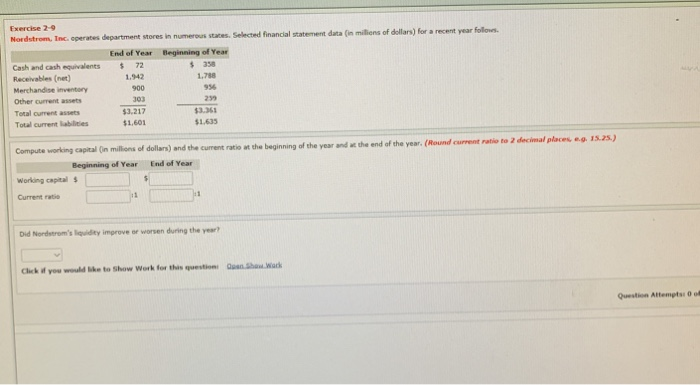

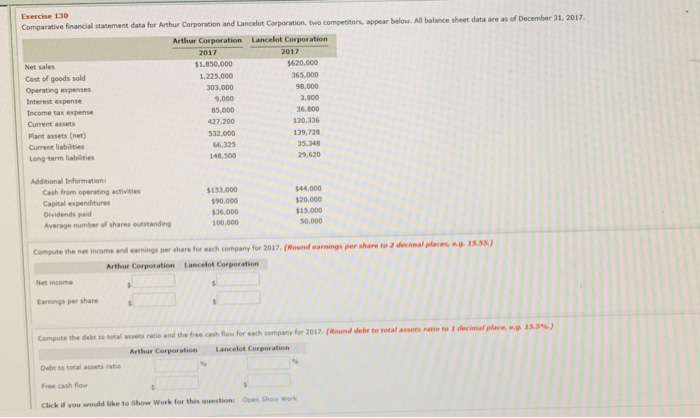

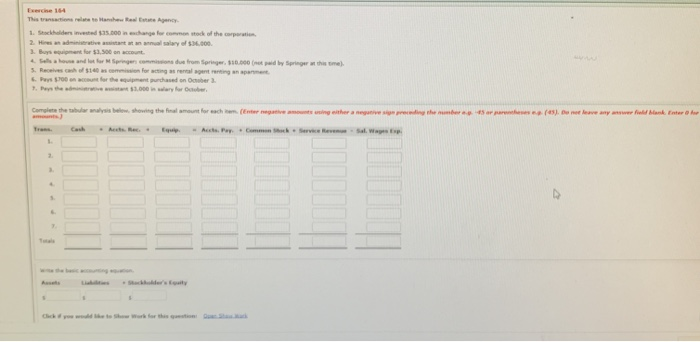

Exercise 2-9 Nordstrom, Inc. operates department stores in numerous states. Selected financial statement data (in milions of dollars) for a recent year follows. Beginning of Year s 35 End of Year Cash and cash equivalents Receivables (net) 72 1.788 1.942 956 900 Merchandise inventory 239 303 Other current assets $3.217 $3.361 Total current assets $1.635 $1,601 Total current labilities Compute working capital (in millions of dollars) and the cumrent ratio at the beginning of the vear and at the end of the year. (Round current ratio to 2 decimal places e.g. 15.25.) End of Year Beginning of Yean Working capital S Current ratio Did Nordstrom's liquidity improve or worsen during the year? Qpen Shew Wark Click d you would ike to Show Work for this question Question Attempts: 0 of Exercise 130 Comparative financial statement data for Arthur Corporation and Lancelot Corporation, two competitors, appear below. All balance sheet data are as of December 31. 2017 Lancelot Corporation Arthur Corporation 2017 2017 $620,000 $1,850,000 Net sales 365.000 1.225.000 Cost of goods sold 98.000 303,000 Operating expenses 3.800 9,000 Interest expense 36.000 85,000 Income tax expense 130.336 427,200 Current assets 139.728 532,000 Plant assets (net) 35,348 66.325 Current liabilities 29,620 148,500 Long-term liabilities Addtional Information $153.000 $44,000 Cash from operating activities 590.000 $20,000 Capital expenditures Dividends paid Average number of shares outstanding $15.000 $36.000 50,000 100,000 Compute the net income and earnings per share for each company for 2017. (Round earings per share to 2 decimal places, e.g. 15.55.) Lancelot Corporation Arthur Corporation. Net income Earnings per share Compute the debt to total assets ratio and the free cash flow for each company for 2017. (Round debt to total assets ratio to 1 decimal place, eg 15.5%) Lancelot Corporation Arthur Corporation Debt to total assets ratio Free cash flow Open Show work Click if you would like to Show Work for this question Exercise 164 This transations relae to Hanhew Real Estate Agency 1. Stockholders inveted $35.000 in change for common stock of the corparation 2 Hires an adinitative assstant at an annual salary of $36000 3. Buys equipment for $3,500 on account 4 Sells a house and lot for M Springen commissions due from Springer, s10.000 (t paid by Springer an th me) . Receives cah of $140 as cemmission for acing as rental agent renting an apanment Pays $700 on accun for the equipment purchased on October 3 , Ps the ad astan $3.000 in saary for October Complete the tabular analysis below, sheoving the final amount for each em (Enter negative amouts uing either a negative sign preeding the mmber aonts (45). Do nee leave any answer feld blank Enter o fr 45ar pareheses Accts Rec Trans Cash Accts. Pay Common Sck Service Revenu Equip Sal. Wages Ese Teels ng o wwe b steckolder's Eouity Liat Assets a Cck f you wd e to Show Work for this qaestion