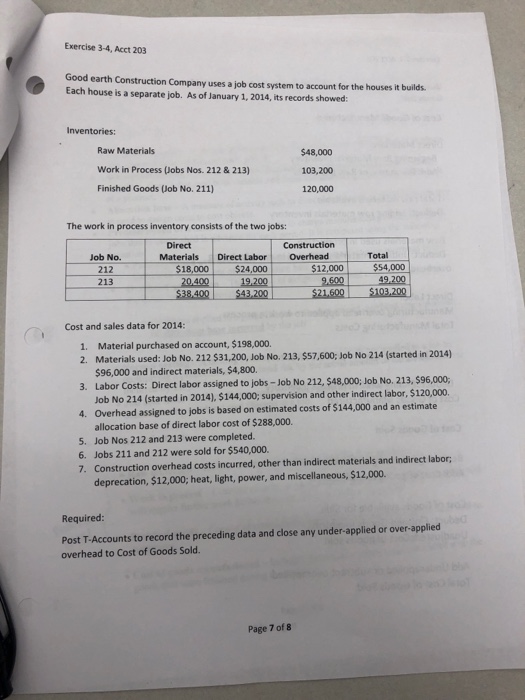

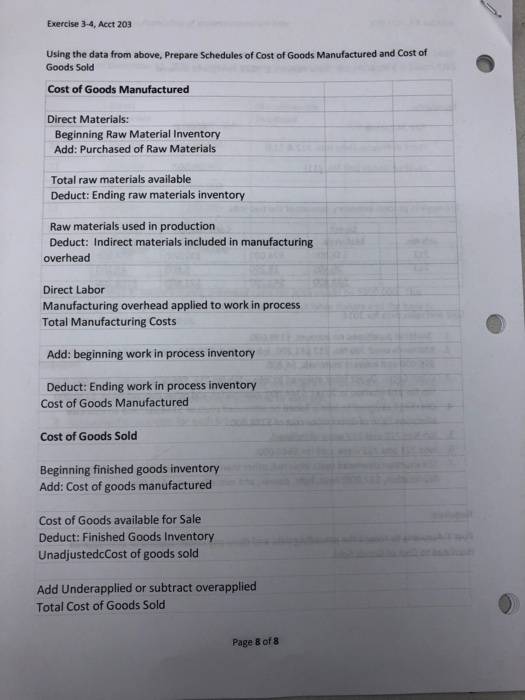

Exercise 3-4, Acct 203 Good earth Construction Company uses a job cost system to account for the houses it builds. Each house is a separate job. As of January 1, 2014, its records showed: Inventories: Raw Materials Work in Process (Jobs Nos. 212 & 213) Finished Goods (Job No. 211) $48,000 103,200 120,000 The work in process inventory consists of the two jobs: Direct Construction Job No. Materials Direct LaborOverhead Total 212 21320.4019,200 $12,000$54,000 9,600 49.200 $18,000$24,000 $33.500 $43.00$321.90$103.200 Cost and sales data for 2014: 1. Material purchased on account, $198,000o. 2. Materials used: Job No. 212 $31,200, Job No. 213, $57,600; Job No 214 (started in 2014) $96,000 and indirect materials, $4,800. Labor Costs: Direct labor assigned to jobs- Job No 212, $48,000; Job No. 213, 596,000, Job No 214 (started in 2014), $144,000, supervision and other indirect labor, $120,000. Overhead assigned to jobs is based on estimated costs of $144,000 and an estimate allocation base of direct labor cost of $288,000. 3. 4. S. Job Nos 212 and 213 were completed. 6. Jobs 211 and 212 were sold for $540,000. 7. Construction overhead costs incurred, other than indirect materials and indirect labor deprecation, $12,000, heat, light, power, and miscellaneous, $12,000. Required: Post T-Accounts to record the preceding data and close any under-applied or over-applied overhead to Cost of Goods Sold Page 7 of 8 Exercise 3-4, Acct 203 Good earth Construction Company uses a job cost system to account for the houses it builds. Each house is a separate job. As of January 1, 2014, its records showed: Inventories: Raw Materials Work in Process (Jobs Nos. 212 & 213) Finished Goods (Job No. 211) $48,000 103,200 120,000 The work in process inventory consists of the two jobs: Direct Construction Job No. Materials Direct LaborOverhead Total 212 21320.4019,200 $12,000$54,000 9,600 49.200 $18,000$24,000 $33.500 $43.00$321.90$103.200 Cost and sales data for 2014: 1. Material purchased on account, $198,000o. 2. Materials used: Job No. 212 $31,200, Job No. 213, $57,600; Job No 214 (started in 2014) $96,000 and indirect materials, $4,800. Labor Costs: Direct labor assigned to jobs- Job No 212, $48,000; Job No. 213, 596,000, Job No 214 (started in 2014), $144,000, supervision and other indirect labor, $120,000. Overhead assigned to jobs is based on estimated costs of $144,000 and an estimate allocation base of direct labor cost of $288,000. 3. 4. S. Job Nos 212 and 213 were completed. 6. Jobs 211 and 212 were sold for $540,000. 7. Construction overhead costs incurred, other than indirect materials and indirect labor deprecation, $12,000, heat, light, power, and miscellaneous, $12,000. Required: Post T-Accounts to record the preceding data and close any under-applied or over-applied overhead to Cost of Goods Sold Page 7 of 8