Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 2 please ASAP. Depreciation is a way to reduce the value of an asset over time (e.g. wear and tear) for tax purposes or

Exercise 2 please ASAP.

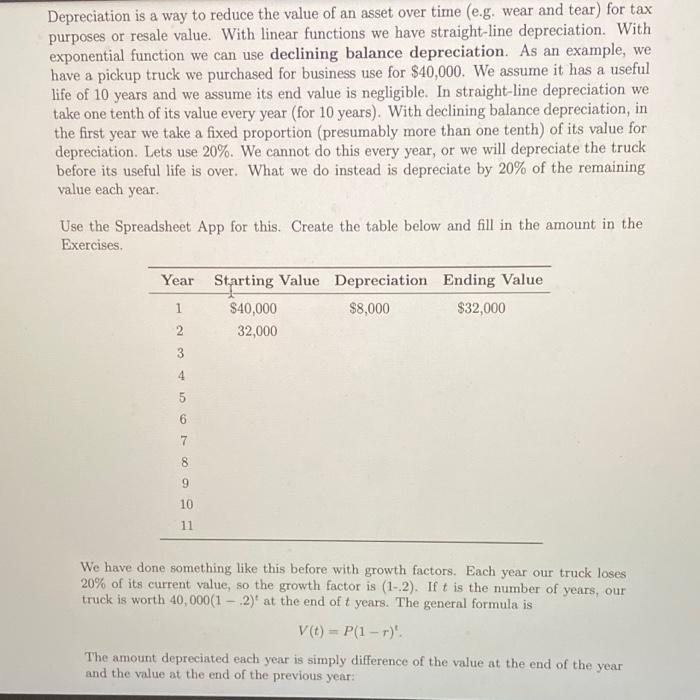

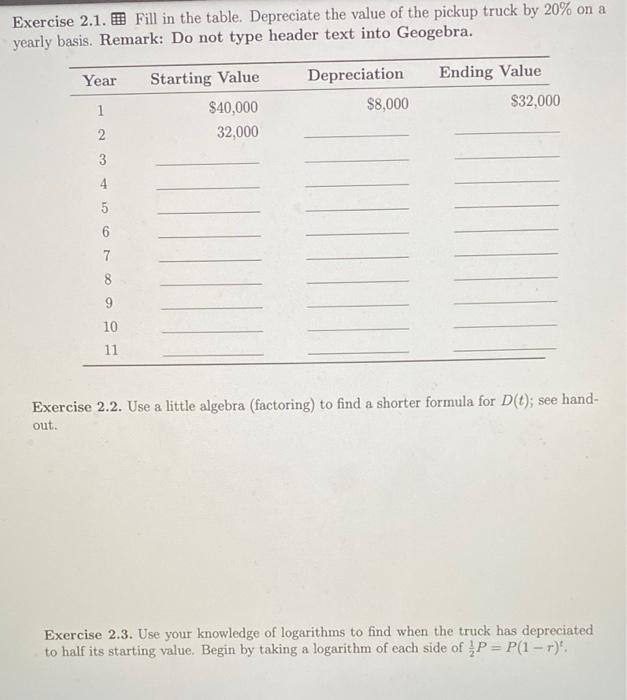

Depreciation is a way to reduce the value of an asset over time (e.g. wear and tear) for tax purposes or resale value. With linear functions we have straight-line depreciation. With exponential function we can use declining balance depreciation. As an example, we have a pickup truck we purchased for business use for $40,000. We assume it has a useful life of 10 years and we assume its end value is negligible. In straight-line depreciation we take one tenth of its value every year (for 10 years). With declining balance depreciation, in the first year we take a fixed proportion (presumably more than one tenth) of its value for depreciation. Lets use 20%. We cannot do this every year, or we will depreciate the truck before its useful life is over. What we do instead is depreciate by 20% of the remaining value each year. Use the Spreadsheet App for this. Create the table below and fill in the amount in the Exercises Year Starting Value Depreciation Ending Value 1 $40,000 $8,000 $32,000 2 32,000 3 4 5 6 8 9 10 11 We have done something like this before with growth factors. Each year our truck loses 20% of its current value, so the growth factor is (1-2). If t is the number of years, our truck is worth 40,000(1 - 2)' at the end of t years. The general formula is VO) = P(1-1) The amount depreciated each year is simply difference of the value at the end of the year and the value at the end of the previous year: Exercise 2.1. Fill in the table. Depreciate the value of the pickup truck by 20% on a yearly basis. Remark: Do not type header text into Geogebra. Year Ending Value Starting Value $40,000 32,000 Depreciation $8,000 1 $32,000 2 3 4 6 7 8 9 10 11 Exercise 2.2. Use a little algebra (factoring) to find a shorter formula for D(0); see hand- out. Exercise 2.3. Use your knowledge of logarithms to find when the truck has depreciated to half its starting value. Begin by taking a logarithm of each side of P= P(1 - 1)

Depreciation is a way to reduce the value of an asset over time (e.g. wear and tear) for tax purposes or resale value. With linear functions we have straight-line depreciation. With exponential function we can use declining balance depreciation. As an example, we have a pickup truck we purchased for business use for $40,000. We assume it has a useful life of 10 years and we assume its end value is negligible. In straight-line depreciation we take one tenth of its value every year (for 10 years). With declining balance depreciation, in the first year we take a fixed proportion (presumably more than one tenth) of its value for depreciation. Lets use 20%. We cannot do this every year, or we will depreciate the truck before its useful life is over. What we do instead is depreciate by 20% of the remaining value each year. Use the Spreadsheet App for this. Create the table below and fill in the amount in the Exercises Year Starting Value Depreciation Ending Value 1 $40,000 $8,000 $32,000 2 32,000 3 4 5 6 8 9 10 11 We have done something like this before with growth factors. Each year our truck loses 20% of its current value, so the growth factor is (1-2). If t is the number of years, our truck is worth 40,000(1 - 2)' at the end of t years. The general formula is VO) = P(1-1) The amount depreciated each year is simply difference of the value at the end of the year and the value at the end of the previous year: Exercise 2.1. Fill in the table. Depreciate the value of the pickup truck by 20% on a yearly basis. Remark: Do not type header text into Geogebra. Year Ending Value Starting Value $40,000 32,000 Depreciation $8,000 1 $32,000 2 3 4 6 7 8 9 10 11 Exercise 2.2. Use a little algebra (factoring) to find a shorter formula for D(0); see hand- out. Exercise 2.3. Use your knowledge of logarithms to find when the truck has depreciated to half its starting value. Begin by taking a logarithm of each side of P= P(1 - 1)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started