Answered step by step

Verified Expert Solution

Question

1 Approved Answer

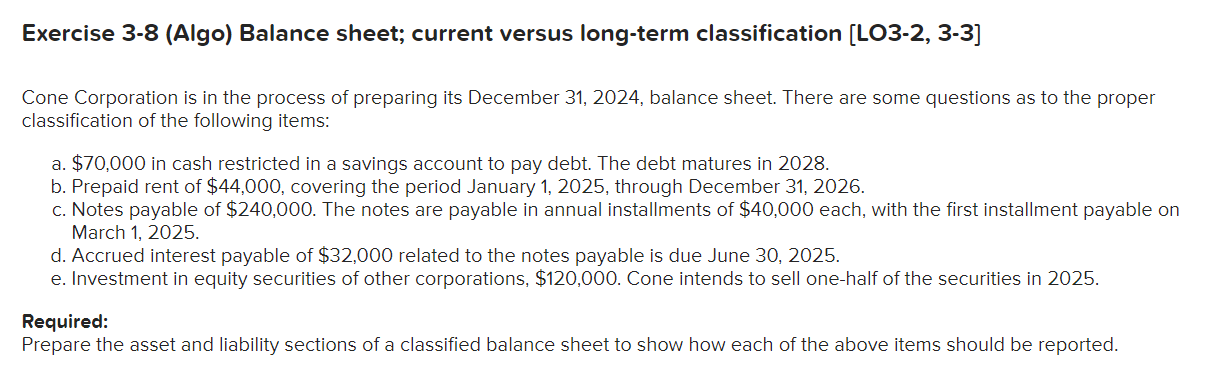

Exercise 3 - 8 ( Algo ) Balance sheet; current versus long - term classification [ LO 3 - 2 , 3 - 3 ]

Exercise Algo Balance sheet; current versus longterm classification LOtableCONE CORPORATIONBalance Sheet PartialAt December AssetsCurrent assets:Prepaid rent,,Investment in equity securitiesLongterm investments:Investment in equity securitiesRestricted cash,,Other assets:Prepaid rent,,Liabilities and Shareholders' EquityCurrent liabilities:Interest payable,,Notes payable current maturities of longterm debtPLongterm liabilities:,,Notes payable longterm

Cone Corporation is in the process of preparing its December balance sheet. There are some questions as to the proper

classification of the following items:

a $ in cash restricted in a savings account to pay debt. The debt matures in

b Prepaid rent of $ covering the period January through December

c Notes payable of $ The notes are payable in annual installments of $ each, with the first installment payable on

March

d Accrued interest payable of $ related to the notes payable is due June

e Investment in equity securities of other corporations, $ Cone intends to sell onehalf of the securities in

Required:

Prepare the asset and liability sections of a classified balance sheet to show how each of the above items should be reported.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started