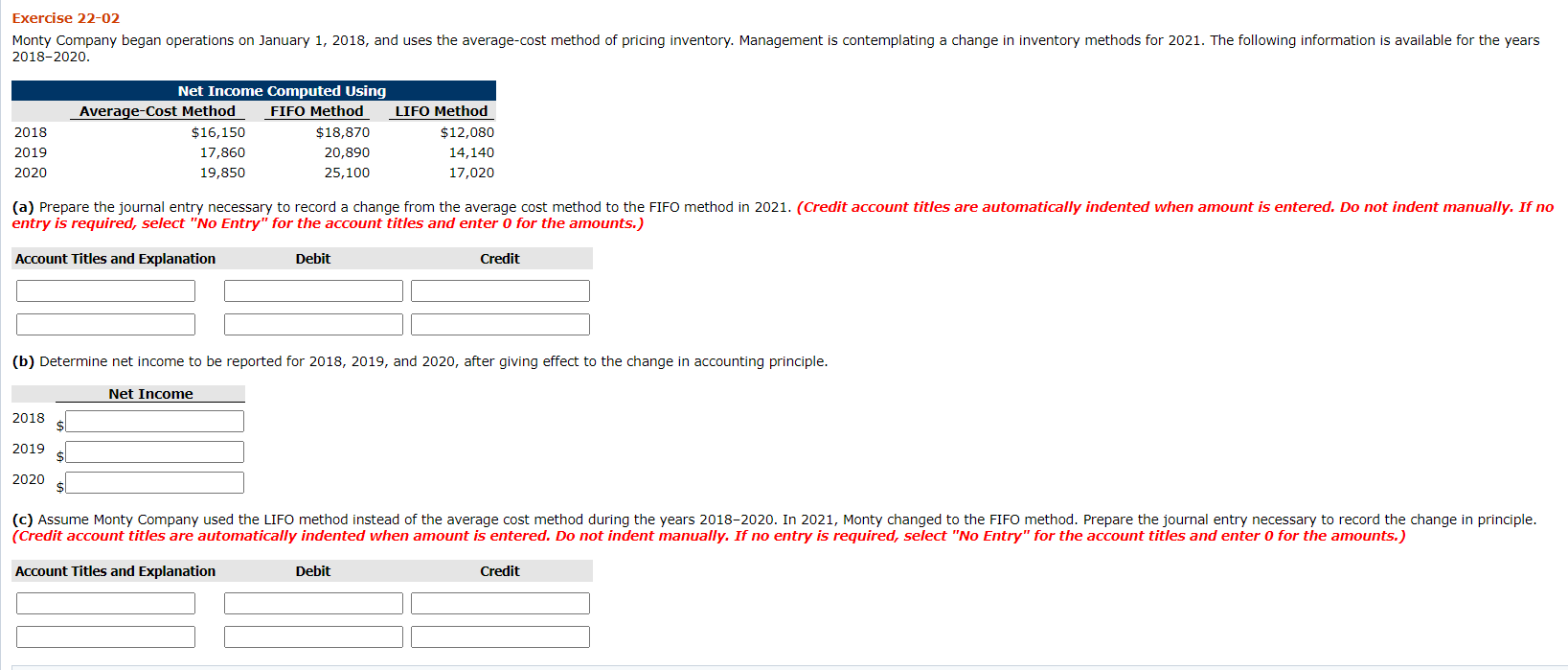

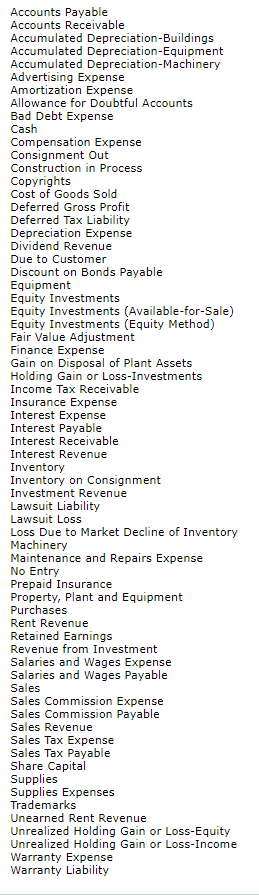

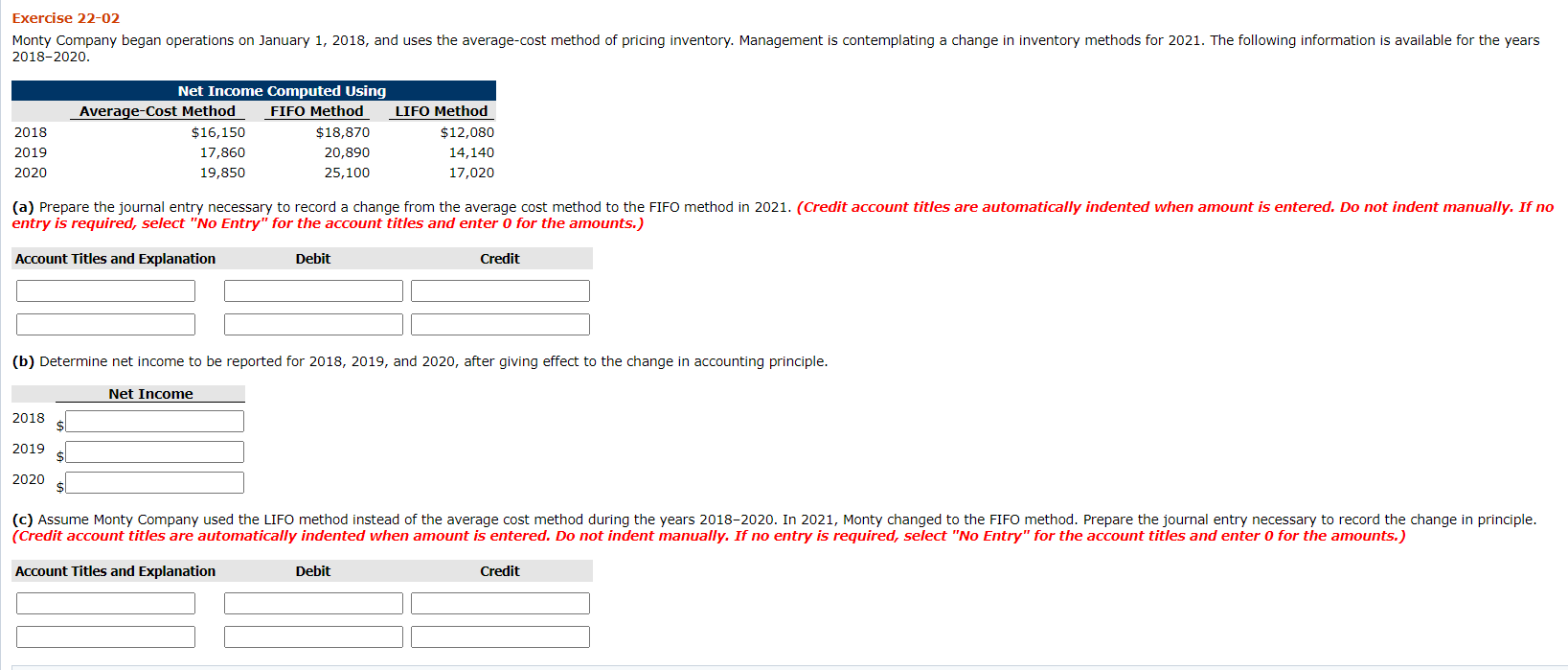

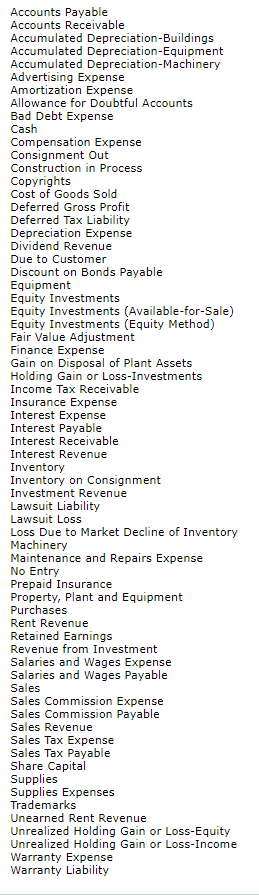

Exercise 22-02 Monty Company began operations on January 1, 2018, and uses the average-cost method of pricing inventory. Management is contemplating a change in inventory methods for 2021. The following information is available for the years 2018-2020. 2018 2019 2020 Net Income Computed Using Average-Cost Method FIFO Method LIFO Method $16,150 $18,870 $12,080 17,860 20,890 14,140 19,850 25,100 17,020 (a) Prepare the journal entry necessary to record a change from the average cost method to the FIFO method in 2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit (b) Determine net income to be reported for 2018, 2019, and 2020, after giving effect to the change in accounting principle. Net Income 2018 2019 2020 (C) Assume Monty Company used the LIFO method instead of the average cost method during the years 2018-2020. In 2021, Monty changed to the FIFO method. Prepare the journal entry necessary to record the change in principle. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Accumulated Depreciation Machinery Advertising Expense Amortization Expense Allowance for Doubtful Accounts Bad Debt Expense Cash Compensation Expense Consignment Out Construction in Process Copyrights Cost of Goods Sold Deferred Gross Profit Deferred Tax Liability Depreciation Expense Dividend Revenue Due to Customer Discount on Bonds Payable Equipment Equity Investments Equity Investments (Available-for-Sale) Equity Investments (Equity Method) Fair Value Adjustment Finance Expense Gain on Disposal of Plant Assets Holding Gain or Loss-Investments Income Tax Receivable Insurance Expense Interest Expense Interest Payable Interest Receivable Interest Revenue Inventory Inventory on Consignment Investment Revenue Lawsuit Liability Lawsuit Loss Loss Due to Market Decline of Inventory Machinery Maintenance and Repairs Expense No Entry Prepaid Insurance Property, Plant and Equipment Purchases Rent Revenue Retained Earnings Revenue from Investment Salaries and Wages Expense Salaries and Wages Payable Sales Sales Commission Expense Sales Commission Payable Sales Revenue Sales Tax Expense Sales Tax Payable Share Capital Supplies Supplies Expenses Trademarks Unearned Rent Revenue Unrealized Holding Gain or Loss-Equity Unrealized Holding Gain or Loss-Income Warranty Expense Warranty Liability