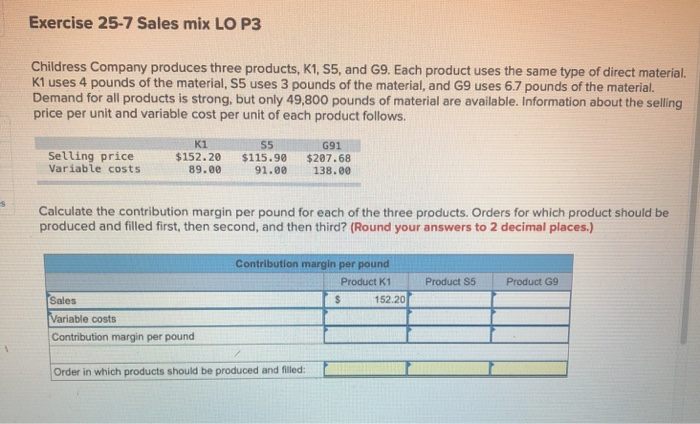

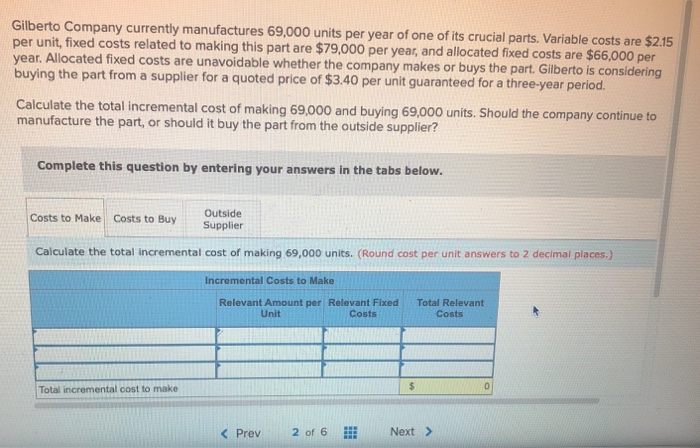

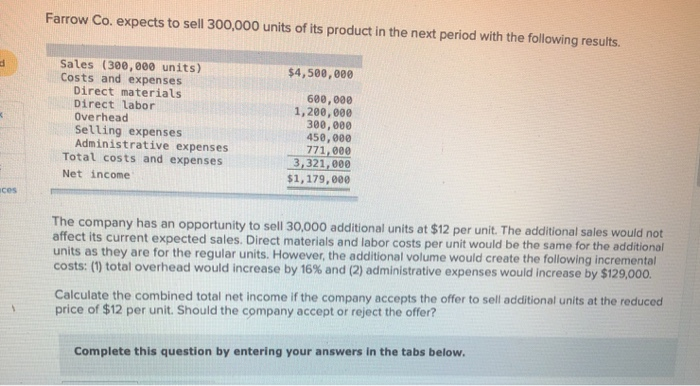

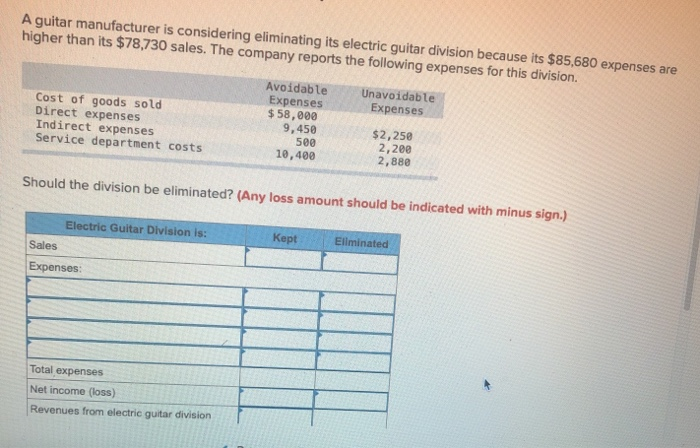

Exercise 25-7 Sales mix LO P3 Childress Company produces three products, K1, S5, and G9. Each product uses the same type of direct material. K1 uses 4 pounds of the material, S5 uses 3 pounds of the material, and G9 uses 6.7 pounds of the material. Demand for all products is strong, but only 49,800 pounds of material are available. Information about the selling price per unit and variable cost per unit of each product follows. Selling price Variable costs K1 $152.20 89.00 89.28 S5 $115.99 09:20 91.00 G91 $287.68 267.68 138.00 Calculate the contribution margin per pound for each of the three products. Orders for which product should be produced and filled first, then second, and then third? (Round your answers to 2 decimal places.) Contribution margin per pound Product K1 152.201 Product S5 Product G9 Sales Variable costs Contribution margin per pound Order in which products should be produced and filled Gilberto Company currently manufactures 69,000 units per year of one of its crucial parts. Variable costs are $2.15 per unit, fixed costs related to making this part are $79,000 per year, and allocated fixed costs are $66,000 per year. Allocated fixed costs are unavoidable whether the company makes or buys the part. Gilberto is considering buying the part from a supplier for a quoted price of $3.40 per unit guaranteed for a three-year period. Calculate the total incremental cost of making 69,000 and buying 69,000 units. Should the company continue to manufacture the part, or should it buy the part from the outside supplier? Complete this question by entering your answers in the tabs below. Costs to Make Costs to Buy Outside Supplier Calculate the total incremental cost of making 69,000 units. (Round cost per unit answers to 2 decimal places.) Incremental Costs to Make Relevant Amount per Relevant Fixed Costs Total Relevant Costs Unit Total incremental cost to make Farrow Co. expects to sell 300,000 units of its product in the next period with the following results. $4,500,000 Sales (300,000 units) Costs and expenses Direct materials Direct labor Overhead Selling expenses Administrative expenses Total costs and expenses Net income 600,000 1,200,000 300,000 450,000 771,000 3,321,000 $1,179,000 ces The company has an opportunity to sell 30,000 additional units at $12 per unit. The additional sales would not affect its current expected sales. Direct materials and labor costs per unit would be the same for the additional units as they are for the regular units. However, the additional volume would create the following incremental costs: (1) total overhead would increase by 16% and (2) administrative expenses would increase by $129,000. Calculate the combined total net income if the company accepts the offer to sell additional units at the reduced price of $12 per unit. Should the company accept or reject the offer? Complete this question by entering your answers in the tabs below. A guitar manufacturer is considering eliminating its electric guitar division because its $85,680 expenses are higher than its $78,730 sales. The company reports the following expenses for this division Unavoidable Expenses Cost of goods sold Direct expenses Indirect expenses Service department costs Avoidable Expenses $ 58,000 9,450 500 10,400 $2,250 2,200 2,888 Should the division be eliminated? (Any loss amount should be indicated with minus sign.) Electric Guitar Division is: Kept Sales Eliminated Expenses: Total expenses Net income (loss) Revenues from electric guitar division