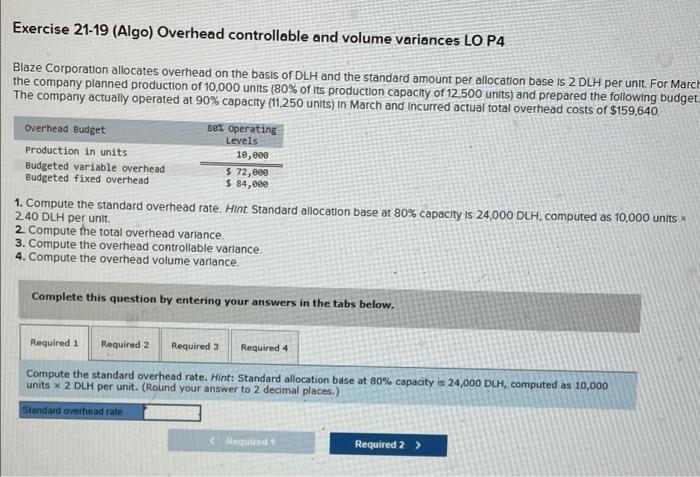

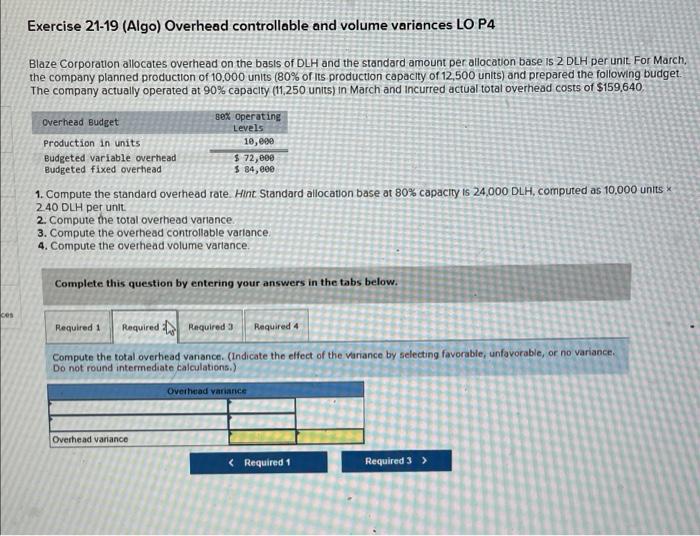

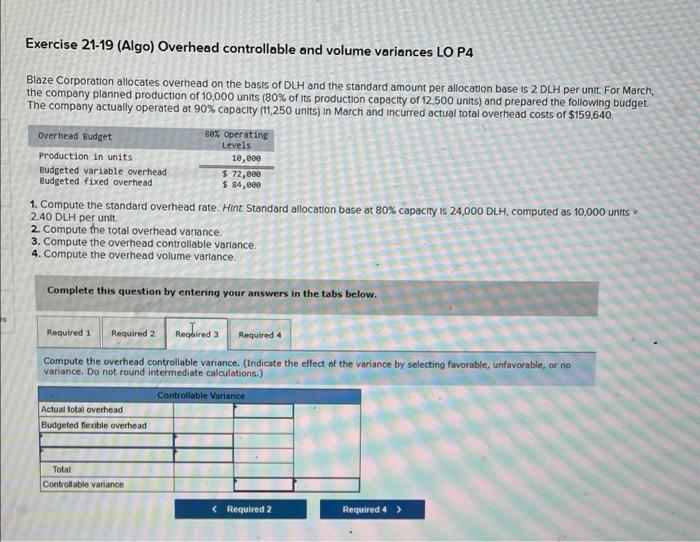

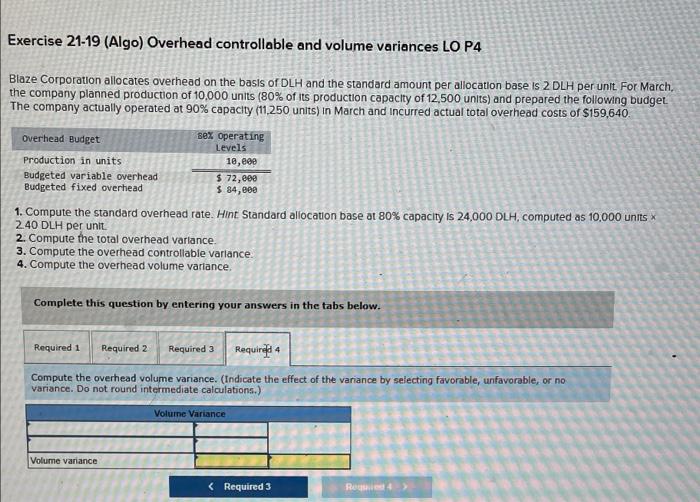

Exercise 21-19 (Algo) Overhead controllable and volume variances LO P4 Blaze Corporation allocates overhead on the basis of DLH and the standard amount per allocation base is 2 DLH per unit. For March the company planned production of 10,000 units (80% of its production capacity of 12,500 units) and prepared the following budget The company actually operated at 90% capacity (11.250 units) In March and Incurred actual total overhead costs of $159,640. overhead Budget sex operating Levels Production in units 18,800 Budgeted variable overhead $ 72,800 Budgeted fixed overhead $ 84,000 1. Compute the standard overhead rate. Hint Standard allocation base at 80% capacity is 24,000 DLH.computed as 10,000 units 2.40 DLH per unit. 2. Compute the total overhead variance. 3. Compute the overhead controllable variance 4. Compute the overhead volume vartance. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the standard overhead rate. Hint: Standard allocation base at 80% capacity is 24,000 DLH, computed as 10,000 units * 2 DLH per unit. (Round your answer to 2 decimal places.) Standard overhead rate Required Required 2 > Exercise 21-19 (Algo) Overhead controllable and volume variances LO P4 Blaze Corporation allocates overhead on the basis of DLH and the standard amount per allocation base is 2 DLH per unit For March. the company planned production of 10,000 units (80% of its production capacity of 12,500 units) and prepared the following budget. The company actually operated at 90% capacity (11,250 units) in March and incurred actual total overhead costs of $159,640 Overhead Budget sex Operating Levels Production in units 10,90 Budgeted variable overhead $ 72,000 Budgeted fixed overhead $ 84,000 1. Compute the standard overhead rate. Hint Standard allocation base at 80% capacity is 24000 DLH, computed as 10,000 units * 2.40 DLH per unit 2. Compute the total overhead variance. 3. Compute the overhead controllable variance 4. Compute the overhead volume vartance. Complete this question by entering your answers in the tabs below. ces Required 1 Required: Required a Required 4 Compute the total overhead vanance. (Indicate the effect of the variance by selecting favorable, unfavorable, or no variance Do not round intermediate calculations.) Overhead variance Overhead variance Exercise 21-19 (Algo) Overhead controllable and volume variances LO P4 Blaze Corporation allocates overhead on the basis of DLH and the standard amount per allocation base is 2 DLH per unit. For March, the company planned production of 10,000 units (80% of its production capacity of 12,500 units) and prepared the following budget The company actually operated at 90% capacity (11.250 units) in March and incurred actual total overhead costs of $159,640, overhead Budget Sex Operating Levels Production in units 10,88 Budgeted variable overhead $ 72,000 Budgeted fixed overhead $ 84,000 1. Compute the standard overhead rate Hint Standard allocation base at 80% capacity is 24,000 DLH, computed as 10,000 units * 2.40 DLH per unit 2. Compute the total overhead variance 3. Compute the overhead controllable variance 4. Compute the overhead volume vartance. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the overhead controllable variance. (Indicate the effect of the variance by selecting favorable, unfavorable, or no variance. Do not round intermediate calculations.) Controllable Variance Actual total overhead Budgeted flexible overhead Total Controllable variance Exercise 21-19 (Algo) Overhead controllable and volume variances LO P4 Blaze Corporation allocates overhead on the basis of DLH and the standard amount per allocation base is 2 DLH per unit For March, the company planned production of 10,000 units (80% of its production capacity of 12,500 units) and prepared the following budget The company actually operated at 90% capacity (11.250 units) in March and incurred actual total overhead costs of $159,640. Overhead Budget sex Operating Levels Production in units 18,eee Budgeted variable overhead $ 72,080 Budgeted fixed overhead $ 84,000 1. Compute the standard overhead rate. Hint Standard allocation base at 80% capacity is 24,000 DLH, computed as 10,000 units * 2.40 DLH per unit. 2. Compute the total overhead variance. 3. Compute the overhead controllable variance 4. Compute the overhead volume variance. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the overhead volume variance. (Indicate the effect of the variance by selecting favorable, unfavorable, or no variance. Do not round intermediate calculations.) Volume Variance Volume variance