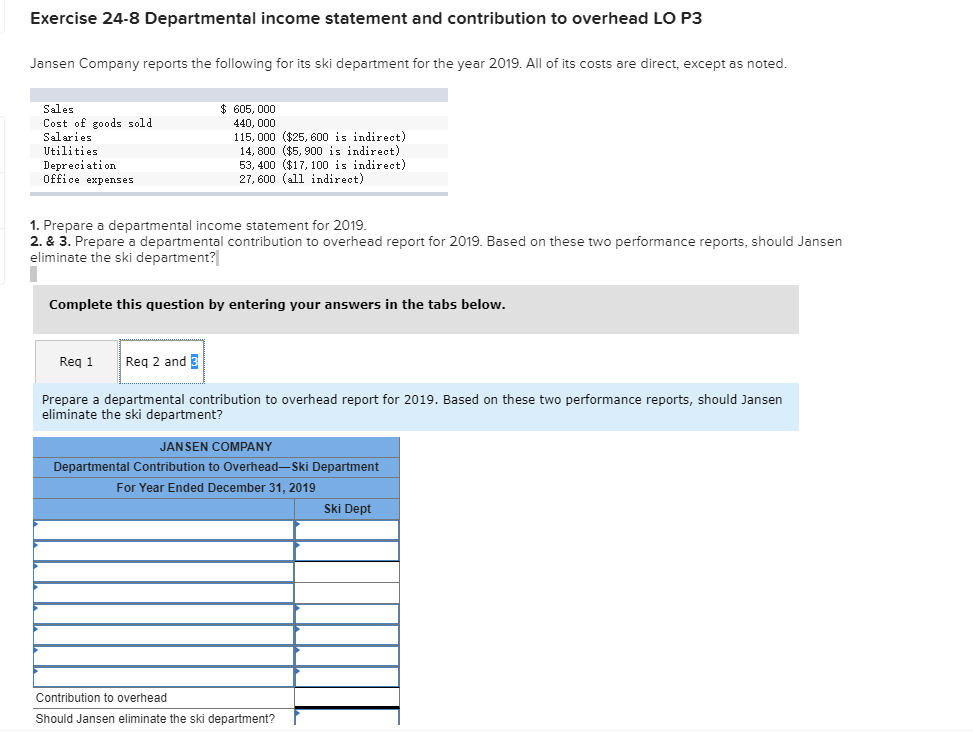

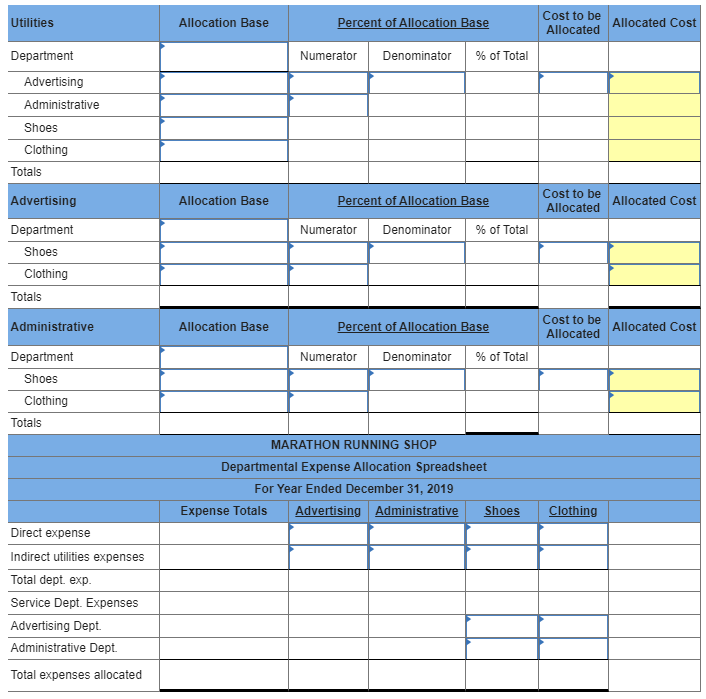

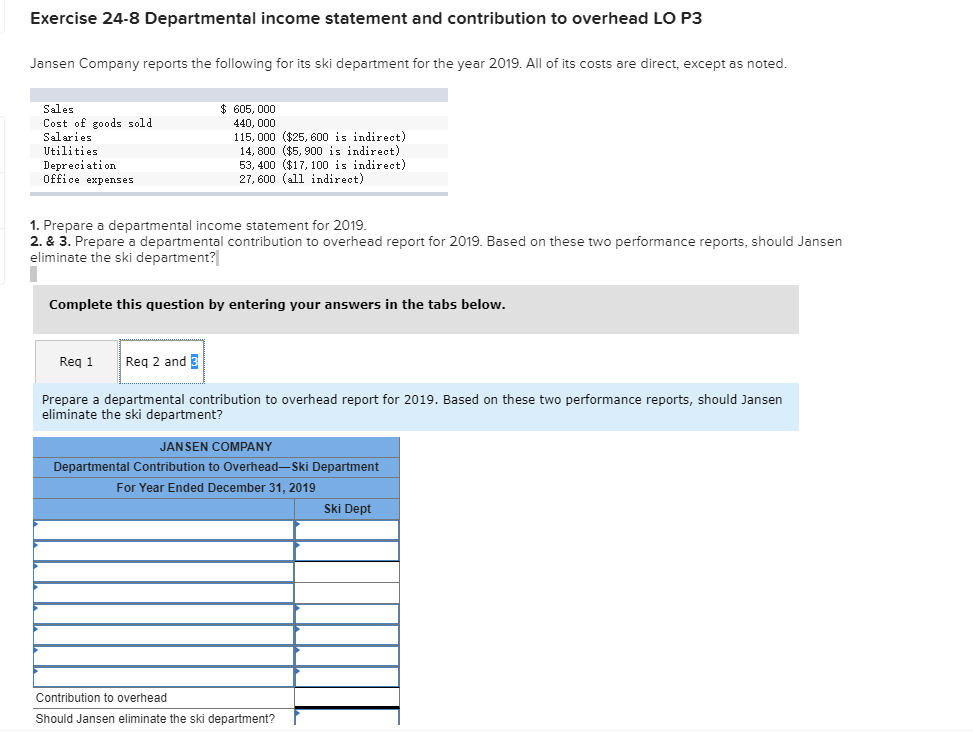

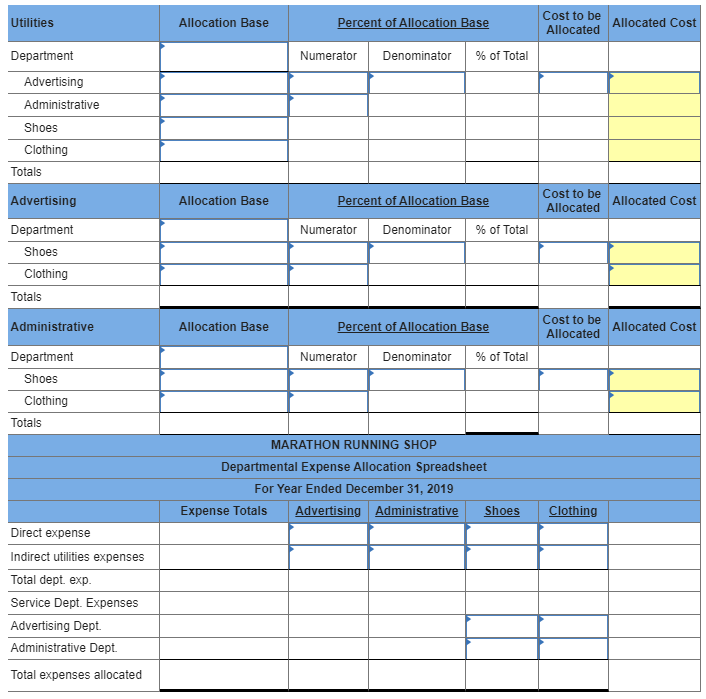

Exercise 24-8 Departmental income statement and contribution to overhead LO P3 Jansen Company reports the following for its ski department for the year 2019. All of its costs are direct, except as noted. Sales Cost of goods sold Salaries Utilities Depreciation Office expenses $ 605,000 440,000 115,000 ($25, 600 is indirect) 14, 800 ($5, 900 is indirect) 53,400 ($17, 100 is indirect) 27, 600 (all indirect) 1. Prepare a departmental income statement for 2019. 2. & 3. Prepare a departmental contribution to overhead report for 2019. Based on these two performance reports, should Jansen eliminate the ski department? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 and 3 Prepare a departmental contribution to overhead report for 2019. Based on these two performance reports, should Jansen eliminate the ski department? JANSEN COMPANY Departmental Contribution to Overhead-Ski Department For Year Ended December 31, 2019 Ski Dept Contribution to overhead Should Jansen eliminate the ski department? Utilities Allocation Base Percent of Allocation Base Cost to be Allocated Allocated Cost Numerator Denominator % of Total Department Advertising Administrative Shoes Clothing Totals Advertising Allocation Base Cost to be Allocated Allocated Cost Percent of Allocation Base Numerator Denominator % of Total Department Shoes Clothing Totals Administrative Allocation Base Percent of Allocation Base Cost to be Allocated Allocated Cost Numerator Denominator % of Total Department Shoes Clothing Totals MARATHON RUNNING SHOP Departmental Expense Allocation Spreadsheet For Year Ended December 31, 2019 Expense Totals Advertising Administrative Shoes Clothing Direct expense Indirect utilities expenses Total dept. exp. Service Dept. Expenses Advertising Dept. Administrative Dept. Total expenses allocated Exercise 24-8 Departmental income statement and contribution to overhead LO P3 Jansen Company reports the following for its ski department for the year 2019. All of its costs are direct, except as noted. Sales Cost of goods sold Salaries Utilities Depreciation Office expenses $ 605,000 440,000 115,000 ($25, 600 is indirect) 14, 800 ($5, 900 is indirect) 53,400 ($17, 100 is indirect) 27, 600 (all indirect) 1. Prepare a departmental income statement for 2019. 2. & 3. Prepare a departmental contribution to overhead report for 2019. Based on these two performance reports, should Jansen eliminate the ski department? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 and 3 Prepare a departmental contribution to overhead report for 2019. Based on these two performance reports, should Jansen eliminate the ski department? JANSEN COMPANY Departmental Contribution to Overhead-Ski Department For Year Ended December 31, 2019 Ski Dept Contribution to overhead Should Jansen eliminate the ski department? Utilities Allocation Base Percent of Allocation Base Cost to be Allocated Allocated Cost Numerator Denominator % of Total Department Advertising Administrative Shoes Clothing Totals Advertising Allocation Base Cost to be Allocated Allocated Cost Percent of Allocation Base Numerator Denominator % of Total Department Shoes Clothing Totals Administrative Allocation Base Percent of Allocation Base Cost to be Allocated Allocated Cost Numerator Denominator % of Total Department Shoes Clothing Totals MARATHON RUNNING SHOP Departmental Expense Allocation Spreadsheet For Year Ended December 31, 2019 Expense Totals Advertising Administrative Shoes Clothing Direct expense Indirect utilities expenses Total dept. exp. Service Dept. Expenses Advertising Dept. Administrative Dept. Total expenses allocated