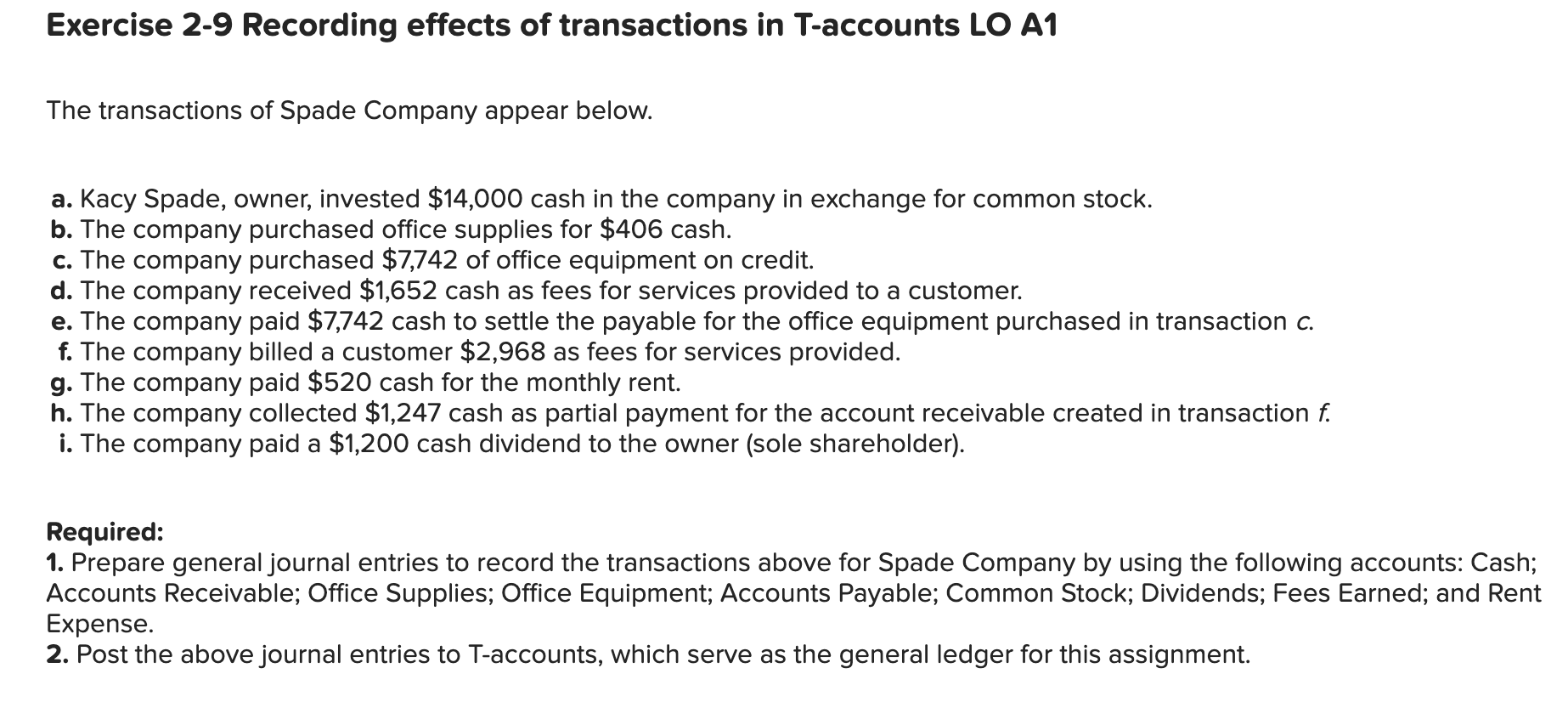

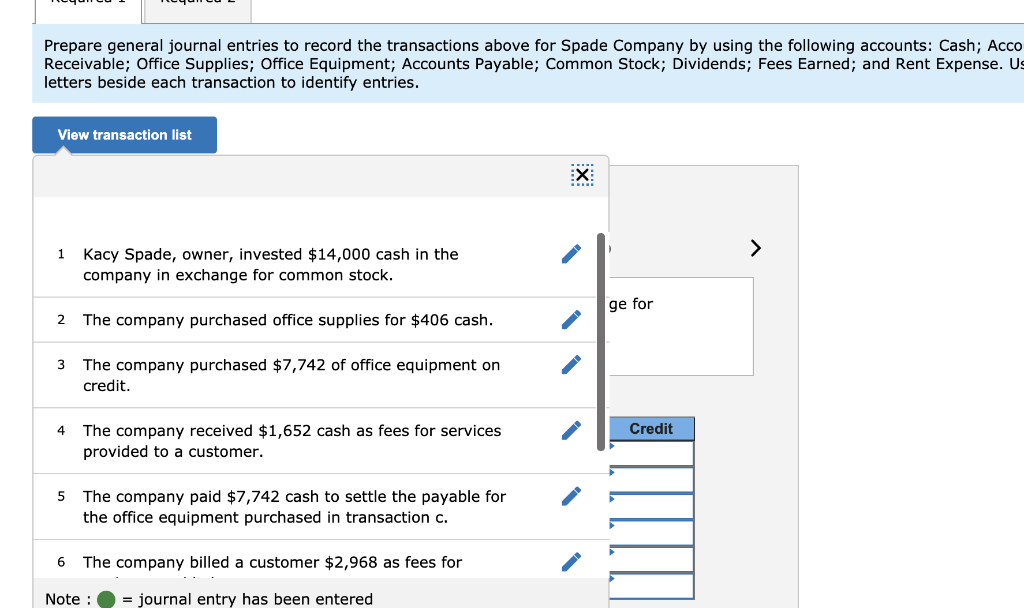

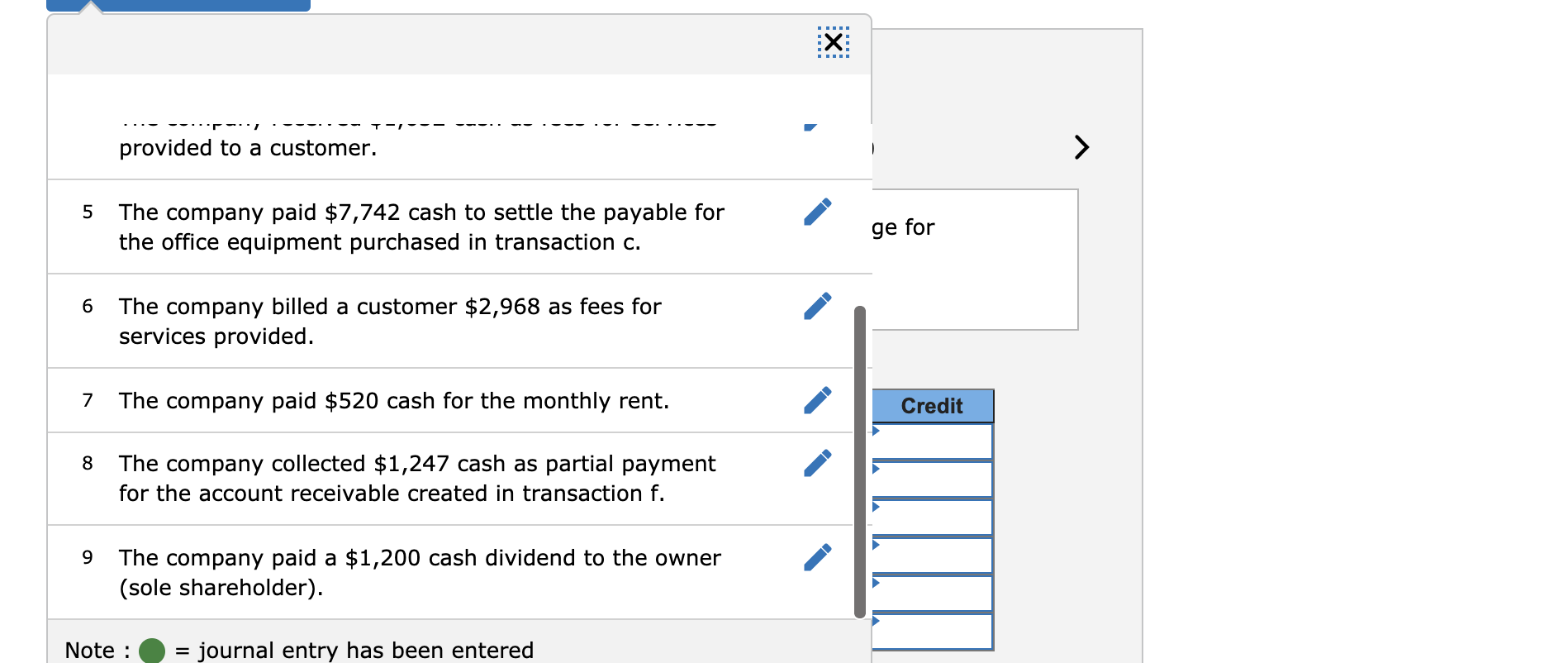

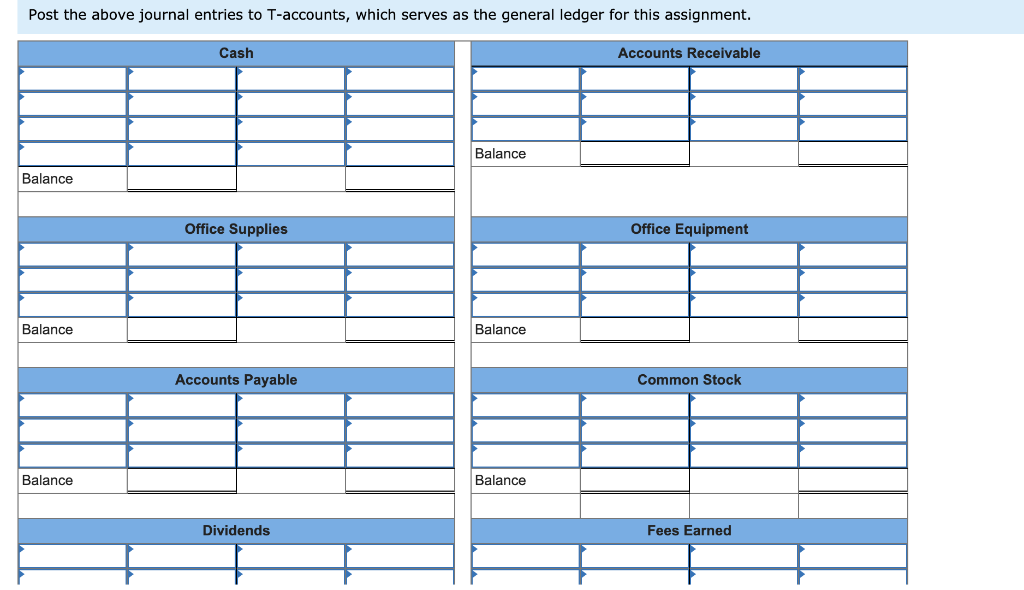

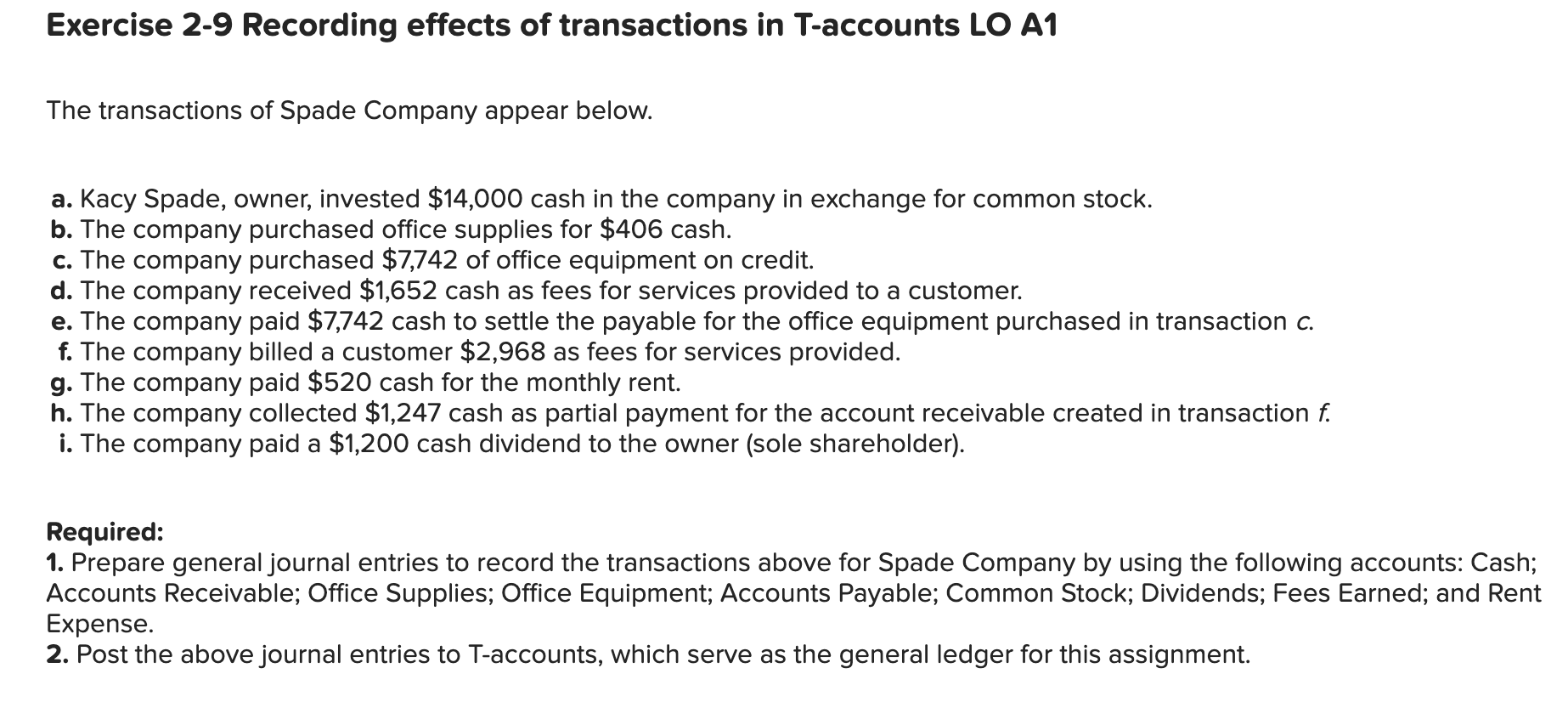

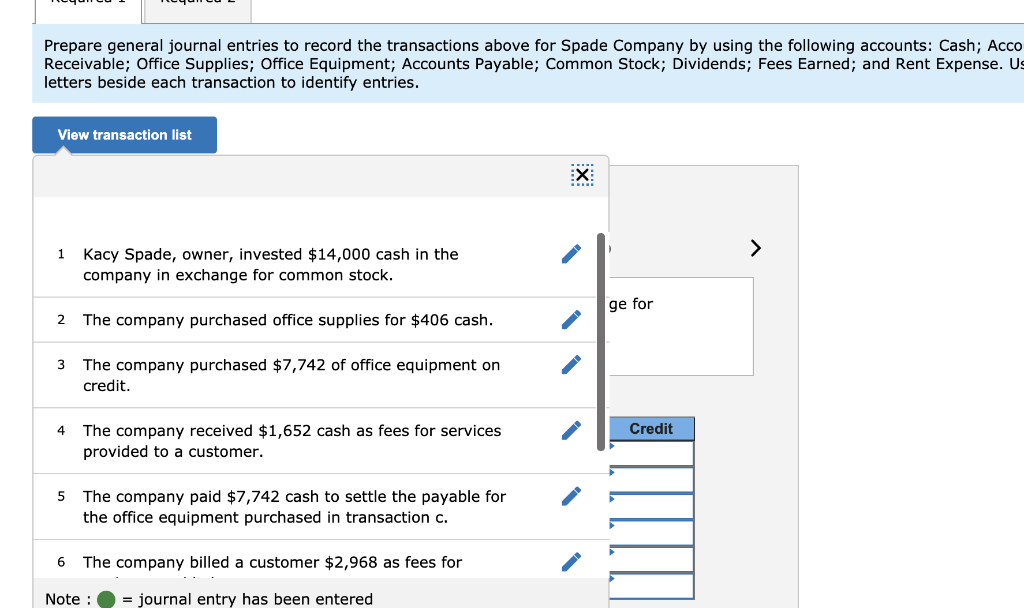

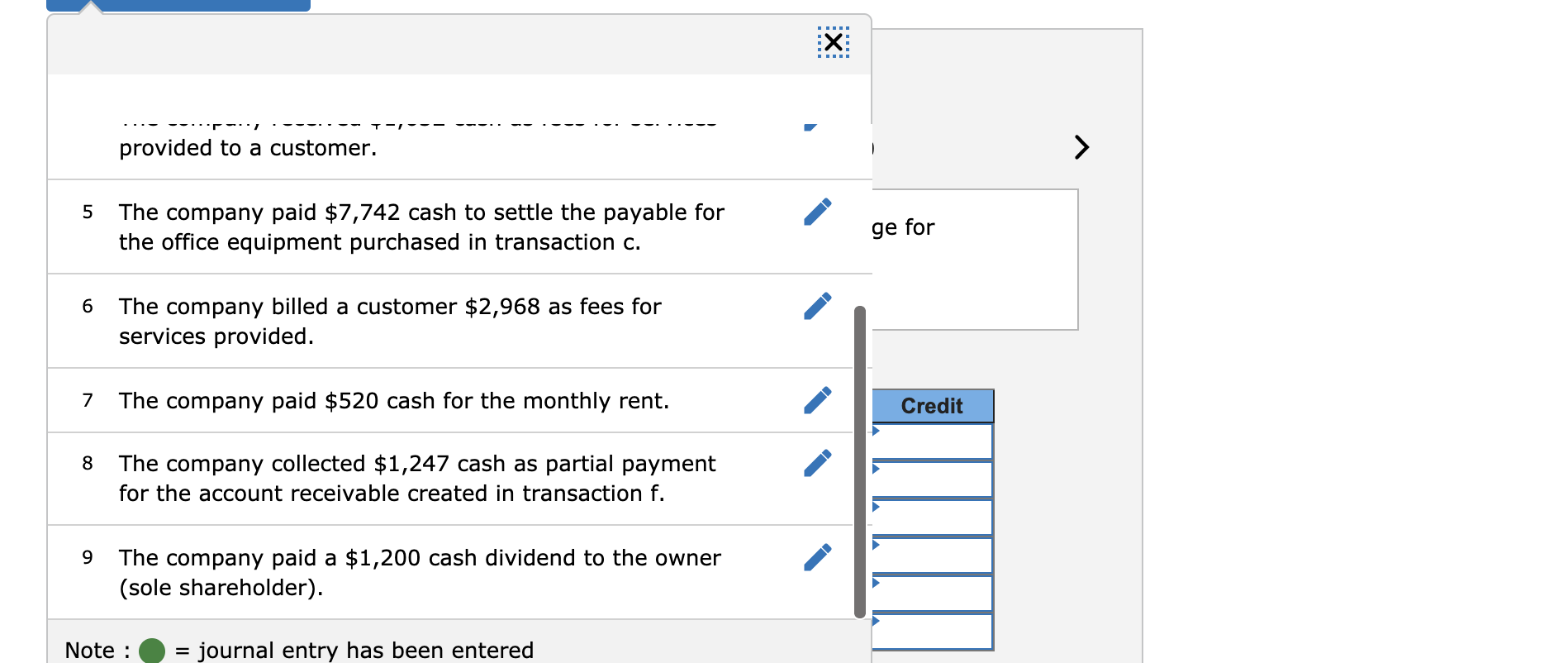

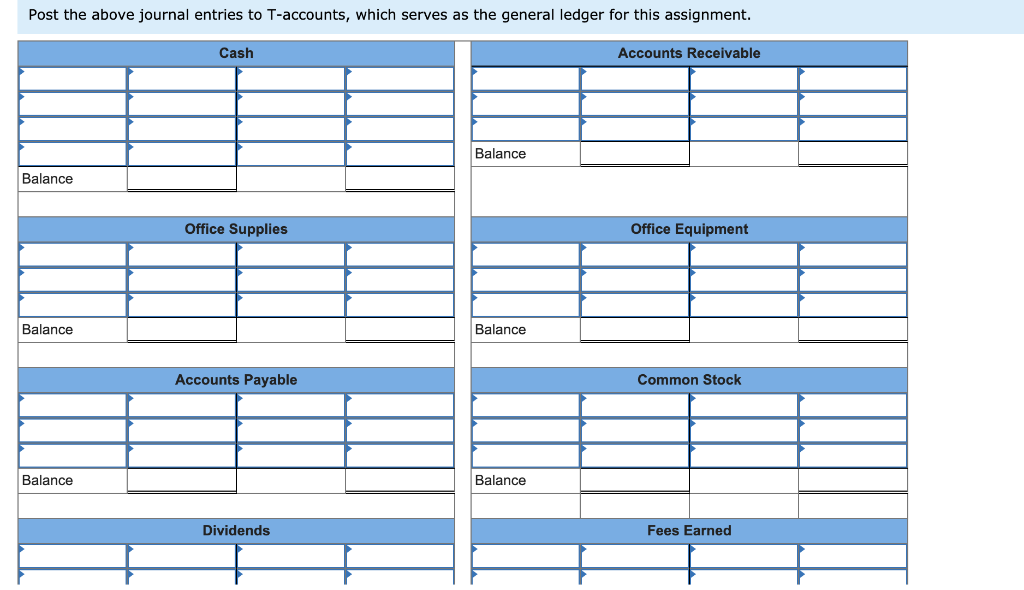

Exercise 2-9 Recording effects of transactions in T-accounts LO A1 The transactions of Spade Company appear below. a. Kacy Spade, owner, invested $14,000 cash in the company in exchange for common stock. b. The company purchased office supplies for $406 cash. c. The company purchased $7,742 of office equipment on credit. d. The company received $1,652 cash as fees for services provided to a customer. e. The company paid $7,742 cash to settle the payable for the office equipment purchased in transaction c. f. The company billed a customer $2,968 as fees for services provided. g. The company paid $520 cash for the monthly rent. h. The company collected $1,247 cash as partial payment for the account receivable created in transaction f. i. The company paid a $1,200 cash dividend to the owner (sole shareholder). Required: 1. Prepare general journal entries to record the transactions above for Spade Company by using the following accounts: Cash; Accounts Receivable; Office Supplies; Office Equipment; Accounts Payable; Common Stock; Dividends; Fees Earned; and Rent Expense. 2. Post the above journal entries to T-accounts, which serve as the general ledger for this assignment. Prepare general journal entries to record the transactions above for Spade Company by using the following accounts: Cash; Acco Receivable; Office Supplies; Office Equipment; Accounts Payable; Common Stock; Dividends; Fees Earned; and Rent Expense. Us letters beside each transaction to identify entries. View transaction list :X: > 1 Kacy Spade, owner, invested $14,000 cash in the company in exchange for common stock. ge for 2 The company purchased office supplies for $406 cash. 3 The company purchased $7,742 of office equipment on credit. 4 Credit The company received $1,652 cash as fees for services provided to a customer. 5 The company paid $7,742 cash to settle the payable for the office equipment purchased in transaction c. 6 The company billed a customer $2,968 as fees for Note: = journal entry has been entered provided to a customer. > 5 The company paid $7,742 cash to settle the payable for the office equipment purchased in transaction c. ge for 6 The company billed a customer $2,968 as fees for services provided. 7 The company paid $520 cash for the monthly rent. Credit 8 The company collected $1,247 cash as partial payment for the account receivable created in transaction f. 9 The company paid a $1,200 cash dividend to the owner (sole shareholder). Note : = journal entry has been entered Post the above journal entries to T-accounts, which serves as the general ledger for this assignment. Cash Accounts Receivable Balance Balance Office Supplies Office Equipment Balance Balance Accounts Payable Common Stock Balance Balance Dividends Fees Earned