Answered step by step

Verified Expert Solution

Question

1 Approved Answer

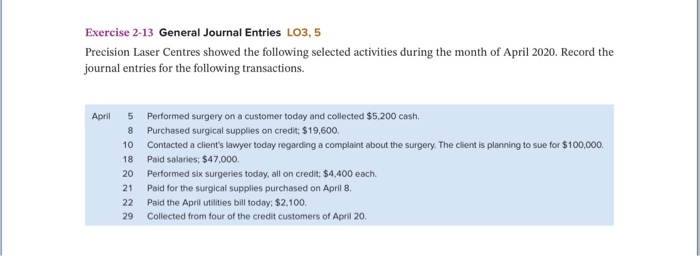

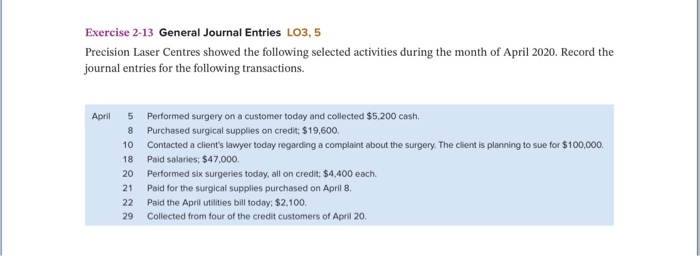

Exercise 2-13 General Journal Entries LO3,5 Precision Laser Centres showed the following selected activities during the month of April 2020. Record the journal entries for

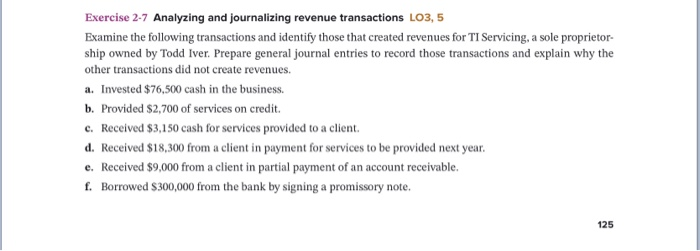

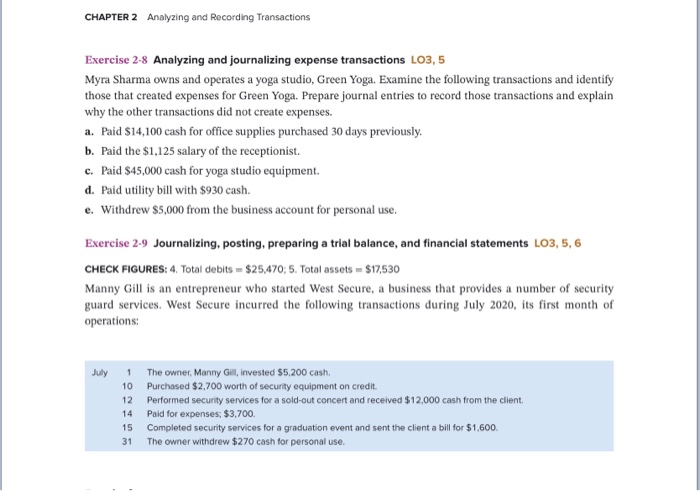

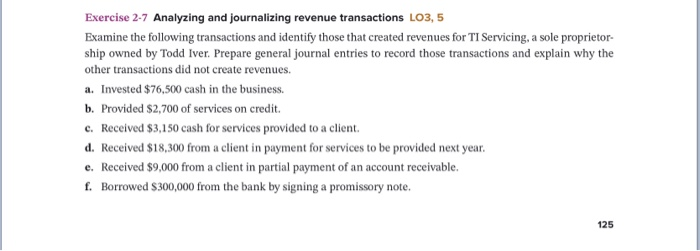

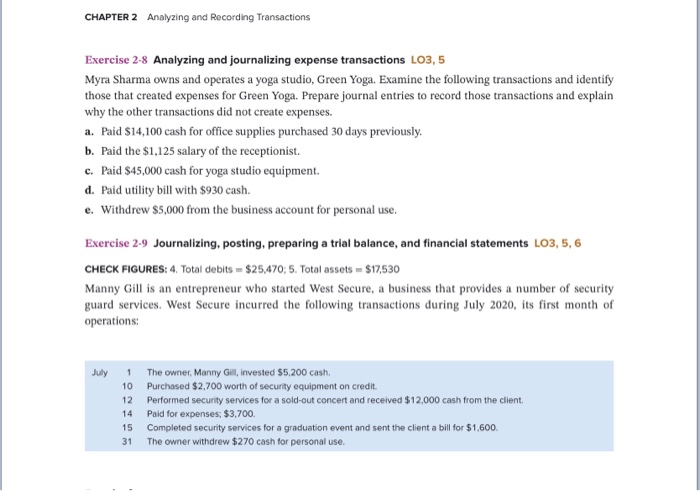

Exercise 2-13 General Journal Entries LO3,5 Precision Laser Centres showed the following selected activities during the month of April 2020. Record the journal entries for the following transactions. April 10 18 20 21 22 5 Performed surgery on a customer today and collected $5,200 cash. 8 Purchased surgical supplies on credit: $19,600. Contacted a client's lawyer today regarding a complaint about the surgery. The client is planning to sue for $100,000 Paid salaries: $47,000 Performed six surgeries today, all on credit; $4,400 each. Paid for the surgical supplies purchased on April 8. Paid the April utilities bill today: $2,100. 29 Collected from four of the credit customers of April 20. Exercise 2-7 Analyzing and journalizing revenue transactions LO3,5 Examine the following transactions and identify those that created revenues for TI Servicing, a sole proprietor ship owned by Todd Iver. Prepare general journal entries to record those transactions and explain why the other transactions did not create revenues. a. Invested $76,500 cash in the business. b. Provided $2,700 of services on credit c. Received $3,150 cash for services provided to a client d. Received $18,300 from a client in payment for services to be provided next year. e. Received $9,000 from a client in partial payment of an account receivable. f. Borrowed $300,000 from the bank by signing a promissory note. 125 CHAPTER 2 Analyzing and Recording Transactions Exercise 2-8 Analyzing and journalizing expense transactions L03,5 Myra Sharma owns and operates a yoga studio, Green Yoga. Examine the following transactions and identify those that created expenses for Green Yoga. Prepare journal entries to record those transactions and explain why the other transactions did not create expenses. a. Paid $14,100 cash for office supplies purchased 30 days previously. b. Paid the $1,125 salary of the receptionist. c. Paid $45,000 cash for yoga studio equipment d. Paid utility bill with $930 cash. e. Withdrew $5,000 from the business account for personal use. Exercise 2-9 Journalizing, posting, preparing a trial balance, and financial statements LO3, 5, 6 CHECK FIGURES: 4. Total debits - $25,470; 5. Total assets = $17,530 Manny Gill is an entrepreneur who started West Secure, a business that provides a number of security guard services. West Secure incurred the following transactions during July 2020, its first month of operations: July 1 The owner, Manny Gill, invested $5,200 cash. 10 Purchased $2,700 worth of security equipment on credit. 12 Performed security services for a sold-out concert and received $12,000 cash from the client. 14 Pald for expenses: $3,700 Completed security services for a graduation event and sent the client a bill for $1,600. The owner withdrew $270 cash for personal use. 15 31 Exercise 2-13 General Journal Entries LO3,5 Precision Laser Centres showed the following selected activities during the month of April 2020. Record the journal entries for the following transactions. April 10 18 20 21 22 5 Performed surgery on a customer today and collected $5,200 cash. 8 Purchased surgical supplies on credit: $19,600. Contacted a client's lawyer today regarding a complaint about the surgery. The client is planning to sue for $100,000 Paid salaries: $47,000 Performed six surgeries today, all on credit; $4,400 each. Paid for the surgical supplies purchased on April 8. Paid the April utilities bill today: $2,100. 29 Collected from four of the credit customers of April 20. Exercise 2-7 Analyzing and journalizing revenue transactions LO3,5 Examine the following transactions and identify those that created revenues for TI Servicing, a sole proprietor ship owned by Todd Iver. Prepare general journal entries to record those transactions and explain why the other transactions did not create revenues. a. Invested $76,500 cash in the business. b. Provided $2,700 of services on credit c. Received $3,150 cash for services provided to a client d. Received $18,300 from a client in payment for services to be provided next year. e. Received $9,000 from a client in partial payment of an account receivable. f. Borrowed $300,000 from the bank by signing a promissory note. 125 CHAPTER 2 Analyzing and Recording Transactions Exercise 2-8 Analyzing and journalizing expense transactions L03,5 Myra Sharma owns and operates a yoga studio, Green Yoga. Examine the following transactions and identify those that created expenses for Green Yoga. Prepare journal entries to record those transactions and explain why the other transactions did not create expenses. a. Paid $14,100 cash for office supplies purchased 30 days previously. b. Paid the $1,125 salary of the receptionist. c. Paid $45,000 cash for yoga studio equipment d. Paid utility bill with $930 cash. e. Withdrew $5,000 from the business account for personal use. Exercise 2-9 Journalizing, posting, preparing a trial balance, and financial statements LO3, 5, 6 CHECK FIGURES: 4. Total debits - $25,470; 5. Total assets = $17,530 Manny Gill is an entrepreneur who started West Secure, a business that provides a number of security guard services. West Secure incurred the following transactions during July 2020, its first month of operations: July 1 The owner, Manny Gill, invested $5,200 cash. 10 Purchased $2,700 worth of security equipment on credit. 12 Performed security services for a sold-out concert and received $12,000 cash from the client. 14 Pald for expenses: $3,700 Completed security services for a graduation event and sent the client a bill for $1,600. The owner withdrew $270 cash for personal use. 15 31

Exercise 2-13 General Journal Entries LO3,5 Precision Laser Centres showed the following selected activities during the month of April 2020. Record the journal entries for the following transactions. April 10 18 20 21 22 5 Performed surgery on a customer today and collected $5,200 cash. 8 Purchased surgical supplies on credit: $19,600. Contacted a client's lawyer today regarding a complaint about the surgery. The client is planning to sue for $100,000 Paid salaries: $47,000 Performed six surgeries today, all on credit; $4,400 each. Paid for the surgical supplies purchased on April 8. Paid the April utilities bill today: $2,100. 29 Collected from four of the credit customers of April 20. Exercise 2-7 Analyzing and journalizing revenue transactions LO3,5 Examine the following transactions and identify those that created revenues for TI Servicing, a sole proprietor ship owned by Todd Iver. Prepare general journal entries to record those transactions and explain why the other transactions did not create revenues. a. Invested $76,500 cash in the business. b. Provided $2,700 of services on credit c. Received $3,150 cash for services provided to a client d. Received $18,300 from a client in payment for services to be provided next year. e. Received $9,000 from a client in partial payment of an account receivable. f. Borrowed $300,000 from the bank by signing a promissory note. 125 CHAPTER 2 Analyzing and Recording Transactions Exercise 2-8 Analyzing and journalizing expense transactions L03,5 Myra Sharma owns and operates a yoga studio, Green Yoga. Examine the following transactions and identify those that created expenses for Green Yoga. Prepare journal entries to record those transactions and explain why the other transactions did not create expenses. a. Paid $14,100 cash for office supplies purchased 30 days previously. b. Paid the $1,125 salary of the receptionist. c. Paid $45,000 cash for yoga studio equipment d. Paid utility bill with $930 cash. e. Withdrew $5,000 from the business account for personal use. Exercise 2-9 Journalizing, posting, preparing a trial balance, and financial statements LO3, 5, 6 CHECK FIGURES: 4. Total debits - $25,470; 5. Total assets = $17,530 Manny Gill is an entrepreneur who started West Secure, a business that provides a number of security guard services. West Secure incurred the following transactions during July 2020, its first month of operations: July 1 The owner, Manny Gill, invested $5,200 cash. 10 Purchased $2,700 worth of security equipment on credit. 12 Performed security services for a sold-out concert and received $12,000 cash from the client. 14 Pald for expenses: $3,700 Completed security services for a graduation event and sent the client a bill for $1,600. The owner withdrew $270 cash for personal use. 15 31 Exercise 2-13 General Journal Entries LO3,5 Precision Laser Centres showed the following selected activities during the month of April 2020. Record the journal entries for the following transactions. April 10 18 20 21 22 5 Performed surgery on a customer today and collected $5,200 cash. 8 Purchased surgical supplies on credit: $19,600. Contacted a client's lawyer today regarding a complaint about the surgery. The client is planning to sue for $100,000 Paid salaries: $47,000 Performed six surgeries today, all on credit; $4,400 each. Paid for the surgical supplies purchased on April 8. Paid the April utilities bill today: $2,100. 29 Collected from four of the credit customers of April 20. Exercise 2-7 Analyzing and journalizing revenue transactions LO3,5 Examine the following transactions and identify those that created revenues for TI Servicing, a sole proprietor ship owned by Todd Iver. Prepare general journal entries to record those transactions and explain why the other transactions did not create revenues. a. Invested $76,500 cash in the business. b. Provided $2,700 of services on credit c. Received $3,150 cash for services provided to a client d. Received $18,300 from a client in payment for services to be provided next year. e. Received $9,000 from a client in partial payment of an account receivable. f. Borrowed $300,000 from the bank by signing a promissory note. 125 CHAPTER 2 Analyzing and Recording Transactions Exercise 2-8 Analyzing and journalizing expense transactions L03,5 Myra Sharma owns and operates a yoga studio, Green Yoga. Examine the following transactions and identify those that created expenses for Green Yoga. Prepare journal entries to record those transactions and explain why the other transactions did not create expenses. a. Paid $14,100 cash for office supplies purchased 30 days previously. b. Paid the $1,125 salary of the receptionist. c. Paid $45,000 cash for yoga studio equipment d. Paid utility bill with $930 cash. e. Withdrew $5,000 from the business account for personal use. Exercise 2-9 Journalizing, posting, preparing a trial balance, and financial statements LO3, 5, 6 CHECK FIGURES: 4. Total debits - $25,470; 5. Total assets = $17,530 Manny Gill is an entrepreneur who started West Secure, a business that provides a number of security guard services. West Secure incurred the following transactions during July 2020, its first month of operations: July 1 The owner, Manny Gill, invested $5,200 cash. 10 Purchased $2,700 worth of security equipment on credit. 12 Performed security services for a sold-out concert and received $12,000 cash from the client. 14 Pald for expenses: $3,700 Completed security services for a graduation event and sent the client a bill for $1,600. The owner withdrew $270 cash for personal use. 15 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started