Answered step by step

Verified Expert Solution

Question

1 Approved Answer

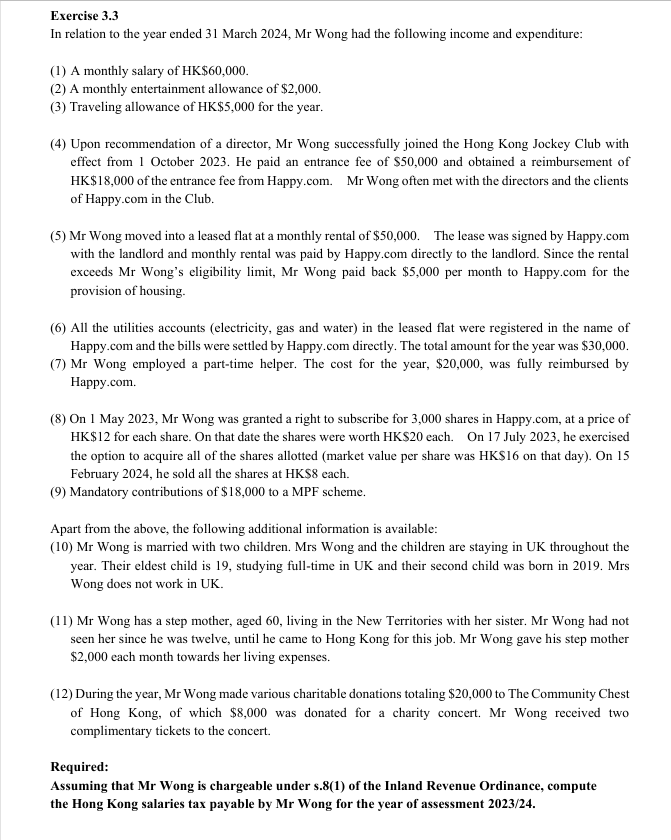

Exercise 3 . 3 In relation to the year ended 3 1 March 2 0 2 4 , Mr Wong had the following income and

Exercise

In relation to the year ended March Mr Wong had the following income and expenditure:

A monthly salary of HK $

A monthly entertainment allowance of $

Traveling allowance of HK $ for the year.

Upon recommendation of a director, Mr Wong successfully joined the Hong Kong Jockey Club with effect from October He paid an entrance fee of $ and obtained a reimbursement of HK $ of the entrance fee from

Happy.com. Mr Wong often met with the directors and the clients of

Happy.com in the Club.

Mr Wong moved into a leased flat at a monthly rental of $ The lease was signed by Happy.com with the landlord and monthly rental was paid by

Happy.com directly to the landlord. Since the rental exceeds Mr Wong's eligibility limit Mr Wong paid back $ per month to Happy.com for the

provision of housing.

All the utilities accounts electricity gas and water in the leased flat were registered in the name of Happy.com and the bills were settled by Happy.com directly. The total amount for the year was $

Mr Wong employed a parttime helper. The cost for the year, $ was fully reimbursed by Happy.com.

On May Mr Wong was granted a right to subscribe for shares in

Happy.com, at a price of HK $ for each share. On that date the shares were worth HK$ each. On July he exercised the option to acquire all of the shares allotted market value per share was HK$ on that day On

February he sold all the shares at HK$ each.

Mandatory contributions of $ to a MPF scheme.

Apart from the above, the following additional information is available:

Mr Wong is married with two children. Mrs Wong and the children are staying in UK throughout the year. Their eldest child is studying fulltime in UK and their second child was born in Mrs Wong does not work in UK

Mr Wong has a step mother, aged living in the New Territories with her sister. Mr Wong had not seen her since he was twelve, until he came to Hong Kong for this job. Mr Wong gave his step mother $ each month towards her living expenses.

During the year, Mr Wong made various charitable donations totaling $ to The Community Chest of Hong Kong, of which $ was donated for a charity concert. Mr Wong received two complimentary tickets to the concert.

Required:

Assuming that Mr Wong is chargeable under s of the Inland Revenue Ordinance, compute the Hong Kong salaries tax payable by Mr Wong for the year of assessment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started