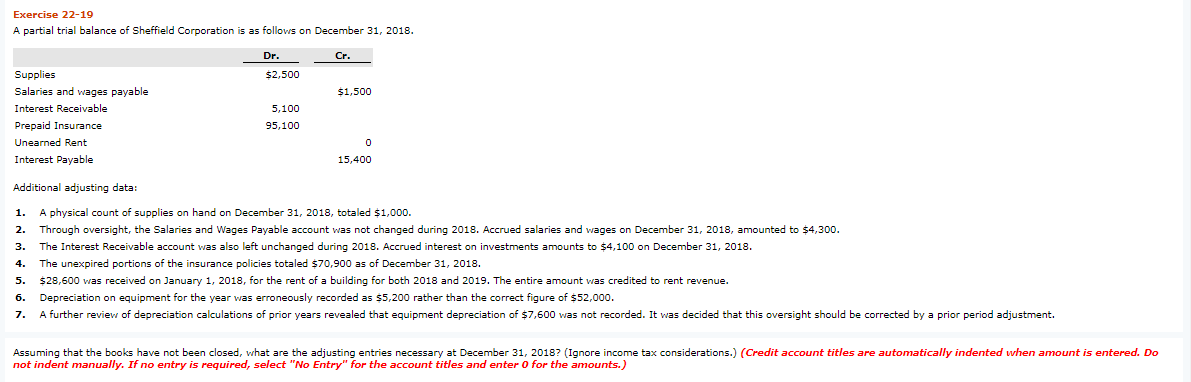

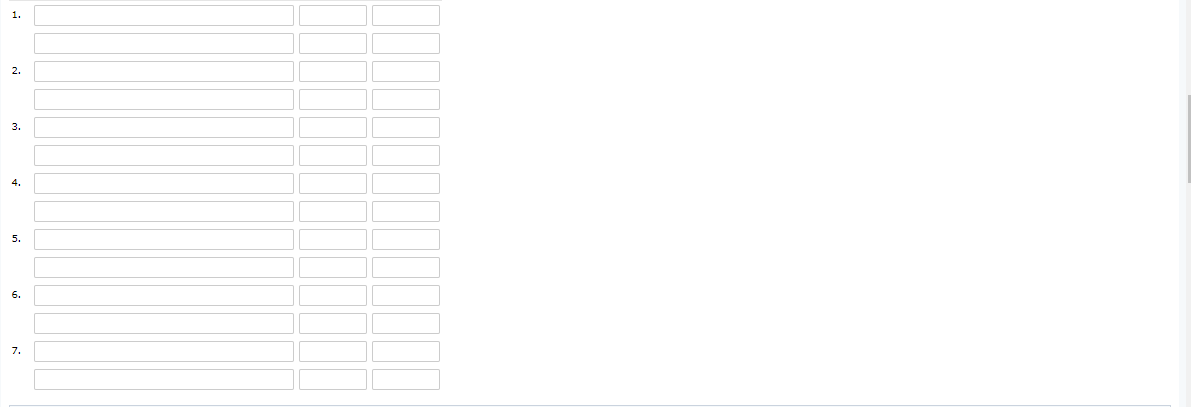

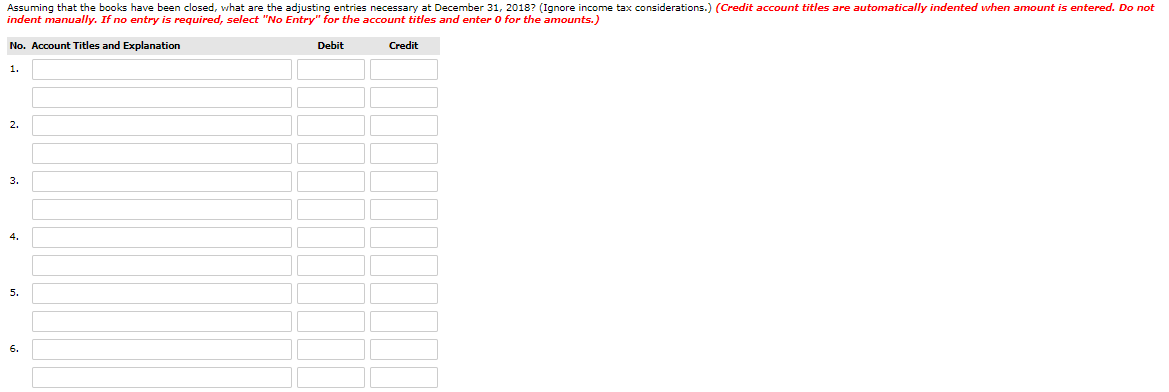

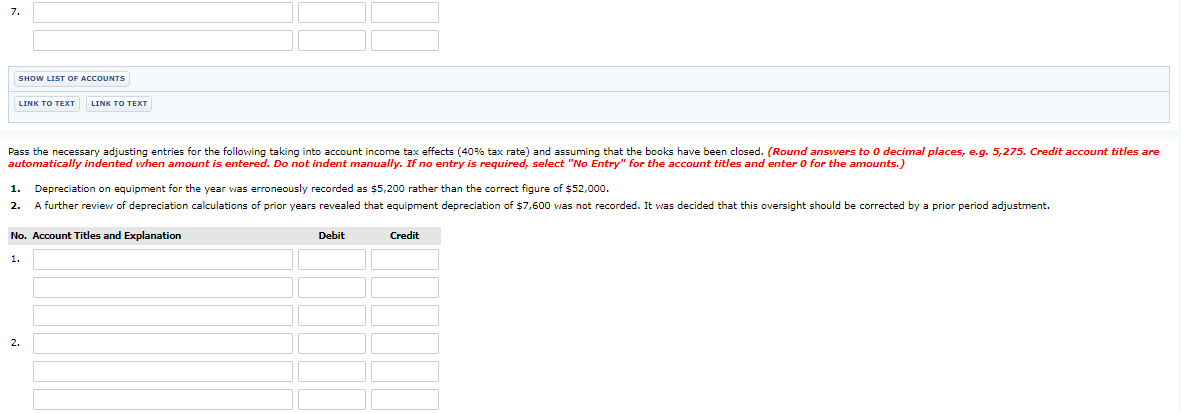

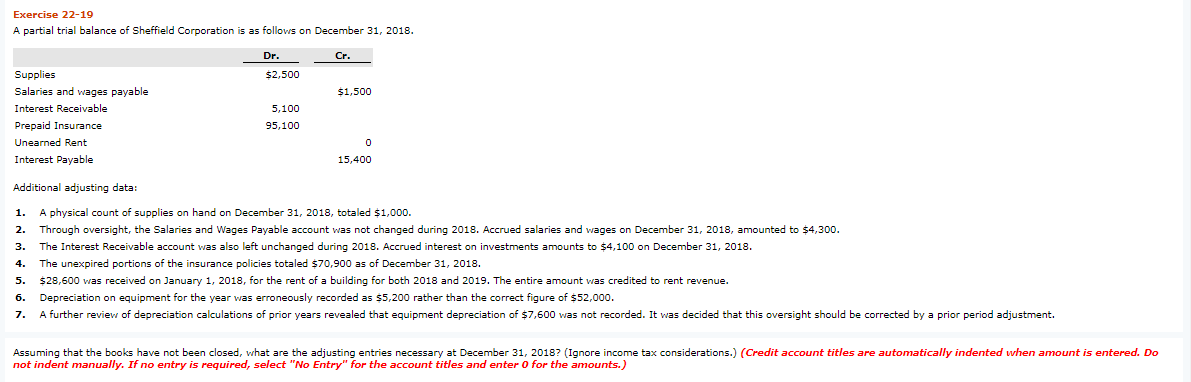

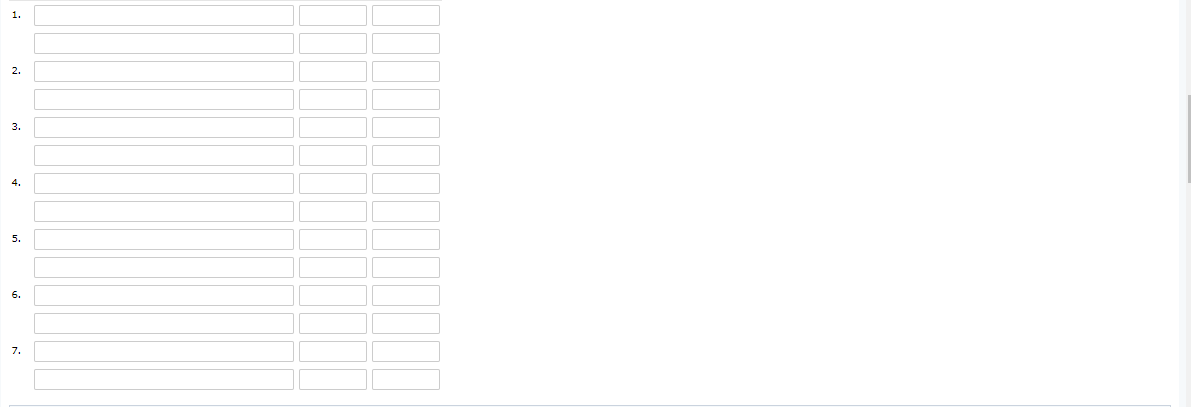

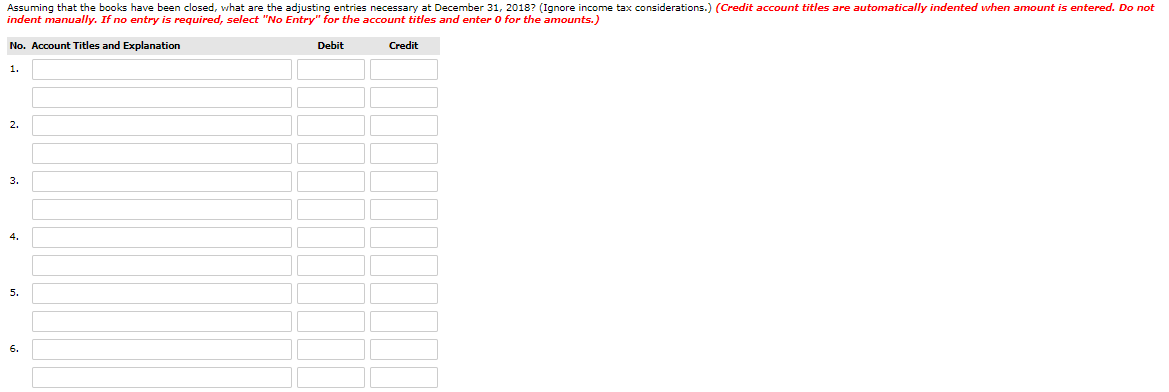

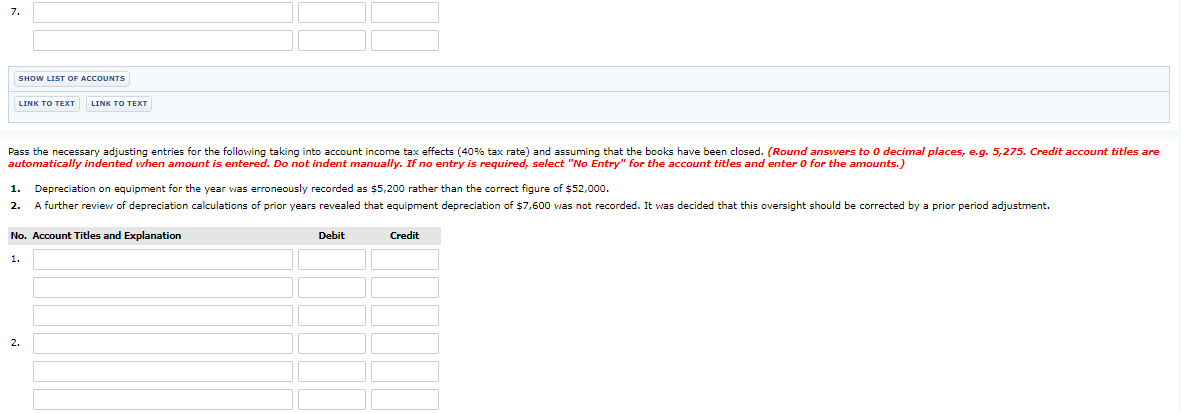

Exercise 22-19 A partial trial balance of Sheffield Corporation is as follows on December 31, 2018. - Cr. Dr. $2,500 $1,500 Supplies Salaries and wages payable Interest Receivable Prepaid Insurance Unearned Rent Interest Payable 5,100 95,100 15,400 Additional adjusting data: 1. 2. 3. 4. 5. 6. 7. A physical count of supplies on hand on December 31, 2018, totaled $1,000. Through oversight, the Salaries and Wages Payable account was not changed during 2018. Accrued salaries and wages on December 31, 2018, amounted to $4,300. The Interest Receivable account was also left unchanged during 2018. Accrued interest on investments amounts to $4,100 on December 31, 2018. The unexpired portions of the insurance policies totaled $70,900 as of December 31, 2018. $28,600 was received on January 1, 2018, for the rent of a building for both 2018 and 2019. The entire amount was credited to rent revenue. Depreciation on equipment for the year was erroneously recorded as 55,200 rather than the correct figure of $52,000. A further review of depreciation calculations of prior years revealed that equipment depreciation of $7,600 was not recorded. It was decided that this oversight should be corrected by a prior period adjustment. Assuming that the books have not been closed, what are the adjusting entries necessary at December 31, 2018? (Ignore income tax considerations.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Assuming that the books have been closed, what are the adjusting entries necessary at December 31, 2018? (Ignore income tax considerations.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) No. Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT Pass the necessary adjusting entries for the following taking into account income tax effects (40% tax rate) and assuming that the books have been closed. (Round answers to O decimal places, e.g. 5,275. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) 1. 2. Depreciation on equipment for the year was erroneously recorded as $5,200 rather than the correct figure of $52,000. A further review of depreciation calculations of prior years revealed that equipment depreciation of $7,600 was not recorded. It was decided that this oversight should be corrected by a prior period adjustment. No. Account Titles and Explanation Debit Credit