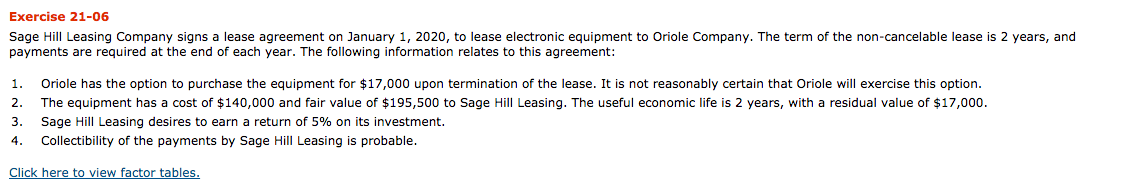

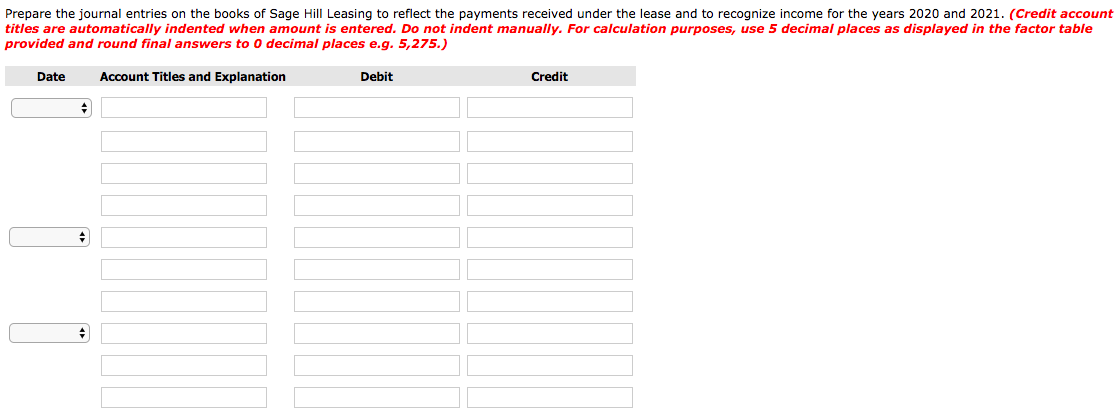

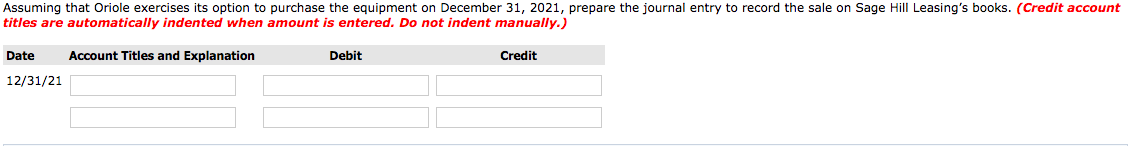

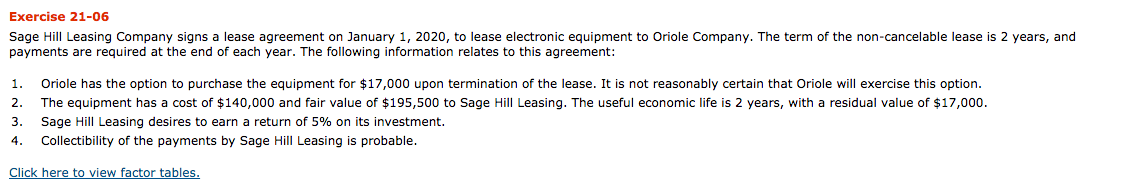

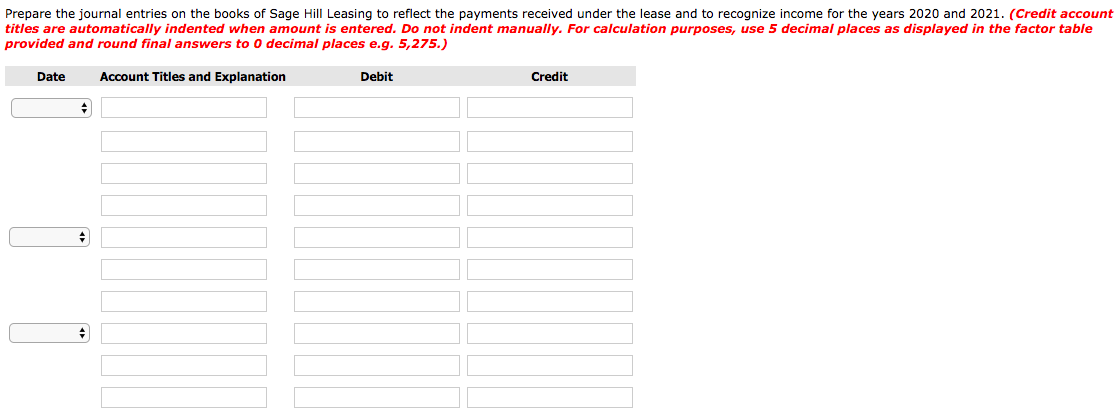

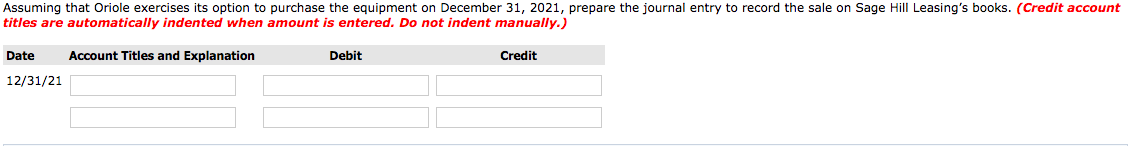

Exercise 21-06 Sage Hill Leasing Company signs a lease agreement on January 1, 2020, to lease electronic equipment to Oriole Company. The term of the non-cancelable lease is 2 years, and payments are required at the end of each year. The following information relates to this agreement: 1. 2. 3. 4. Oriole has the option to purchase the equipment for $17,000 upon termination of the lease. It is not reasonably certain that Oriole will exercise this option. The equipment has a cost of $140,000 and fair value of $195,500 to Sage Hill Leasing. The useful economic life is 2 years, with a residual value of $17,000. Sage Hill Leasing desires to earn a return of 5% on its investment. Collectibility of the payments by Sage Hill Leasing is probable. Click here to view factor tables. Prepare the journal entries on the books of Sage Hill Leasing to reflect the payments received under the lease and to recognize income for the years 2020 and 2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually. For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to o decimal places e.g. 5,275.) Date Account Titles and Explanation Debit Credit Assuming that Oriole exercises its option to purchase the equipment on December 31, 2021, prepare the journal entry to record the sale on Sage Hill Leasing's books. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation 12/31/21 Exercise 21-06 Sage Hill Leasing Company signs a lease agreement on January 1, 2020, to lease electronic equipment to Oriole Company. The term of the non-cancelable lease is 2 years, and payments are required at the end of each year. The following information relates to this agreement: 1. 2. 3. 4. Oriole has the option to purchase the equipment for $17,000 upon termination of the lease. It is not reasonably certain that Oriole will exercise this option. The equipment has a cost of $140,000 and fair value of $195,500 to Sage Hill Leasing. The useful economic life is 2 years, with a residual value of $17,000. Sage Hill Leasing desires to earn a return of 5% on its investment. Collectibility of the payments by Sage Hill Leasing is probable. Click here to view factor tables. Prepare the journal entries on the books of Sage Hill Leasing to reflect the payments received under the lease and to recognize income for the years 2020 and 2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually. For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to o decimal places e.g. 5,275.) Date Account Titles and Explanation Debit Credit Assuming that Oriole exercises its option to purchase the equipment on December 31, 2021, prepare the journal entry to record the sale on Sage Hill Leasing's books. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation 12/31/21