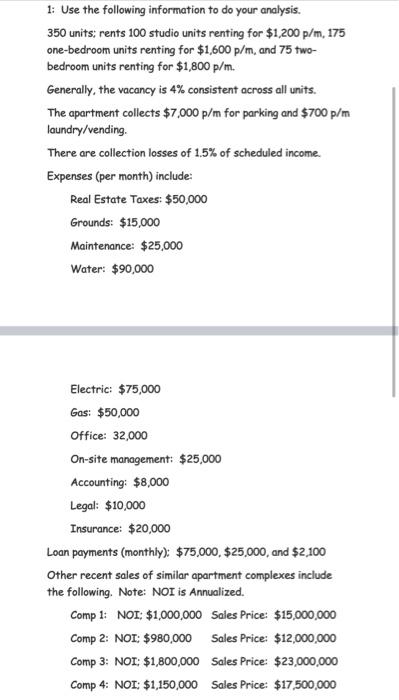

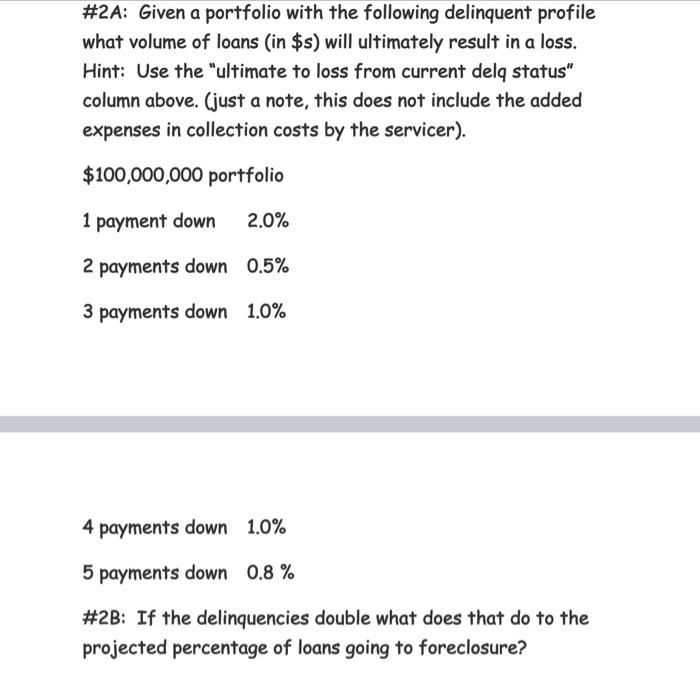

1: Use the following information to do your analysis. 350 units; rents 100 studio units renting for $1,200 p/m, 175 one-bedroom units renting for $1,600 p/m, and 75 two- bedroom units renting for $1,800 p/m. Generally, the vacancy is 4% consistent across all units. The apartment collects $7,000 p/m for parking and $700 p/m laundry/vending. There are collection losses of 1.5% of scheduled income. Expenses (per month) include: Real Estate Taxes: $50,000 Grounds: $15,000 Maintenance: $25,000 Water: $90,000 Electric: $75,000 Gas: $50,000 Office: 32,000 On-site management: $25,000 Accounting: $8,000 Legal: $10,000 Insurance: $20,000 Loan payments (monthly): $75,000, $25,000, and $2,100 Other recent sales of similar apartment complexes include the following. Note: NOI is Annualized. Comp 1: NOI: $1,000,000 Sales Price: $15,000,000 Comp 2: NOI: $980,000 Sales Price: $12,000,000 Comp 3: NOI: $1,800,000 Sales Price: $23,000,000 Comp 4: NOI: $1,150,000 Sales Price: $17,500,000 #2A: Given a portfolio with the following delinquent profile what volume of loans (in $s) will ultimately result in a loss. Hint: Use the "ultimate to loss from current delq status" column above. (just a note, this does not include the added expenses in collection costs by the servicer). $100,000,000 portfolio 1 payment down 2.0% 2 payments down 0.5% 3 payments down 1.0% 4 payments down 1.0% 5 payments down 0.8% #2B: If the delinquencies double what does that do to the projected percentage of loans going to foreclosure? 1: Use the following information to do your analysis. 350 units; rents 100 studio units renting for $1,200 p/m, 175 one-bedroom units renting for $1,600 p/m, and 75 two- bedroom units renting for $1,800 p/m. Generally, the vacancy is 4% consistent across all units. The apartment collects $7,000 p/m for parking and $700 p/m laundry/vending. There are collection losses of 1.5% of scheduled income. Expenses (per month) include: Real Estate Taxes: $50,000 Grounds: $15,000 Maintenance: $25,000 Water: $90,000 Electric: $75,000 Gas: $50,000 Office: 32,000 On-site management: $25,000 Accounting: $8,000 Legal: $10,000 Insurance: $20,000 Loan payments (monthly): $75,000, $25,000, and $2,100 Other recent sales of similar apartment complexes include the following. Note: NOI is Annualized. Comp 1: NOI: $1,000,000 Sales Price: $15,000,000 Comp 2: NOI: $980,000 Sales Price: $12,000,000 Comp 3: NOI: $1,800,000 Sales Price: $23,000,000 Comp 4: NOI: $1,150,000 Sales Price: $17,500,000 #2A: Given a portfolio with the following delinquent profile what volume of loans (in $s) will ultimately result in a loss. Hint: Use the "ultimate to loss from current delq status" column above. (just a note, this does not include the added expenses in collection costs by the servicer). $100,000,000 portfolio 1 payment down 2.0% 2 payments down 0.5% 3 payments down 1.0% 4 payments down 1.0% 5 payments down 0.8% #2B: If the delinquencies double what does that do to the projected percentage of loans going to foreclosure both pitcures are the question

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started