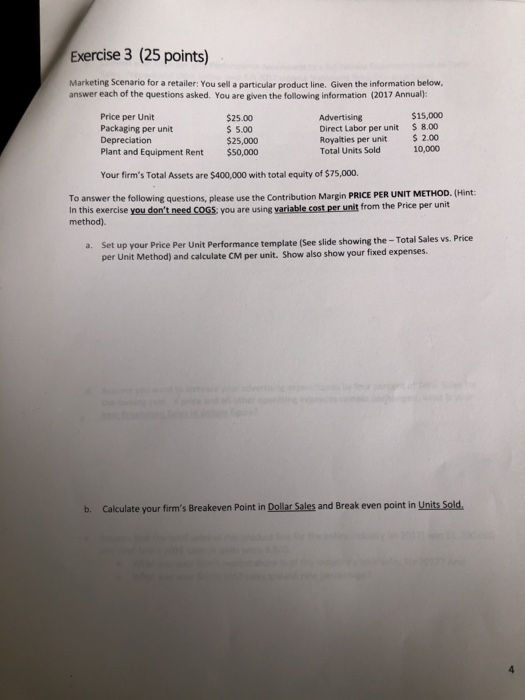

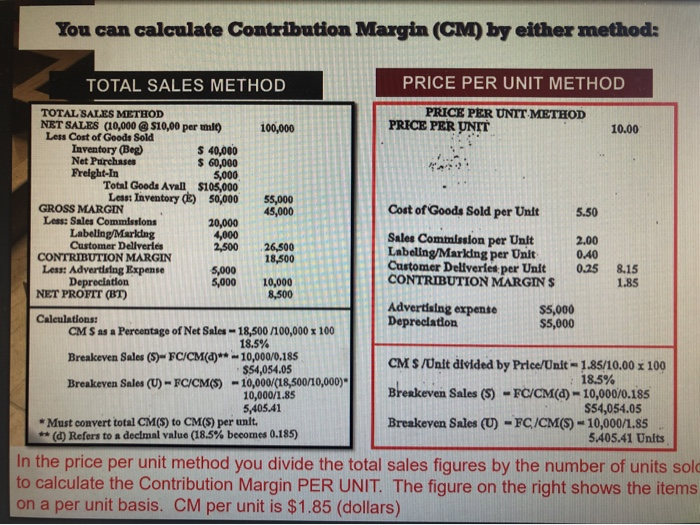

Exercise 3 (25 points) Marketing Scenario for a retailer: You sell a particular product line. Given the information below, answer each of the questions asked. You are given the following information (2017 Annual): Price per Unit $25.00 Advertising $15,000 Packaging per unit $ 5.00 Direct Labor per unit $ 8.00 Depreciation $25,000 Royalties per unit $ 2.00 Plant and Equipment Rent $50,000 Total Units Sold 10,000 Your firm's Total Assets are $400,000 with total equity of $75,000 To answer the following questions, please use the Contribution Margin PRICE PER UNIT METHOD. (Hint: In this exercise you don't need COGS: you are using variable cost per unit from the Price per unit method) a. Set up your Price Per Unit Performance template (See slide showing the - Total Sales vs. Price per Unit Method) and calculate CM per unit. Show also show your fixed expenses. b. Calculate your firm's Breakeven Point in Dollar Sales and Break even point in Units Sold You can calculate Contribution Margin (CM) by either method: 5.50 5,000 5,000 TOTAL SALES METHOD PRICE PER UNIT METHOD TOTAL SALES METHOD PRICE PER UNIT METHOD NET SALES (10,000 $10,00 per mit 100,000 PRICE PER UNIT 10.00 Less Cost of Goods Sold Inventory (Beg) $ 40,000 Net Purchase $ 60,000 Freight-In 5,000 Total Goods Avall $105,000 Less Inventory () 50,000 55,000 GROSS MARGIN 45,000 Cost of Goods Sold per Unit Less: Sales Commissions 20,000 Labeling/Marking 4,000 Sales Commission per Unit 2.00 Customer Dellveries 2,500 26,500 Labeling Marking per Unit 0.40 CONTRIBUTION MARGIN 18,500 Less: Advertising Expense Customer Deliverles per Unit 0.25 8.15 Depreciation 10,000 CONTRIBUTION MARGINS 1.85 NET PROFIT (BT) 8,500 Advertising expense $5,000 Calculations: Depreciation $5,000 CM S as a Percentage of Net Sales - 18,500 /100,000 x 100 18.5% Breakeven Sales (5) - FC/CM(Q)** - 10,000/0.185 $54,054.05 CM $ /Unit divided by Price/Unit - 1.85/10.00 x 100 18.5% Breakeven Sales (U) - FC/CM(S) - 10,000/(18,500/10,000) 10,000/1.85 Breakeven Sales (S) - FC/CM(a) 10,000/0.185 5,405.41 $54,054.05 * Must convert total CM(S) to CM(S) per unit Breakeven Sales (U) - FC/CM(S) - 10,000/1.85 ** (d) Refers to a decimal value (18.5% becomes 0.185) 5.405.41 Units In the price per unit method you divide the total sales figures by the number of units sold to calculate the Contribution Margin PER UNIT. The figure on the right shows the items on a per unit basis. CM per unit is $1.85 (dollars)