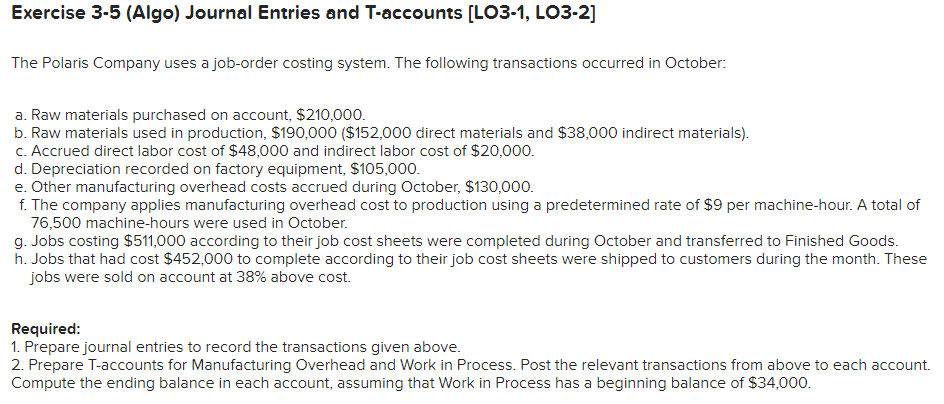

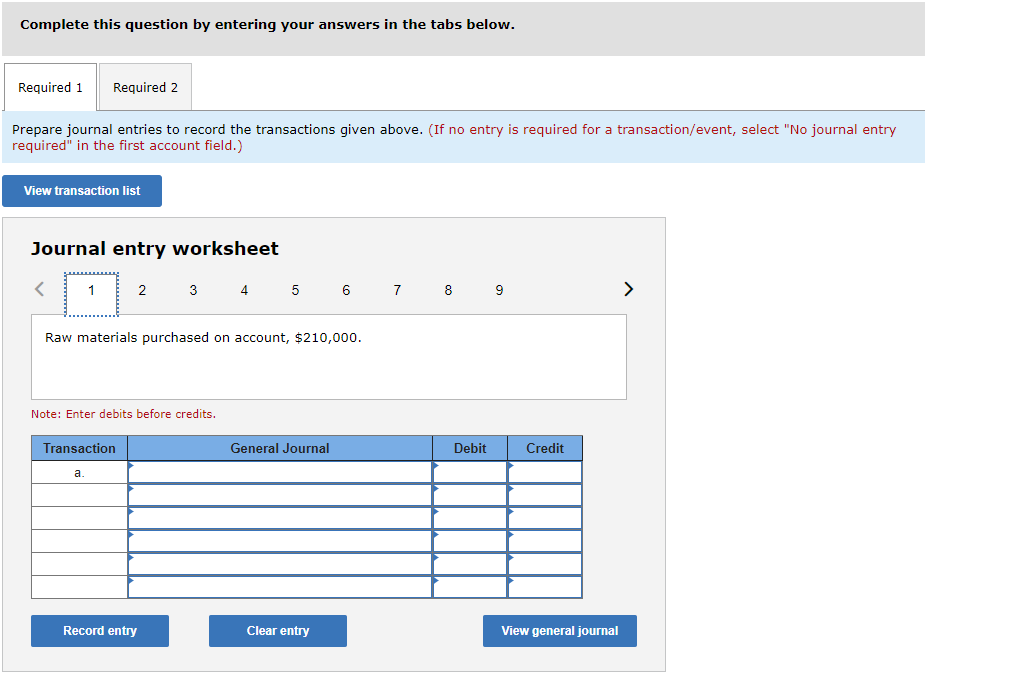

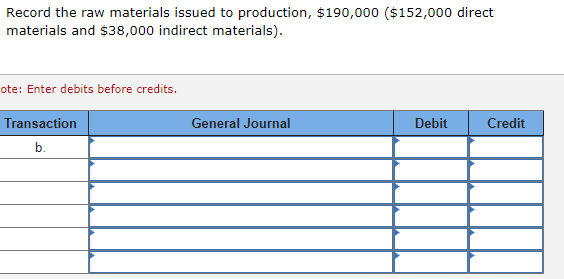

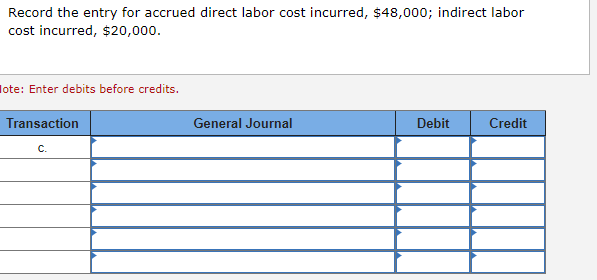

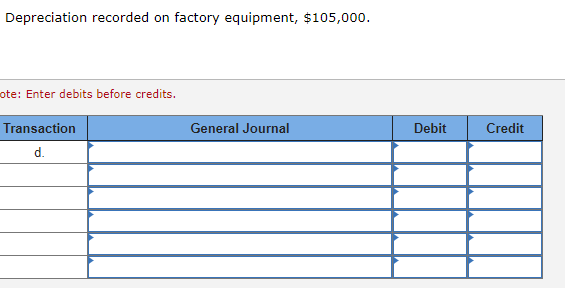

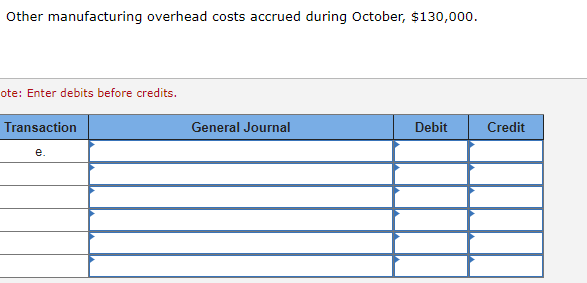

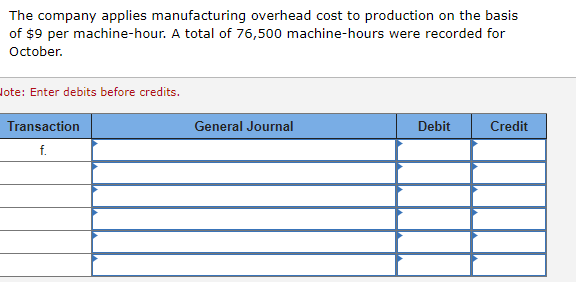

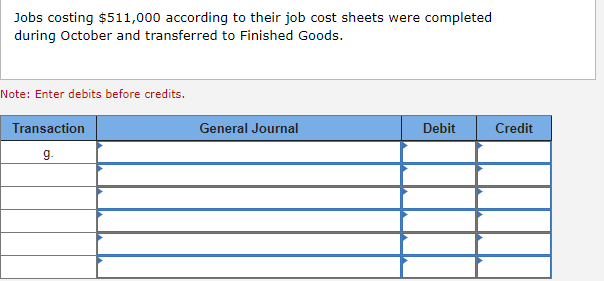

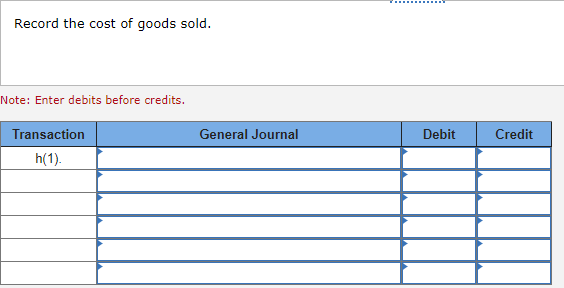

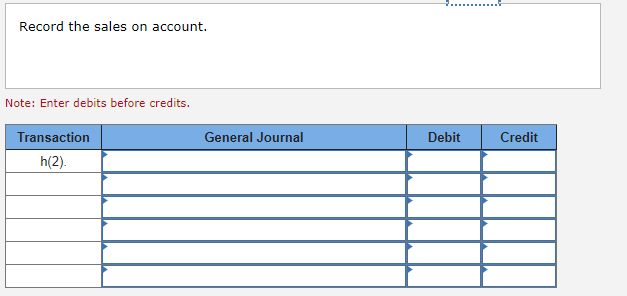

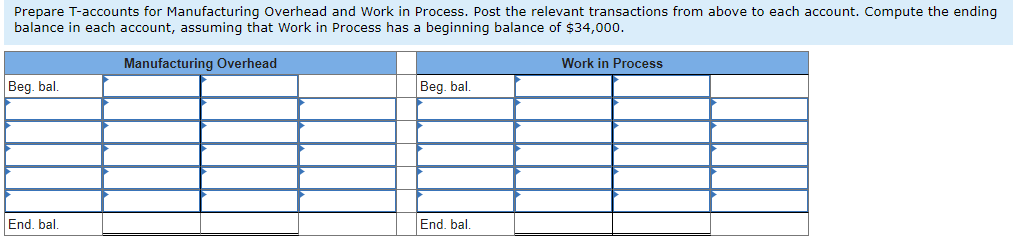

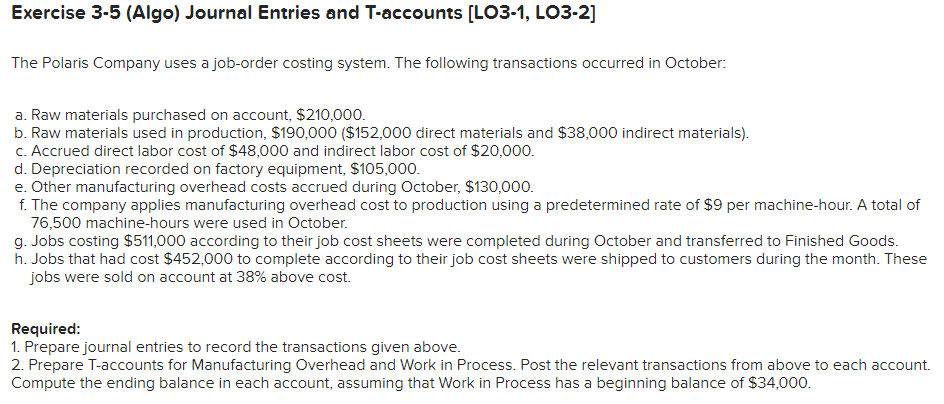

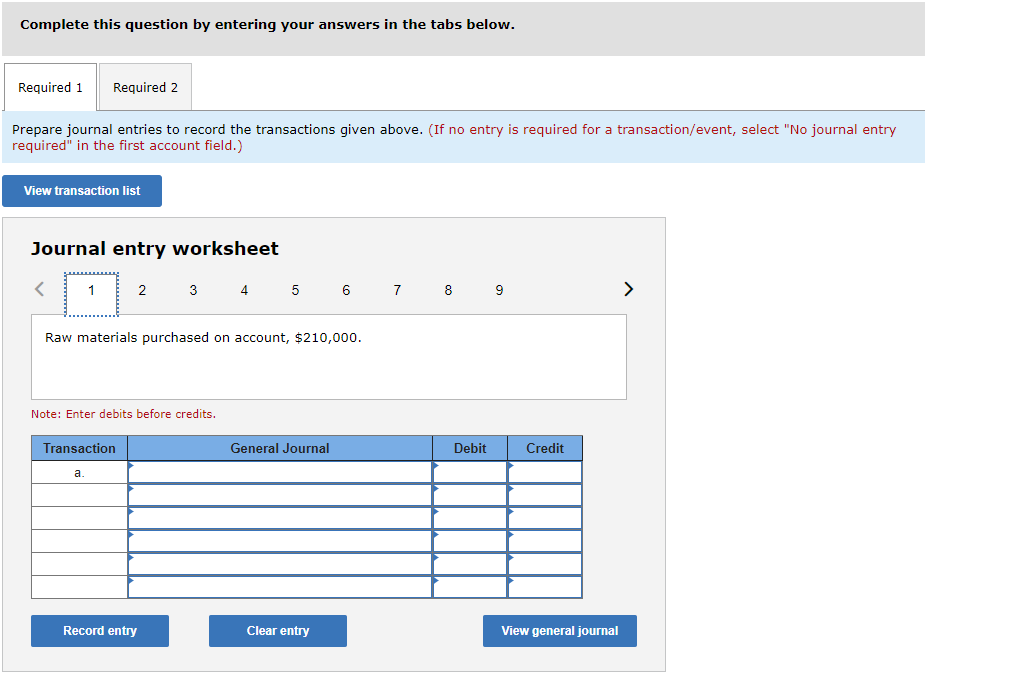

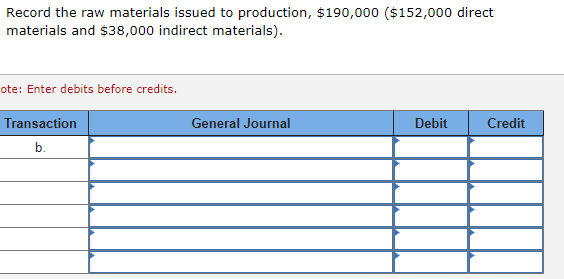

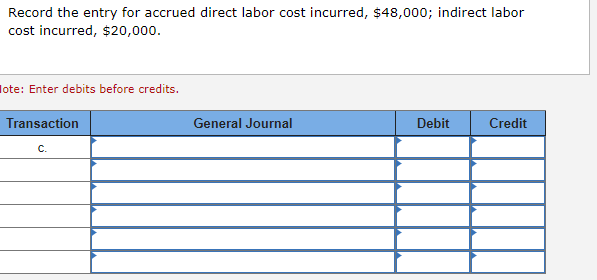

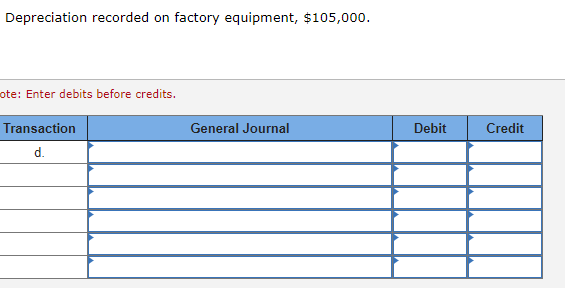

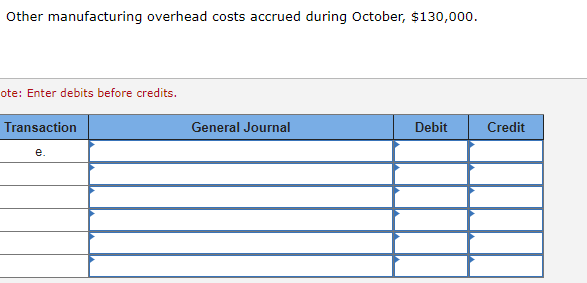

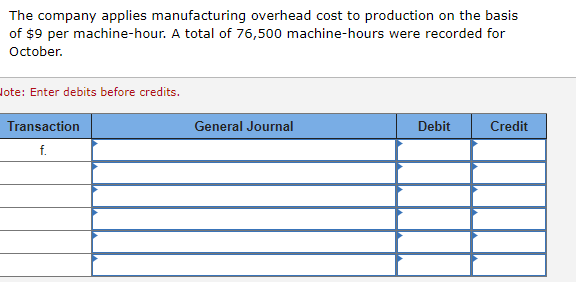

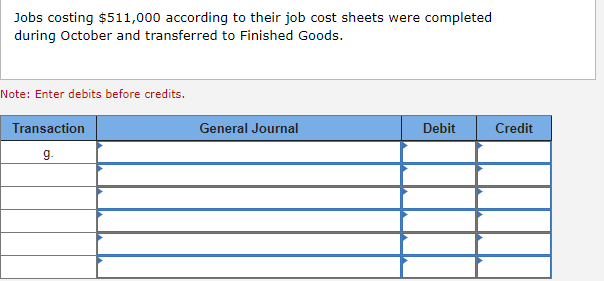

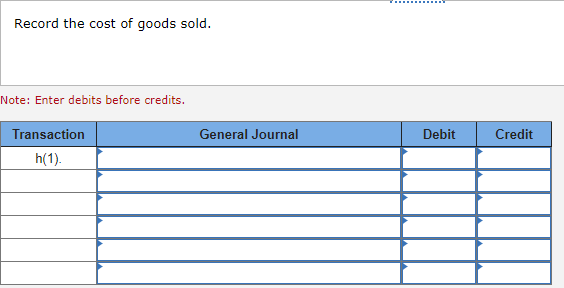

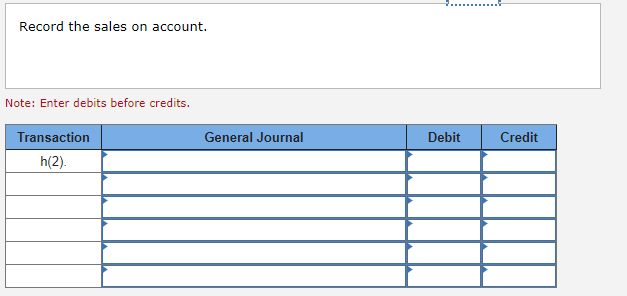

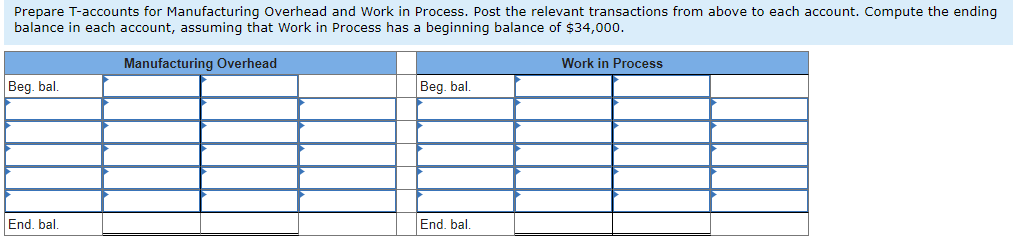

Exercise 3-5 (Algo) Journal Entries and T-accounts [LO3-1, LO3-2] The Polaris Company uses a job-order costing system. The following transactions occurred in October: a. Raw materials purchased on account, $210,000. b. Raw materials used in production, $190,000 ($152,000 direct materials and $38,000 indirect materials). c. Accrued direct labor cost of $48,000 and indirect labor cost of $20,000. d. Depreciation recorded on factory equipment, $105,000. e. Other manufacturing overhead costs accrued during October, $130,000. f. The company applies manufacturing overhead cost to production using a predetermined rate of $9 per machine-hour. A total of 76,500 machine-hours were used in October. g. Jobs costing $511,000 according to their job cost sheets were completed during October and transferred to Finished Goods. h. Jobs that had cost $452,000 to complete according to their job cost sheets were shipped to customers during the month. These jobs were sold on account at 38% above cost. Required: 1. Prepare journal entries to record the transactions given above. 2. Prepare T-accounts for Manufacturing Overhead and Work in Process. Post the relevant transactions from above to each account. Compute the ending balance in each account, assuming that Work in Process has a beginning balance of $34,000. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare journal entries to record the transactions given above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet LLLLLLLLLLLS 2 3 4 5 6 7 8 9 Raw materials purchased on account, $210,000. Note: Enter debits before credits. Transaction General Journal Debit Credit a Record entry Clear entry View general journal Record the raw materials issued to production, $190,000 ($152,000 direct materials and $38,000 indirect materials). ote: Enter debits before credits. General Journal Debit Credit Transaction b. Record the entry for accrued direct labor cost incurred, $48,000; indirect labor cost incurred, $20,000. lote: Enter debits before credits. Transaction General Journal Debit Credit C. Depreciation recorded on factory equipment, $105,000. ote: Enter debits before credits. General Journal Debit Credit Transaction d. Other manufacturing overhead costs accrued during October, $130,000. ote: Enter debits before credits. Transaction General Journal Debit Credit e. The company applies manufacturing overhead cost to production on the basis of $9 per machine-hour. A total of 76,500 machine-hours were recorded for October lote: Enter debits before credits. General Journal Debit Credit Transaction f. w Jobs costing $511,000 according to their job cost sheets were completed during October and transferred to Finished Goods. Note: Enter debits before credits. General Journal Debit Credit Transaction g. Record the cost of goods sold. Note: Enter debits before credits. General Journal Debit Credit Transaction h(1). Record the sales on account. Note: Enter debits before credits. General Journal Debit Credit Transaction h(2) Prepare T-accounts for Manufacturing Overhead and Work in Process. Post the relevant transactions from above to each account. Compute the ending balance in each account, assuming that Work in Process has a beginning balance of $34,000. Manufacturing Overhead Work in Process Beg. bal. Beg. bal. End. bal. End. bal