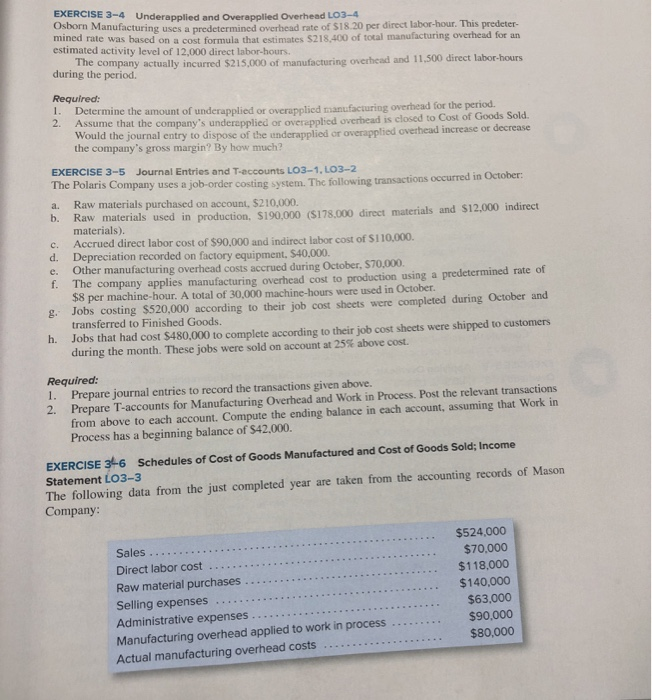

EXERCISE 3-4 Underapplied and Overapplied Overhead LO3-4 Osborn Manufacturing uses a predetermined overhead rate of $18.20 per direct labor-hour. This predeter- mined rate was based on a cost formula that estimates $218,400 of total manufacturing overhead for an estimated activity level of 12,000 direct labor-hours. The company actually incurred $215.000 of manufacturing overhead and 11,500 direct labor-hours during the period. Required: 1. Determine the amount of underapplied or overapplied manufacturing overhead for the period. 2. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. Would the journal entry to dispose of the underapplied or overapplied overhead increase or decrease the company's gross margin? By how much? EXERCISE 3-5 Journal Entries and T-accounts LO3-1, LO3-2 The Polaris Company uses a job-order costing system. The following transactions occurred in October a. Raw materials purchased on account. $210,000 b. Raw materials used in production, $190.000 (5178.000 direct materials and $12,000 indirect materials). c. Accrued direct labor cost of $90,000 and indirect labor cost of S110,000 d. Depreciation recorded on factory equipment, $40,000. e. Other manufacturing overhead costs accrued during October, $70,000. f. The company applies manufacturing overhead cost to production using a predetermined rate of $8 per machine-hour. A total of 30,000 machine-hours were used in October g. Jobs costing $520,000 according to their job cost sheets were completed during October and transferred to Finished Goods h. Jobs that had cost $480,000 to complete according to their job cost sheets were shipped to customers during the month. These jobs were sold on account at 25% above cost. Required: 1. Prepare journal entries to record the transactions given above. 2. Prepare T-accounts for Manufacturing Overhead and Work in Process, Post the relevant transactions from above to each account. Compute the ending balance in each account, assuming that work in Process has a beginning balance of $42,000. EXERCISE 36 Schedules of Cost of Goods Manufactured and Cost of Goods Sold; Income Statement LO3-3 The following data from the just completed year are taken from the accounting records of Mason Company Sales ....... Direct labor cost ....... Raw material purchases .... Selling expenses ......... Administrative expenses...... Manufacturing overhead applied to work in process...... Actual manufacturing overhead costs.... $524,000 $70,000 $118.000 $140,000 $63.000 $90,000 $80,000