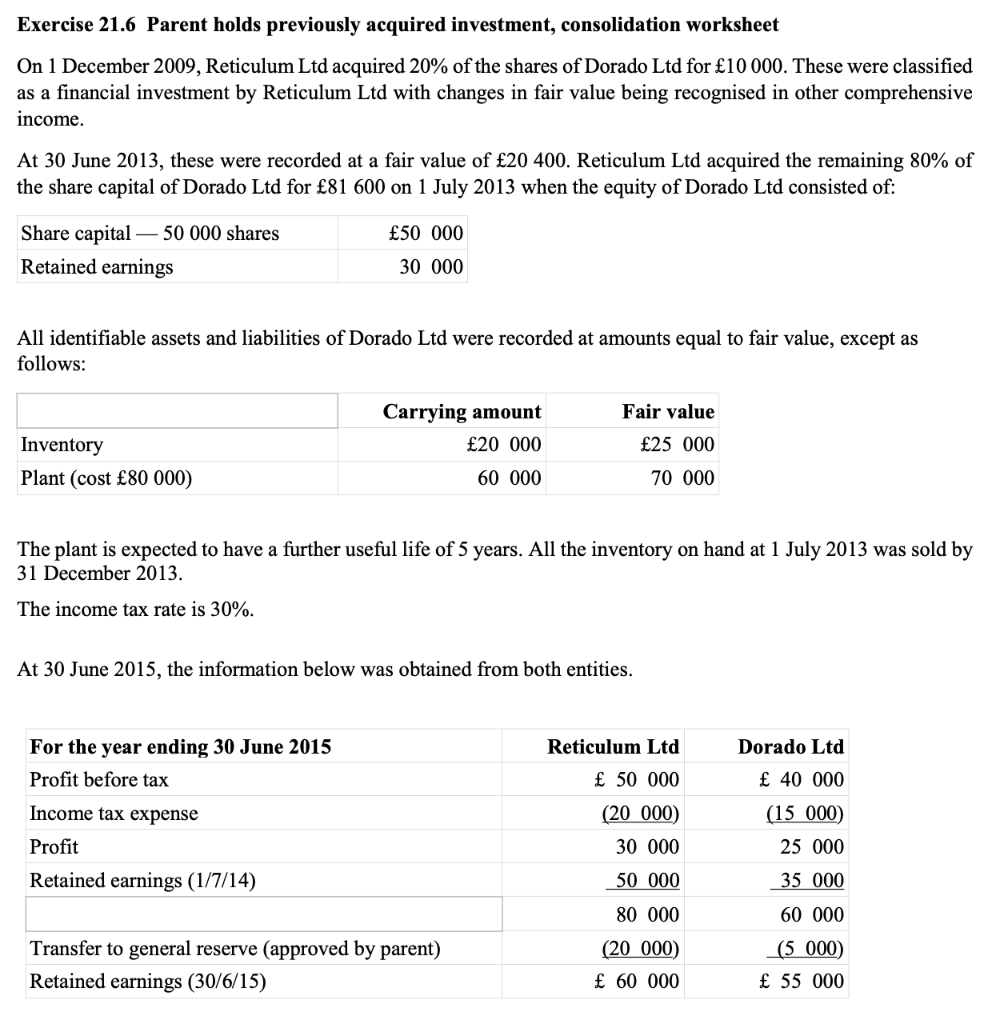

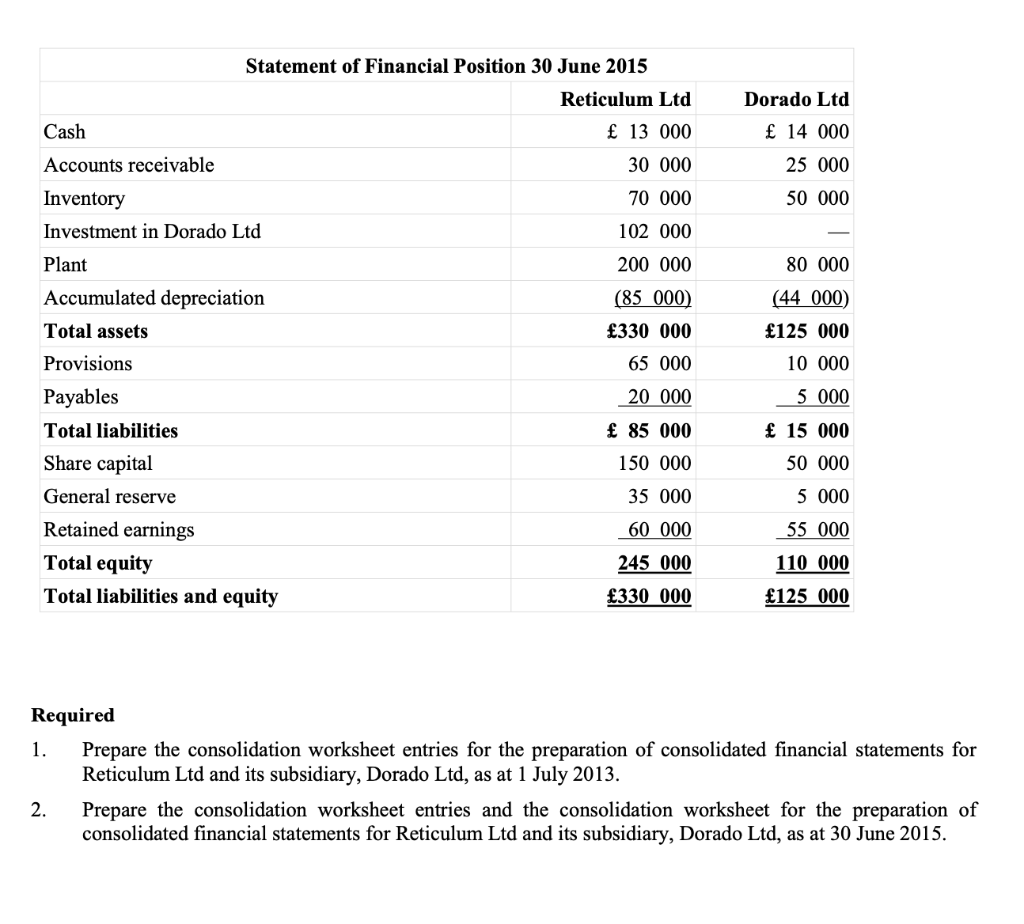

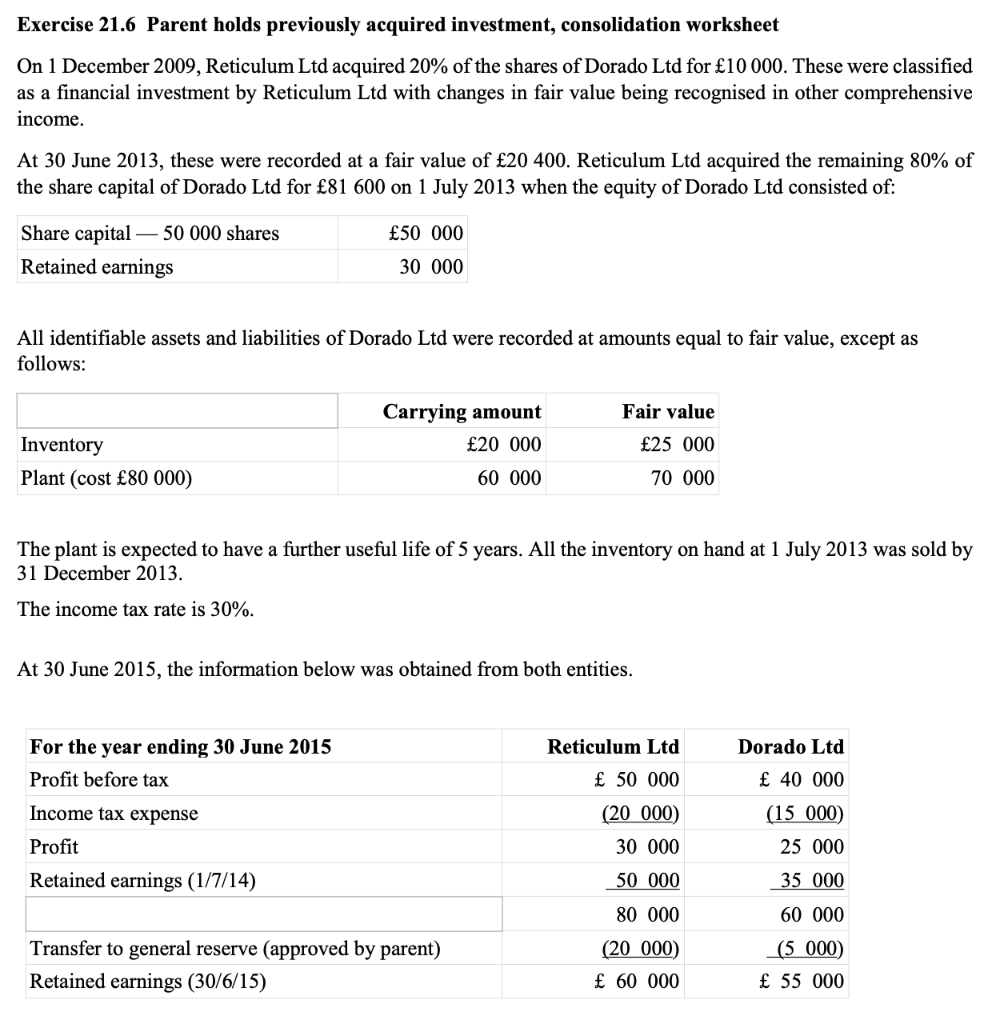

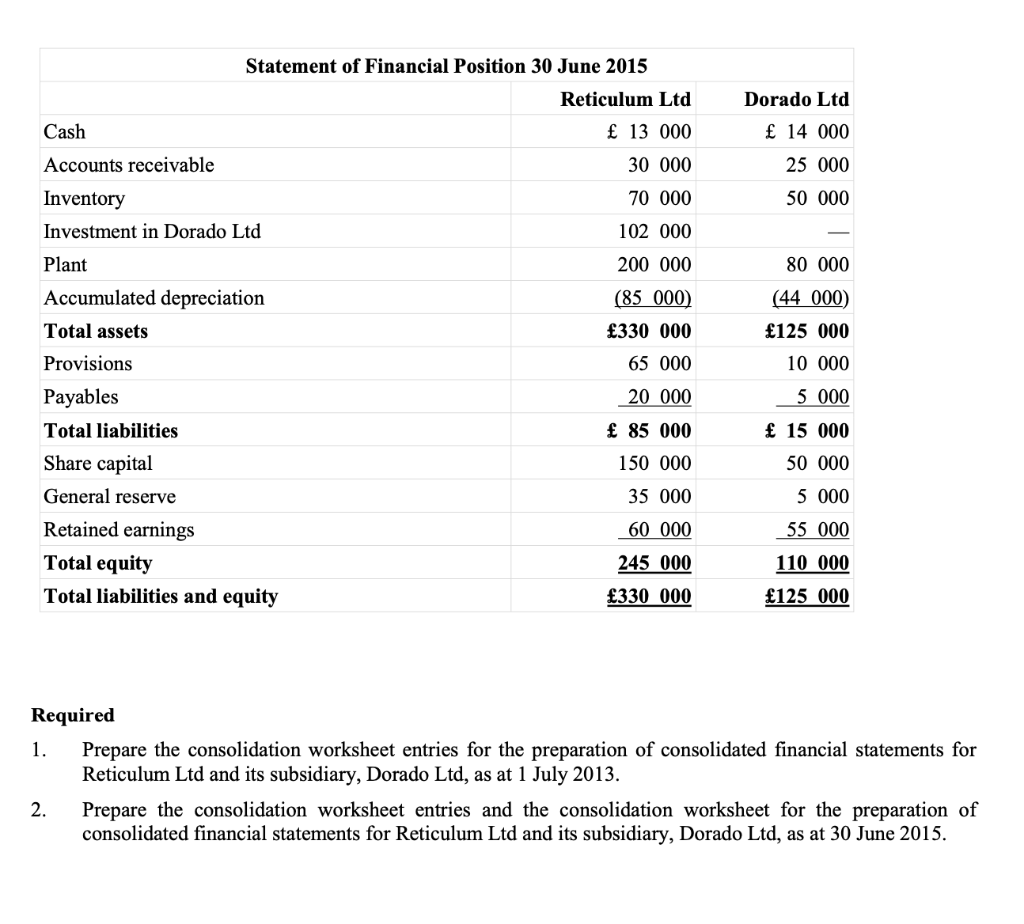

Exercise 21.6 Parent holds previously acquired investment, consolidation worksheet On 1 December 2009, Reticulum Ltd acquired 20% of the shares of Dorado Ltd for 10 000. These were classified as a financial investment by Reticulum Ltd with changes in fair value being recognised in other comprehensive income. At 30 June 2013, these were recorded at a fair value of 20 400. Reticulum Ltd acquired the remaining 80% of the share capital of Dorado Ltd for 81 600 on 1 July 2013 when the equity of Dorado Ltd consisted of: Share capital 50 000 shares Retained earnings 50 000 30 000 All identifiable assets and liabilities of Dorado Ltd were recorded at amounts equal to fair value, except as follows: Fair value Inventory Plant (cost 80 000) Carrying amount 20 000 60 000 25 000 70 000 The plant is expected to have a further useful life of 5 years. All the inventory on hand at 1 July 2013 was sold by 31 December 2013. The income tax rate is 30%. At 30 June 2015, the information below was obtained from both entities. For the year ending 30 June 2015 Profit before tax Reticulum Ltd 50 000 Dorado Ltd 40 000 Income tax expense Profit Retained earnings (1/7/14) (20 000) 30 000 50 000 (15 000) 25 000 35 000 60 000 80 000 Transfer to general reserve (approved by parent) Retained earnings (30/6/15) (20 000) 60 000 (5000) 55 000 Statement of Financial Position 30 June 2015 Dorado Ltd Cash Reticulum Ltd 13 000 30 000 70 000 Accounts receivable 14 000 25 000 50 000 Inventory Investment in Dorado Ltd Plant Accumulated depreciation Total assets 102 000 200 000 (85 000) 330 000 65 000 80 000 (44 000) 125 000 Provisions 10 000 20 000 5 000 85 000 15 000 50 000 Payables Total liabilities Share capital General reserve Retained earnings Total equity Total liabilities and equity 150 000 35 000 60 000 5 000 55 000 110 000 245 000 330 000 125 000 Required 1. Prepare the consolidation worksheet entries for the preparation of consolidated financial statements for Reticulum Ltd and its subsidiary, Dorado Ltd, as at 1 July 2013. 2. Prepare the consolidation worksheet entries and the consolidation worksheet for the preparation of consolidated financial statements for Reticulum Ltd and its subsidiary, Dorado Ltd, as at 30 June 2015. Exercise 21.6 Parent holds previously acquired investment, consolidation worksheet On 1 December 2009, Reticulum Ltd acquired 20% of the shares of Dorado Ltd for 10 000. These were classified as a financial investment by Reticulum Ltd with changes in fair value being recognised in other comprehensive income. At 30 June 2013, these were recorded at a fair value of 20 400. Reticulum Ltd acquired the remaining 80% of the share capital of Dorado Ltd for 81 600 on 1 July 2013 when the equity of Dorado Ltd consisted of: Share capital 50 000 shares Retained earnings 50 000 30 000 All identifiable assets and liabilities of Dorado Ltd were recorded at amounts equal to fair value, except as follows: Fair value Inventory Plant (cost 80 000) Carrying amount 20 000 60 000 25 000 70 000 The plant is expected to have a further useful life of 5 years. All the inventory on hand at 1 July 2013 was sold by 31 December 2013. The income tax rate is 30%. At 30 June 2015, the information below was obtained from both entities. For the year ending 30 June 2015 Profit before tax Reticulum Ltd 50 000 Dorado Ltd 40 000 Income tax expense Profit Retained earnings (1/7/14) (20 000) 30 000 50 000 (15 000) 25 000 35 000 60 000 80 000 Transfer to general reserve (approved by parent) Retained earnings (30/6/15) (20 000) 60 000 (5000) 55 000 Statement of Financial Position 30 June 2015 Dorado Ltd Cash Reticulum Ltd 13 000 30 000 70 000 Accounts receivable 14 000 25 000 50 000 Inventory Investment in Dorado Ltd Plant Accumulated depreciation Total assets 102 000 200 000 (85 000) 330 000 65 000 80 000 (44 000) 125 000 Provisions 10 000 20 000 5 000 85 000 15 000 50 000 Payables Total liabilities Share capital General reserve Retained earnings Total equity Total liabilities and equity 150 000 35 000 60 000 5 000 55 000 110 000 245 000 330 000 125 000 Required 1. Prepare the consolidation worksheet entries for the preparation of consolidated financial statements for Reticulum Ltd and its subsidiary, Dorado Ltd, as at 1 July 2013. 2. Prepare the consolidation worksheet entries and the consolidation worksheet for the preparation of consolidated financial statements for Reticulum Ltd and its subsidiary, Dorado Ltd, as at 30 June 2015