Question

Exercise 3 Gores Green Chemicals inventory goes through 2 distinct processes. Process 1 had beginning WIP inventory of $98,260 on October 1. Of this amount,

Exercise 3

Gores Green Chemicals inventory goes through 2 distinct processes. Process 1 had beginning WIP inventory of $98,260 on October 1. Of this amount, $31,400 was the cost of direct materials, and $66,860 was for conversion costs. The 8,000 units in the beginning inventory were 30% complete with respect to both direct materials and conversion costs.

During October 17,000 units were transferred out, 500 were spoiled, and 4,500 units remain in ending inventory. Spoiled units were 100% complete with respect to materials and 50% complete with respect to conversion costs. The units in ending WIP were 80% complete with respect to direct materials and 40% complete with respect to conversion costs. Cost incurred during the period amounted to $390,600 for direct materials and $504,640 for conversion costs.

Required:

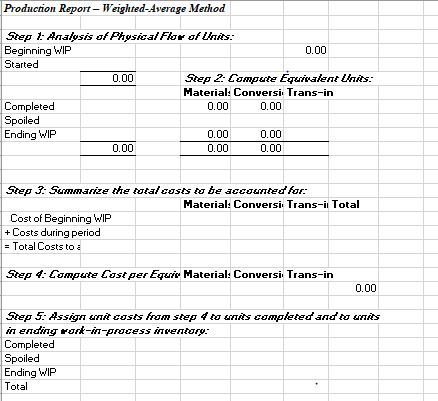

- Prepare a production cost report for Process 1 using weighted-average costing.

- What journal entry would be made after preparing the production cost report for process 1?

Follow Outline:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started