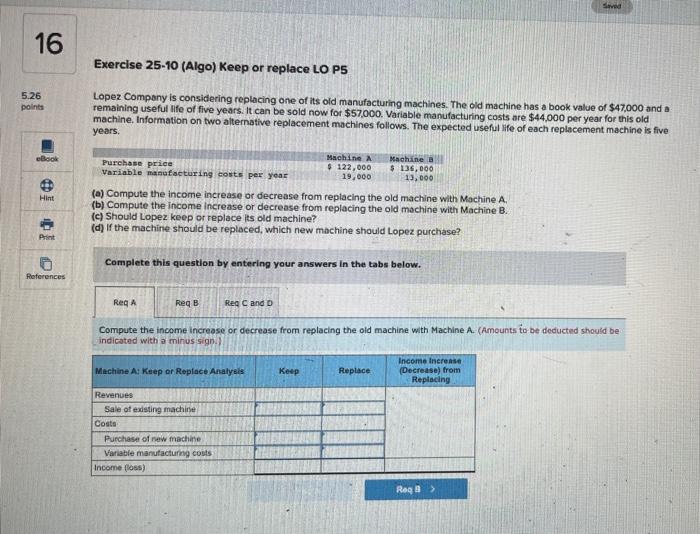

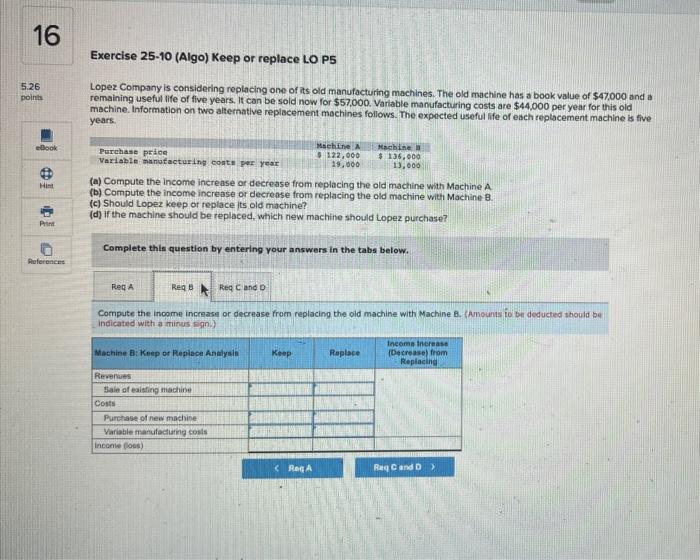

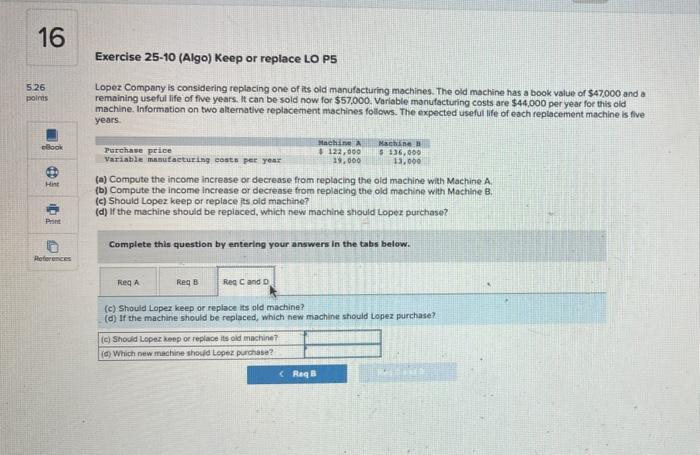

Exercise 25-10 (Algo) Keep or replace LO P5 Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a book value of $47,000 and a remaining useful life of five years. It can be sold now for $57,000. Variable manufacturing costs are $44,000 per year for this old machine. Information on two alternative replacement machines follows. The expected useful life of each replacement machine is five years. (a) Compute the income increase or decrease from replacing the old machine with Machine A, (b) Compute the income increase or decrease from replacing the old machine with Machine B. (c) Should Lopez keep or replace its old machine? (d) If the machine should be replaced, which new machine should Lopez purchase? Complete this question by entering your answers in the tabs below. Compute the income increase or decrease from replacing the old machine with Machine A. (Amounts to be deducted should be indicated with a minus sign.) Exercise 25-10 (Algo) Keep or replace LO P5 Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a book value of $47.000 and a remaining useful life of five years. It can be sold now for $57,000. Variable manufacturing costs are $44,000 per year for this old machine. Information on two altemative replacement machines follows. The expected useful life of each reptacement machine is five years. (a) Compute the income increase or decrease from replacing the old machine with Machine A (b) Compute the income increase or decrease from replacing the old machine with Machine B. (c) Should topez keep ot replace its old machine? (d) if the machine should be replaced, which new machine should Lopez purchase? Complete this question by entering your answers in the tabs below. Compute the inoome increase or decrease from replacing the old machine with Machine 8 . fAmounts io be deductid should be indicated with a minus rign.) Exercise 25-10 (Algo) Keep or replace LO P5 Lopez Company is considering replacing one of its old manufacturing machines. The oid machine has a book value of $47,000 and a remaining useful life of five years. It can be sold now for $57,000. Variable manufacturing costs are $44,000 per year for this old machine. Information on two alternative replacement machines follows. The expected useful life of each replacement machine is five years. (a) Compute the income increase or decrease from replacing the old machine with Machine A. (b) Compute the income increase or decrease from replacing the old machine with Machlne B, (c) Should Lopez keep or replace jts old machine? (d) If the machine should be repiaced, which new machine should Lopex purchase? Complete this question by entering your answers in the tabs below. (c) Should Lopez keep or replace its old machine? (d) If the machine should be replaced, which new machine should Lopez purchase