Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EXERCISE 2: LEASING VERSUS BUYING You have two options: to buy or to lease a video store. Option 1: Purchase Year 0 Cost 1 1

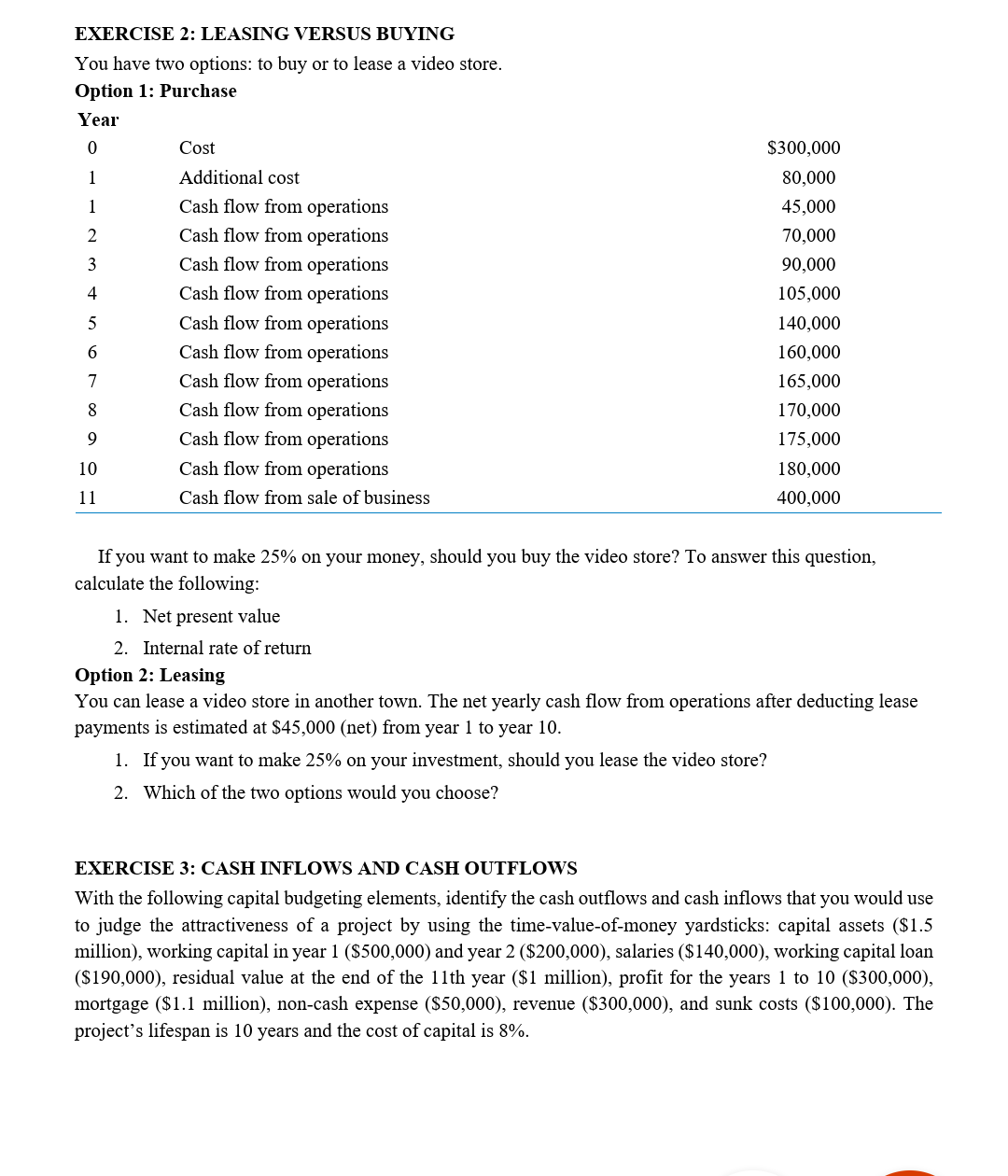

EXERCISE 2: LEASING VERSUS BUYING You have two options: to buy or to lease a video store. Option 1: Purchase Year 0 Cost 1 1 2 3 4 5 6 Additional cost Cash flow from operations Cash flow from operations Cash flow from operations Cash flow from operations Cash flow from operations Cash flow from operations Cash flow from operations Cash flow from operations Cash flow from operations Cash flow from operations Cash flow from sale of business $300,000 80,000 45,000 70,000 90,000 105,000 140,000 160,000 165,000 170,000 175,000 180,000 400,000 7 8 9 10 11 If you want to make 25% on your money, should you buy the video store? To answer this question, calculate the following: 1. Net present value 2. Internal rate of return Option 2: Leasing You can lease a video store in another town. The net yearly cash flow from operations after deducting lease payments is estimated at $45,000 (net) from year 1 to year 10. 1. If you want to make 25% on your investment, should you lease the video store? 2. Which of the two options would you choose? EXERCISE 3: CASH INFLOWS AND CASH OUTFLOWS With the following capital budgeting elements, identify the cash outflows and cash inflows that you would use to judge the attractiveness of a project by using the time-value-of-money yardsticks: capital assets ($1.5 million), working capital in year 1 ($500,000) and year 2 ($200,000), salaries ($140,000), working capital loan ($190,000), residual value at the end of the 11th year ($1 million), profit for the years 1 to 10 ($300,000), mortgage ($1.1 million), non-cash expense ($50,000), revenue ($300,000), and sunk costs ($100,000). The project's lifespan is 10 years and the cost of capital is 8%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started