Answered step by step

Verified Expert Solution

Question

1 Approved Answer

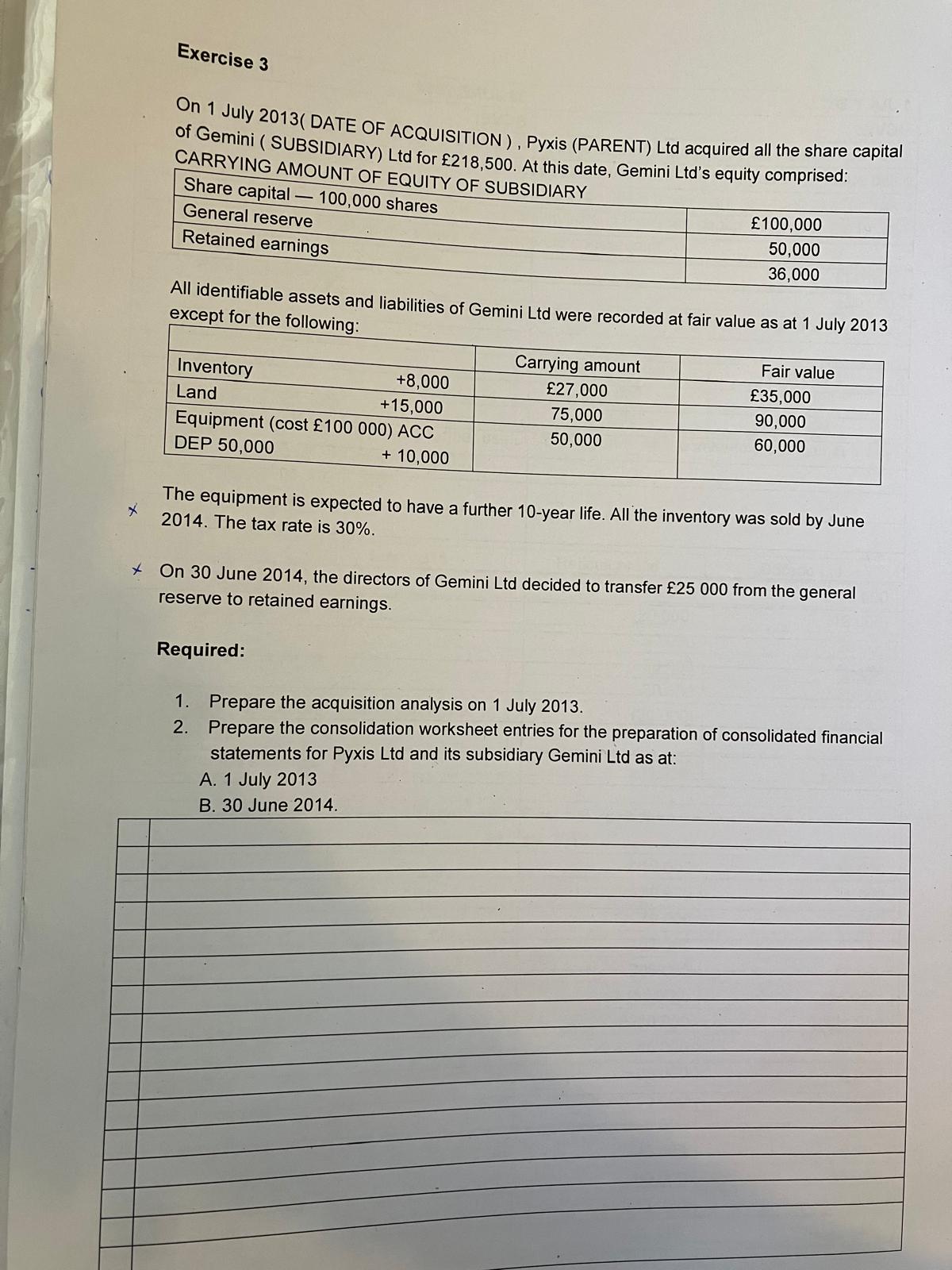

Exercise 3 On 1 July 2 0 1 3 ( DATE OF ACQUISITION ) , Pyxis ( PARENT ) Ltd acquired all the share capital

Exercise

On July DATE OF ACQUISITION Pyxis PARENT Ltd acquired all the share capital

of Gemini SUBSIDIARY Ltd for At this date, Gemini Ltds equity comprised:

CARRYING AMOUNT OF EQUITY OF SUBSIDIARY

All identifiable assets and liabilities of Gemini Ltd were recorded at fair value as at July

except for the following:

The equipment is expected to have a further year life. All the inventory was sold by June

The tax rate is

times On June the directors of Gemini Ltd decided to transfer from the general

reserve to retained earnings.

Required:

Prepare the acquisition analysis on July

Prepare the consolidation worksheet entries for the preparation of consolidated financial

statements for Pyxis Ltd and its subsidiary Gemini Ltd as at:

A July

B June

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started