Answered step by step

Verified Expert Solution

Question

1 Approved Answer

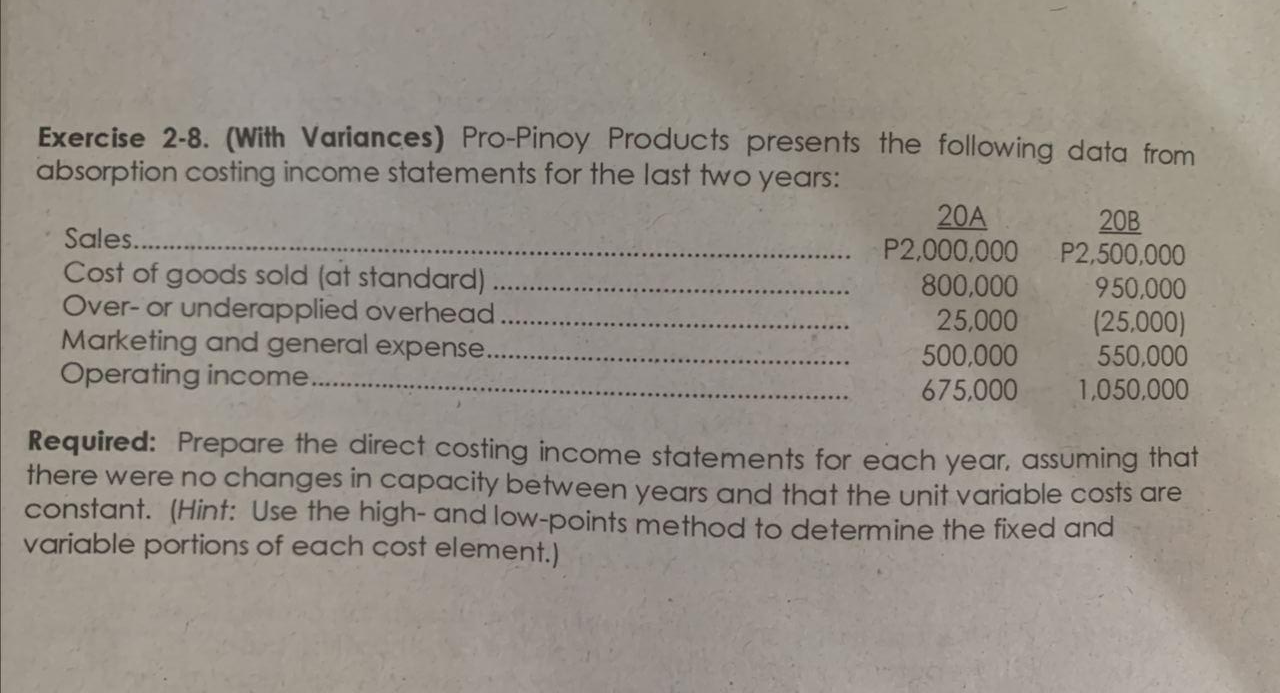

Exercise 2-8. (With Variances) Pro-Pinoy Products presents the following data from absorption costing income statements for the last two years: 20A 20B Sales........... P2,000,000 P2,500,000

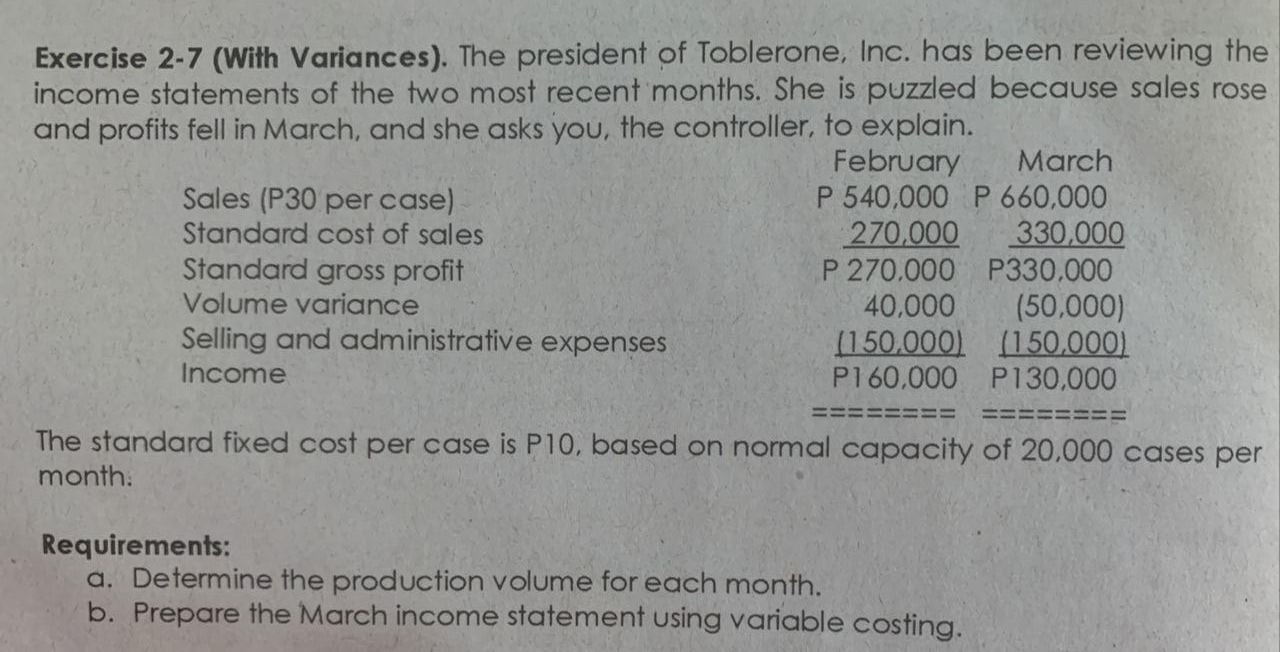

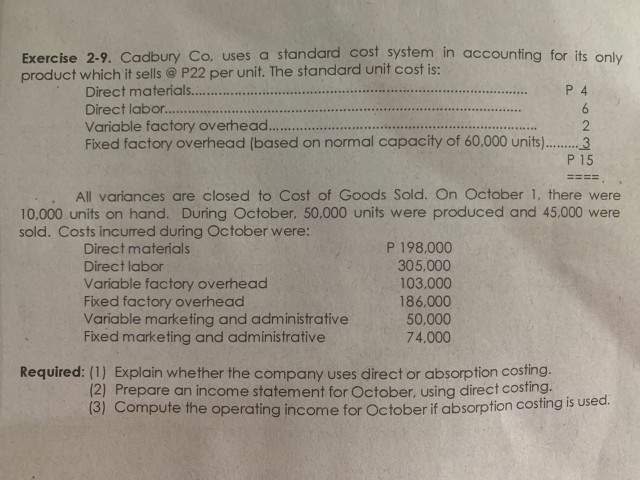

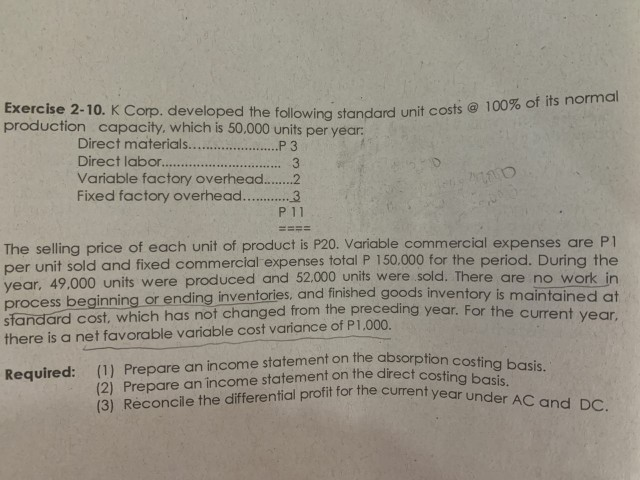

Exercise 2-8. (With Variances) Pro-Pinoy Products presents the following data from absorption costing income statements for the last two years: 20A 20B Sales........... P2,000,000 P2,500,000 Cost of goods sold (at standard) 800,000 950.000 Over- or underapplied overhead 25,000 (25.000) Marketing and general expense. 500,000 550,000 Operating income..... 675,000 1,050.000 Required: Prepare the direct costing income statements for each year, assuming that there were no changes in capacity between years and that the unit variable costs are constant. (Hint: Use the high- and low-points method to determine the fixed and variable portions of each cost element.) Exercise 2-7 (With Variances). The president of Toblerone, Inc. has been reviewing the income statements of the two most recent months. She is puzzled because sales rose and profits fell in March, and she asks you, the controller, to explain. February March Sales (P30 per case) P 540,000 P 660,000 Standard cost of sales 270,000 330,000 Standard gross profit P 270.000 P330.000 Volume variance 40,000 (50,000) Selling and administrative expenses (150.000) (150,000) Income P160,000 P130,000 The standard fixed cost per case is P10, based on normal capacity of 20,000 cases per month Requirements: a. Determine the production volume for each month. b. Prepare the March income statement using variable costing. P4 Exercise 2-9. Cadbury Co. uses a standard cost system in accounting for its only product which it sells @ P22 per unit. The standard unit cost is: Direct materials............ Direct labor.... 6 Variable factory overhead.... 2 Fixed factory overhead (based on normal capacity of 60,000 units)......... 3 P 15 ==== All variances are closed to cost of Goods Sold. On October 1, there were 10,000 units on hand. During October. 50,000 units were produced and 45.000 were sold. Costs incurred during October were: Direct materials P 198,000 Direct labor 305,000 Variable factory overhead 103.000 Fixed factory overhead 186,000 Variable marketing and administrative 50.000 Fixed marketing and administrative 74.000 Required: (1) Explain whether the company uses director absorption costing. (2) Prepare an income statement for October, using direct costing. (3) Compute the operating income for October if absorption costing is used. (2) Prepare an income statement on the direct costing basis. (3) Reconcile the differential profit for the current year under AC and DC. Exercise 2-10. K Corp. developed the following standard unit costs @ 100% of its normal production capacity, which is 50,000 units per year. Direct materials....... .P 3 Direct labor.......... 3 Variable factory overhead........2 Fixed factory overhead... 3 P11 The selling price of each unit of product is P20. Variable commercial expenses are P1 per unit sold and fixed commercial expenses total P 150.000 for the period. During the year, 49,000 units were produced and 52,000 units were sold. There are no work in process beginning or ending inventories, and finished goods inventory is maintained at standard cost, which has not changed from the preceding year. For the current year, there is a net favorable variable cost variance of P1,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started