Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 3-16 The adjusted trial balance below of Smith Advisory Services is incomplete. Enter the adjust- ment amounts directly in the adjustment columns of the

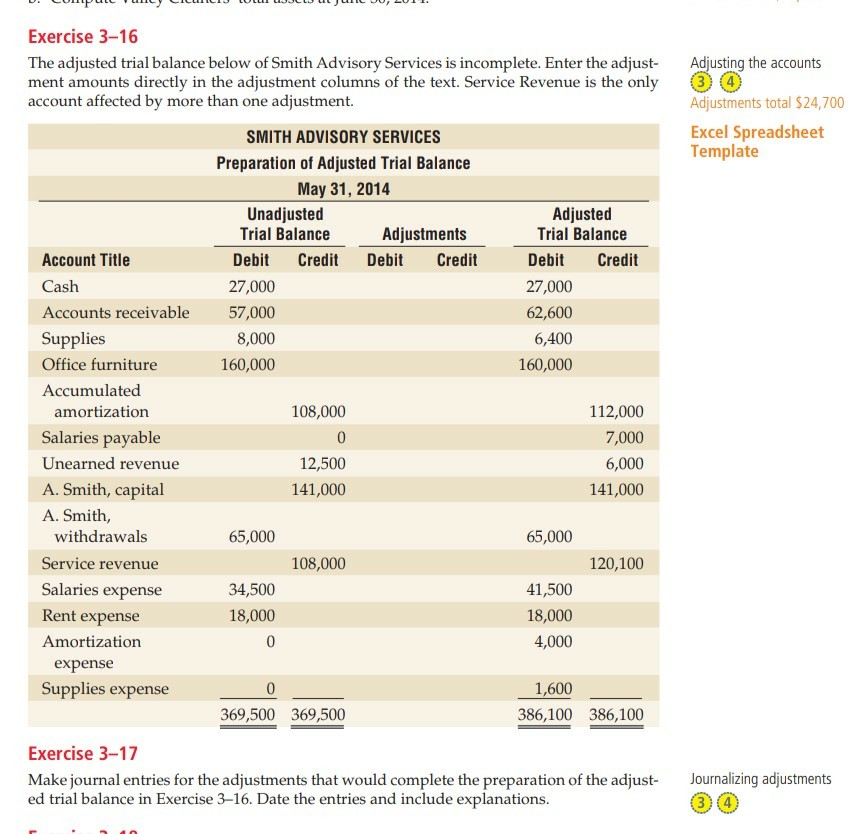

Exercise 3-16 The adjusted trial balance below of Smith Advisory Services is incomplete. Enter the adjust- ment amounts directly in the adjustment columns of the text. Service Revenue is the only account affected by more than one adjustment. Adjusting the accounts Adjustments total $24,700 Excel Spreadsheet SMITH ADVISORY SERVICES Preparation of Adjusted Trial Balance May 31, 2014 Template Unadjusted Trial Balance Adjusted Adjustments Trial Balance Debit Credit Debi Credit Debit Credit Account Title Cash 27,000 Accounts receivable 57,000 8,000 160,000 27,000 62,600 6,400 160,000 Supplies Office furniture Accumulated 112,000 7,000 6,000 141,000 108,000 amortization Salaries payable Unearned revenue A. Smith, capital A. Smith, 12,500 141,000 withdrawals Service revenue Salaries expense Rent expense Amortization 65,000 65,000 108,000 120,100 34,500 18,000 41,500 18,000 4,000 expense Supplies expense 1,600 369,500 369,500 386,100 386,100 Exercise 3-17 Make journal entries for the adjustments that would complete the preparation of the adjust- ed trial balance in Exercise 3-16. Date the entries and include explanations. Journalizing adjustments 3 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started