Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 2.11 Cost Assignment Methods Nizam Company produces speaker cabinets. Recently, Nizam switched from a traditional departmental assembly line system to a manufacturing cell in

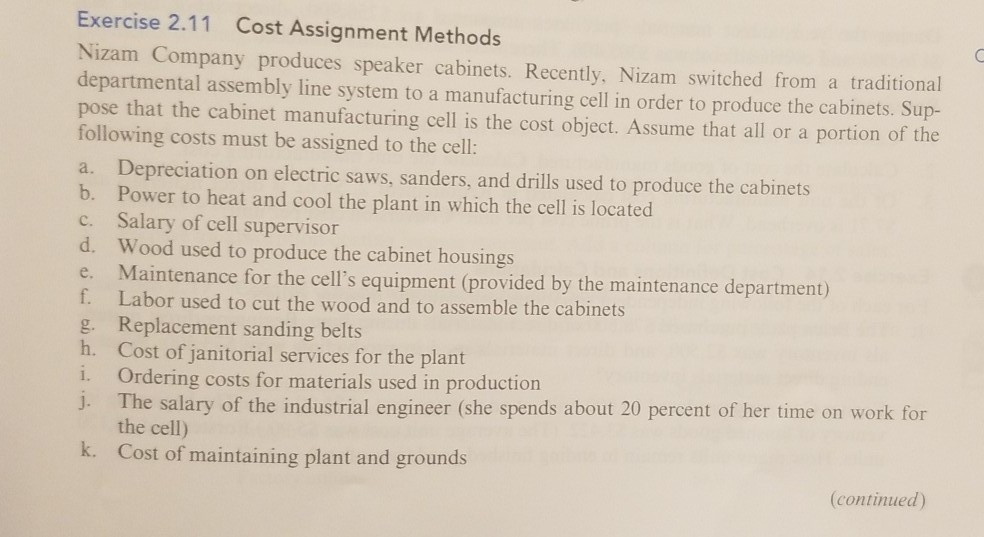

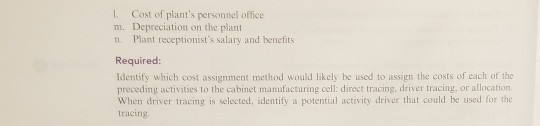

Exercise 2.11 Cost Assignment Methods Nizam Company produces speaker cabinets. Recently, Nizam switched from a traditional departmental assembly line system to a manufacturing cell in order to produce the cabinets. Sup- pose that the cabinet manufacturing cell is the cost object. Assume that all or a portion of the following costs must be assigned to the cell: a. Depreciation on electric saws, sanders, and drills used to produce the cabinets b. Power to heat and cool the plant in which the cell is located c. Salary of cell supervisor d. Wood used to produce the cabinet housings e. Maintenance for the cell's equipment (provided by the maintenance department) Labor used to cut the wood and to assemble the cabinets Replacement sanding belts h. Cost of janitorial services for the plant Ordering costs for materials used in production j. The salary of the industrial engineer (she spends about 20 percent of her time on work for the cell) k. Cost of maintaining plant and grounds (continued) 1. Cost of plant's personnel office m. Depreciation on the plant 1 Plant receptionist's salary and benefits Required: Identify which cost assignment method would likely be used to assign the costs of each of the preceding activities to the cabinet manufacturing cell direct tracing, driver tracing, or allocation When driver tracing is selected, identify a potential activity driver that could be used for the tracing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started