Answered step by step

Verified Expert Solution

Question

1 Approved Answer

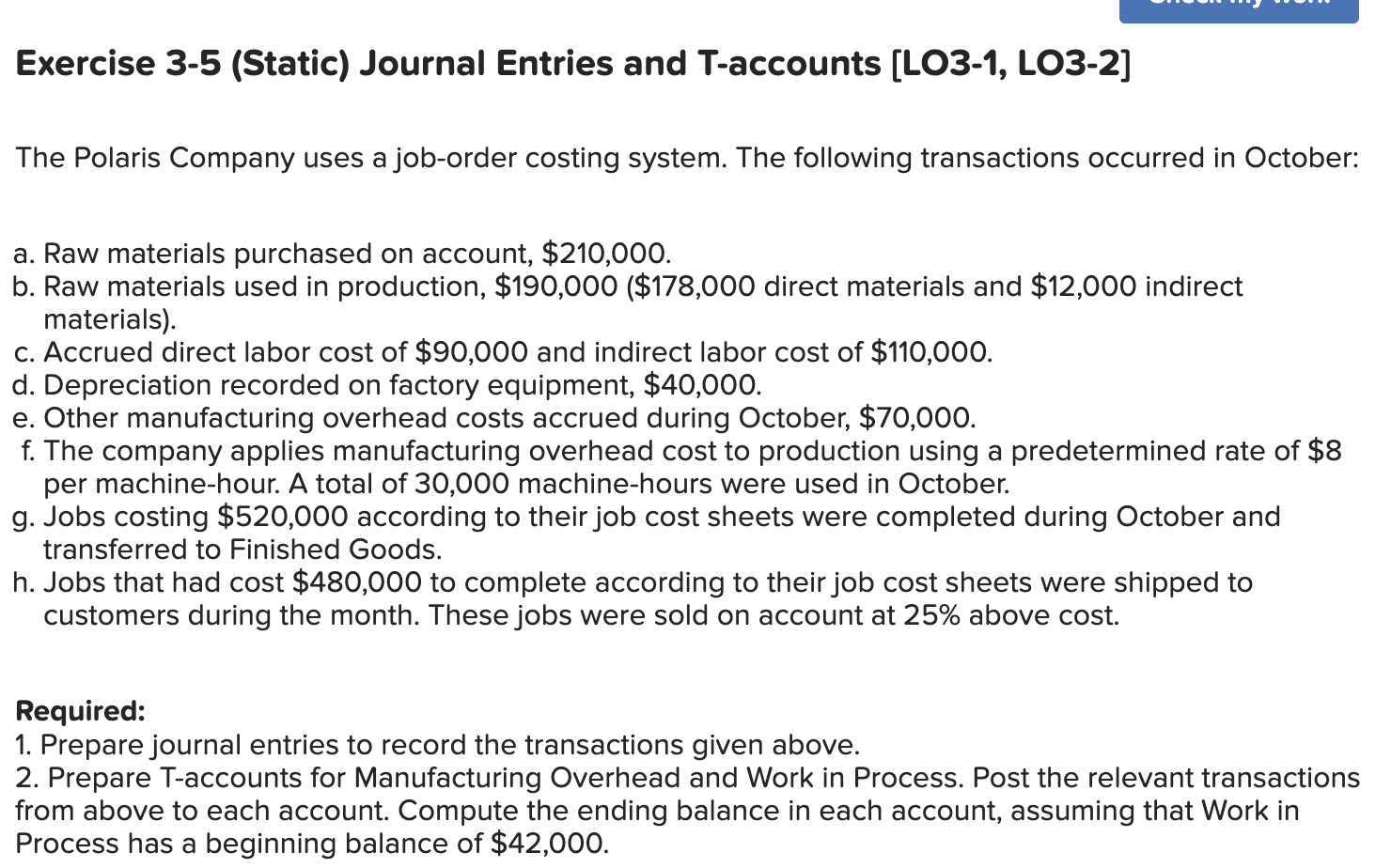

Exercise 3 - 5 ( Static ) Journal Entries and T - accounts [ LO 3 - 1 , LO 3 - 2 ] The

Exercise Static Journal Entries and Taccounts LO LO

The Polaris Company uses a joborder costing system. The following transactions occurred in October:

a Raw materials purchased on account, $

b Raw materials used in production, $ $ direct materials and $ indirect

materials

c Accrued direct labor cost of $ and indirect labor cost of $

d Depreciation recorded on factory equipment, $

e Other manufacturing overhead costs accrued during October, $

f The company applies manufacturing overhead cost to production using a predetermined rate of $

per machinehour. A total of machinehours were used in October.

g Jobs costing $ according to their job cost sheets were completed during October and

transferred to Finished Goods.

h Jobs that had cost $ to complete according to their job cost sheets were shipped to

customers during the month. These jobs were sold on account at above cost.

Required:

Prepare journal entries to record the transactions given above.

Prepare Taccounts for Manufacturing Overhead and Work in Process. Post the relevant transactions

from above to each account. Compute the ending balance in each account, assuming that Work in

Process has a beginning balance of $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started