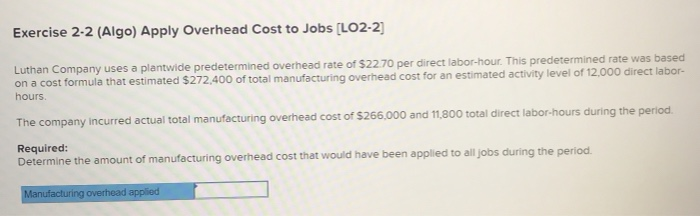

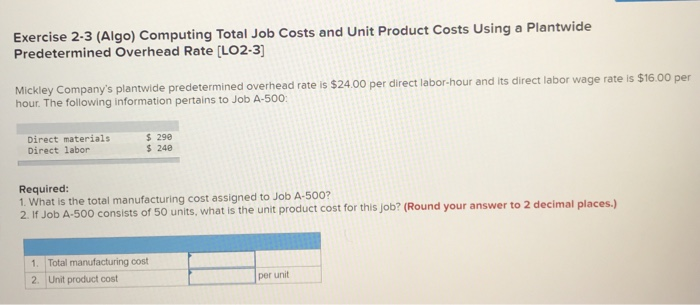

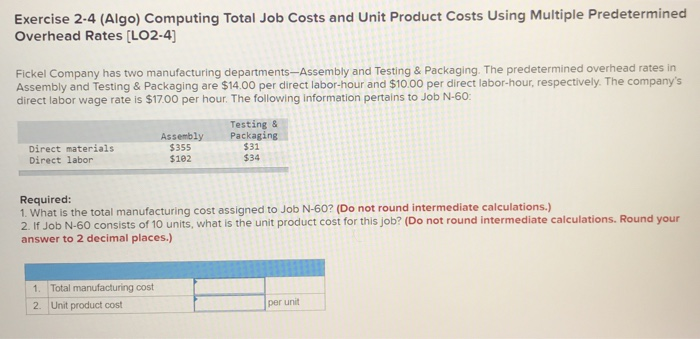

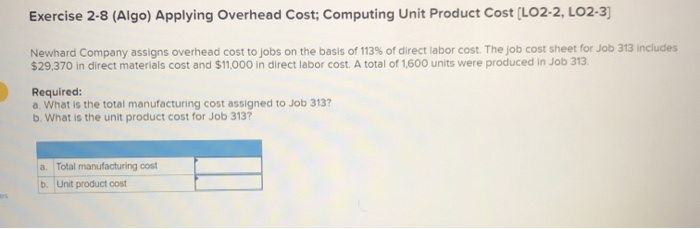

Exercise 2-2 (Algo) Apply Overhead Cost to Jobs (LO2-2) Luthan Company uses a plantwide predetermined overhead rate of $22.70 per direct labor-hour. This predetermined rate was based on a cost formula that estimated $272,400 of total manufacturing overhead cost for an estimated activity level of 12,000 direct labor- hours. The company incurred actual total manufacturing overhead cost of $266,000 and 11,800 total direct labor-hours during the period. Required: Determine the amount of manufacturing overhead cost that would have been applied to all jobs during the period. Manufacturing overhead applied Exercise 2-3 (Algo) Computing Total Job Costs and Unit Product Costs Using a Plantwide Predetermined Overhead Rate (LO2-3) Mickley Company's plantwide predetermined overhead rate is $24.00 per direct labor-hour and its direct labor wage rate is $16.00 per hour. The following information pertains to Job A-500 Direct materials Direct labor $ 290 $ 240 Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 50 units, what is the unit product cost for this job? (Round your answer to 2 decimal places.) 1. Total manufacturing cost 2. Unit product cost per unit Exercise 2-4 (Algo) Computing Total Job Costs and Unit Product Costs Using Multiple Predetermined Overhead Rates (LO2-4) Fickel Company has two manufacturing departments-Assembly and Testing & Packaging. The predetermined overhead rates in Assembly and Testing & Packaging are $14.00 per direct labor-hour and $10.00 per direct labor-hour, respectively. The company's direct labor wage rate is $17.00 per hour. The following information pertains to Job N-60: Testing & Assembly Packaging Direct materials Direct labor $355 $102 $31 $34 Required: 1. What is the total manufacturing cost assigned to Job N-60? (Do not round intermediate calculations.) 2. If Job N-60 consists of 10 units, what is the unit product cost for this job? (Do not round intermediate calculations. Round your answer to 2 decimal places.) 1. Total manufacturing cost 2. Unit product cost per unit Exercise 2-8 (Algo) Applying Overhead Cost; Computing Unit Product Cost (LO2-2, LO2-3) Newhard Company assigns overhead cost to jobs on the basis of 113% of direct labor cost. The job cost sheet for Job 313 includes $29,370 in direct materials cost and $11,000 in direct labor cost. A total of 1,600 units were produced in Job 313. Required: a. What is the total manufacturing cost assigned to Job 313? b. What is the unit product cost for Job 3137 a. Total manufacturing cost b. Unit product cost