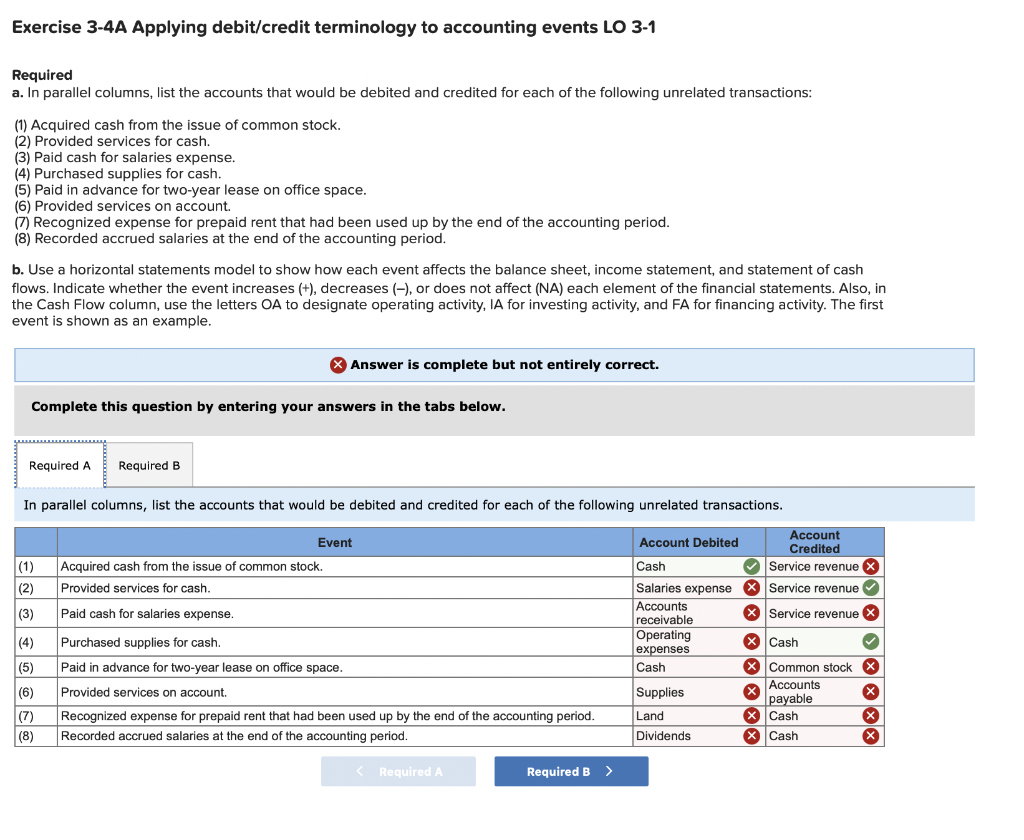

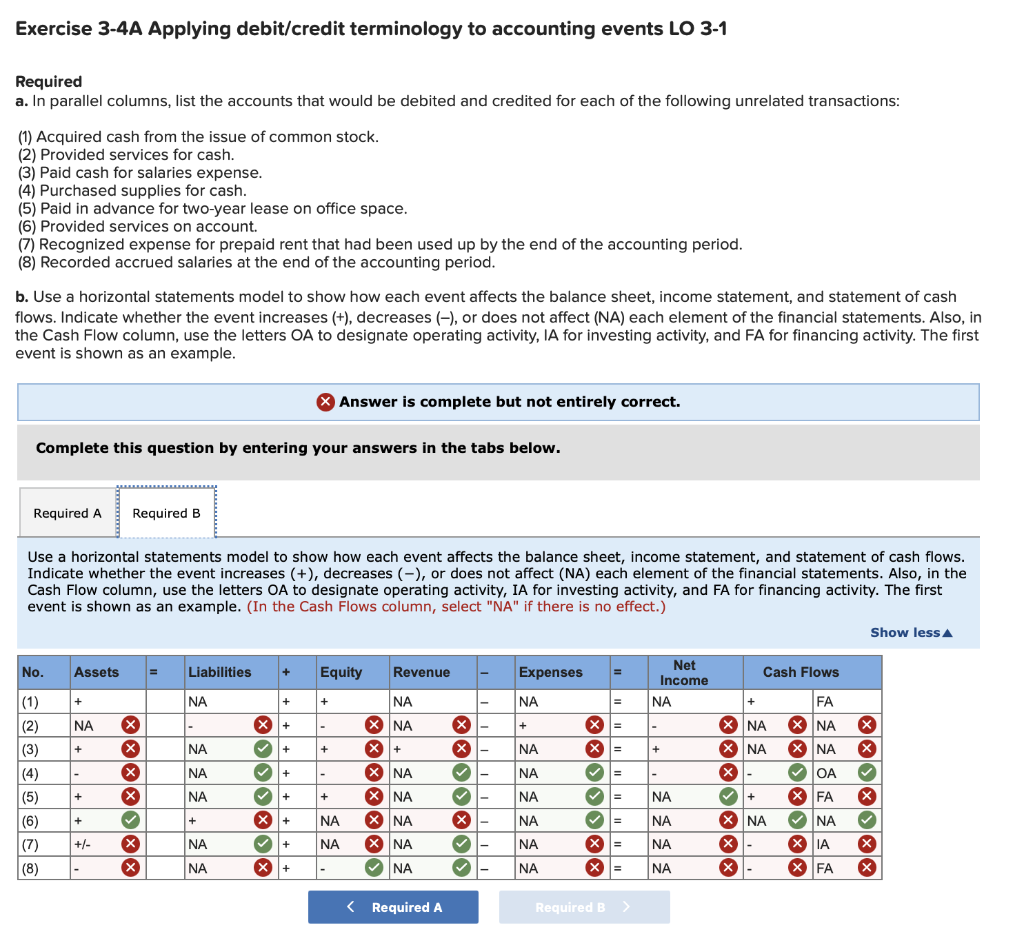

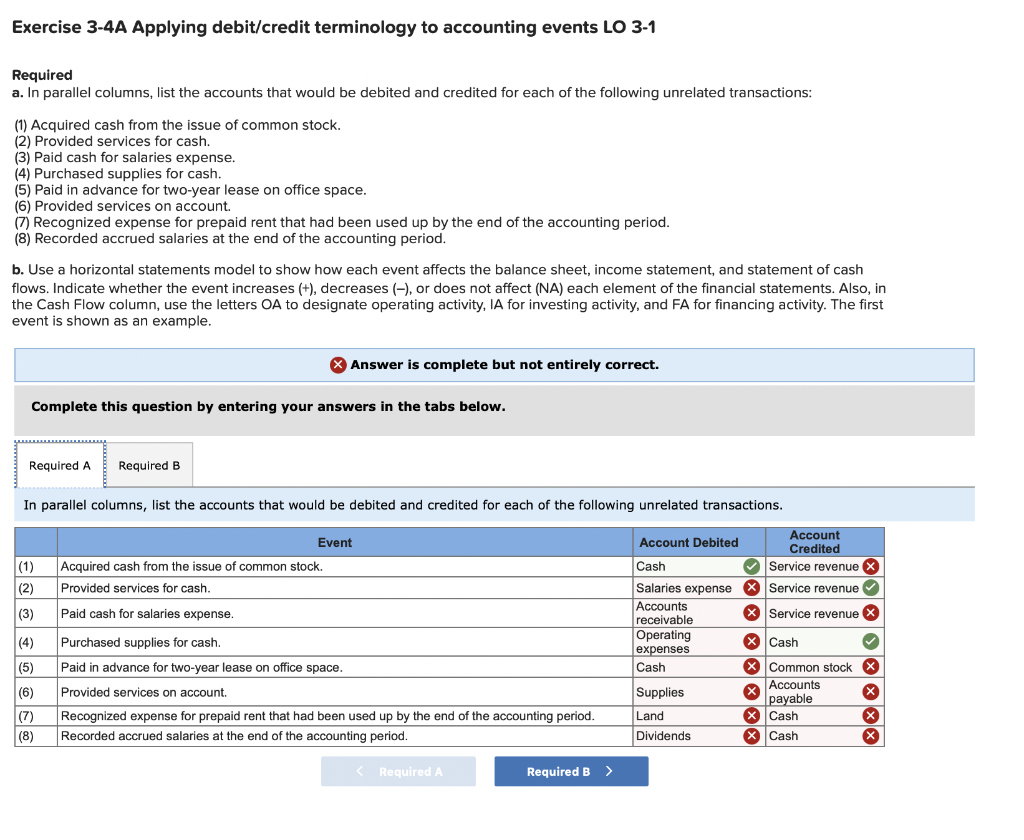

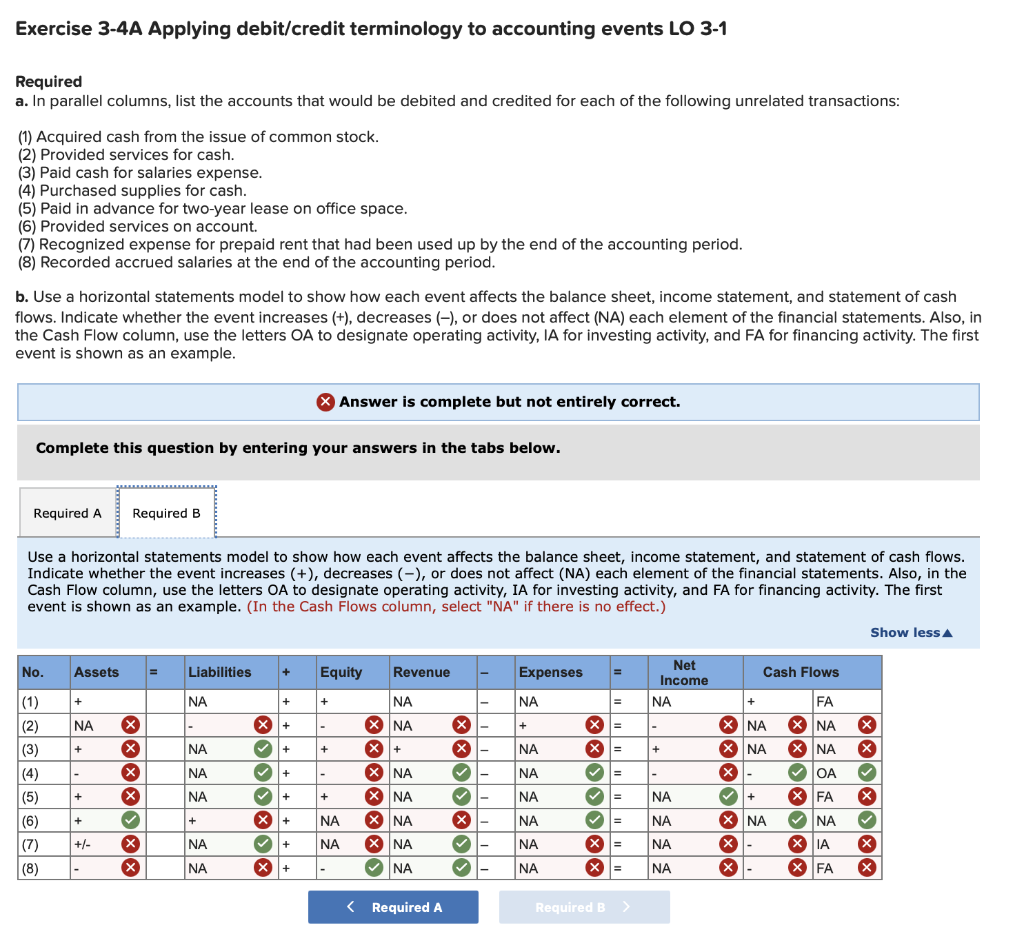

Exercise 3-4A Applying debit/credit terminology to accounting events LO 3-1 Required a. In parallel columns, list the accounts that would be debited and credited for each of the following unrelated transactions: (1) Acquired cash from the issue of common stock. (2) Provided services for cash. (3) Paid cash for salaries expense. (4) Purchased supplies for cash. (5) Paid in advance for two-year lease on office space. (6) Provided services on account. (7) Recognized expense for prepaid rent that had been used up by the end of the accounting period. (8) Recorded accrued salaries at the end of the accounting period. b. Use a horizontal statements model to show how each event affects the balance sheet, income statement, and statement of cash flows. Indicate whether the event increases (+), decreases (-), or does not affect (NA) each element of the financial statements. Also, in the Cash Flow column, use the letters OA to designate operating activity, IA for investing activity, and FA for financing activity. The first event is shown as an example. > Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B In parallel columns, list the accounts that would be debited and credited for each of the following unrelated transactions. (1) Event Acquired cash from the issue of common stock. Provided services for cash. (2) (3) Paid cash for salaries expense. (4) Account Account Debited Credited Cash Service revenue X Salaries expense x Service revenue Accounts x Service revenue X receivable Operating X Cash expenses Cash X Common stock X Supplies x Accounts X payable Land x Cash X Dividends x Cash X Purchased supplies for cash. Paid in advance for two-year lease on office space. Provided services on account. Recognized expense for prepaid rent that had been used up by the end of the accounting period. Recorded accrued salaries at the end of the accounting period. (5) (6) (7) (8) Exercise 3-4A Applying debit/credit terminology to accounting events LO 3-1 Required a. In parallel columns, list the accounts that would be debited and credited for each of the following unrelated transactions: (1) Acquired cash from the issue of common stock. (2) Provided services for cash. (3) Paid cash for salaries expense. (4) Purchased supplies for cash. (5) Paid in advance for two-year lease on office space. (6) Provided services on account. (7) Recognized expense for prepaid rent that had been used up by the end of the accounting period. (8) Recorded accrued salaries at the end of the accounting period. b. Use a horizontal statements model to show how each event affects the balance sheet, income statement, and statement of cash flows. Indicate whether the event increases (+), decreases (-), or does not affect (NA) each element of the financial statements. Also, in the Cash Flow column, use the letters OA to designate operating activity, IA for investing activity, and FA for financing activity. The first event is shown as an example, Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Use a horizontal statements model to show how each event affects the balance sheet, income statement, and statement of cash flows. Indicate whether the event increases (+), decreases (-), or does not affect (NA) each element of the financial statements. Also, in the Cash Flow column, use the letters OA to designate operating activity, IA for investing activity, and FA for financing activity. The first event is shown as an example. (In the Cash Flows column, select "NA" if there is no effect.) Show less A No. Assets Liabilities + Equity Revenue Expenses = Cash Flows Net Income NA + NA + + NA = + (1) (2) NA X + - + x = - X NA X (3) + NA + + x NA = + x X X x X (4) - + - NA = - NA NA NA X NA X + X NA X NA X NA X NA NA X NA X- + FA X NA X NA X FA NA XIA X FA (5) + + + NA = X (6) + + X + NA = NA NA NA NA NA NA (7) +/- NA + x = X NA X- X- NA NA X (8) X NA X + x = X