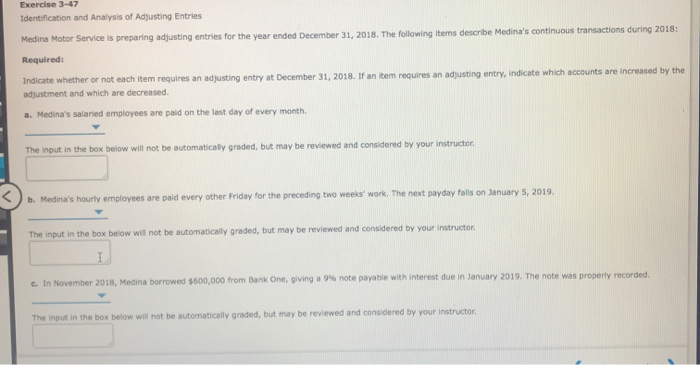

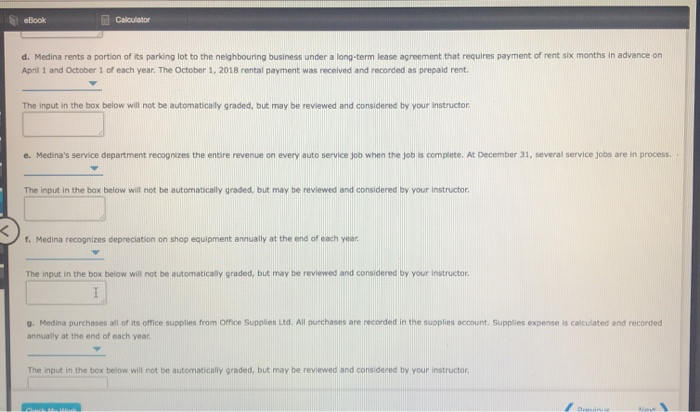

Exercise 3-47 Identification and Analysis of Adjusting Entries Medina Motor Service is preparing adjusting entries for the year ended December 31, 2018. The following items describe Medina's continuous transactions during 2018: Required: Indicate whether or not each item requires an adjusting entry at December 31, 2018. If an item requires an adjusting entry, indicate which accounts are increased by the adjustment and which are decreased a. Medina's salaried employees are paid on the last day of every month. The input in the box below will not be automatically graded, but may be reviewed and considered by your instructor, b. Medina's hourly employees are paid every other Friday for the preceding two weeks' work. The next payday falls on January 5, 2019. The input in the box below will not be automatically graded, but may be reviewed and considered by your instructor c. In November 2018, Medina borrowed $600,000 from Bank One, giving a 9 note payable with interest due in January 2019. The note was property recorded The input in the box below will not be automatically graded, but may be reviewed and considered by your instructor eBook Calculator d. Medina rents a portion of its parking lot to the neighbouring business under a long-term lease agreement that requires payment of rent six months in advance on April 1 and October 1 of each year. The October 1, 2018 rental payment was received and recorded as prepaid rent. The input in the box below will not be automatically graded, but may be reviewed and considered by your instructor. e. Medina's service department recognizes the entire revenue on every auto service job when the job is complete. At December 31, several service jobs are in process. The input in the box below will not be automatically graded, but may be reviewed and considered by your instructor. f. Medina recognizes depreciation on shop equipment annually at the end of each year The input in the box below will not be automatically graded, but may be reviewed and considered by your instructor 1 9. Medina purchases all of its office supplies from Office Supplies Ltd. All purchases are recorded in the supplies account. Supplies expense is calculated and recorded annually at the end of each year The input in the box below will not be automatically graded, but may be reviewed and considered by your instructor