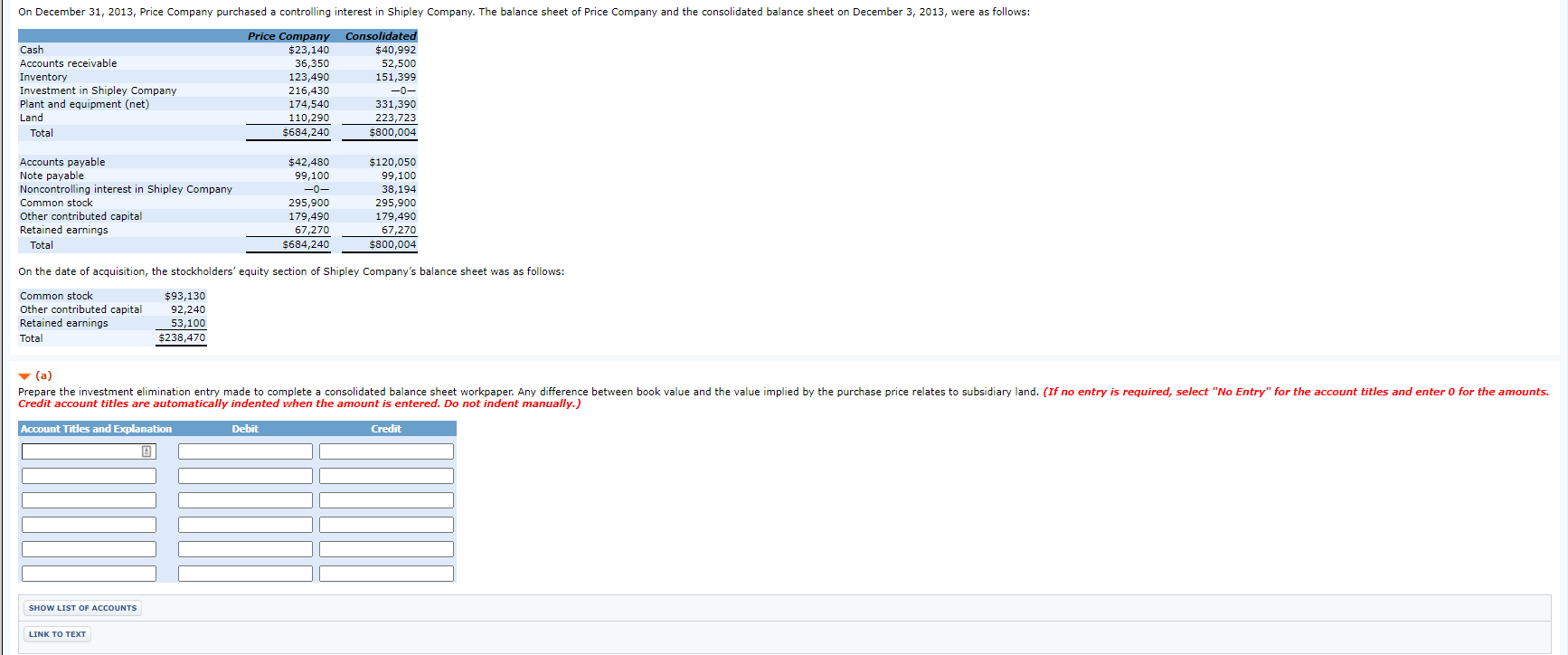

| Exercise 3-6 On December 31, 2013, Price Company purchased a controlling interest in Shipley Company. The balance sheet of Price Company and the consolidated balance sheet on December 3, 2013, were as follows: | | | Price Company | | Consolidated | | Cash | | $23,140 | | $40,992 | | Accounts receivable | | 36,350 | | 52,500 | | Inventory | | 123,490 | | 151,399 | | Investment in Shipley Company | | 216,430 | | 0 | | Plant and equipment (net) | | 174,540 | | 331,390 | | Land | | 110,290 | | 223,723 | | Total | | $684,240 | | $800,004 | | | | | | | | Accounts payable | | $42,480 | | $120,050 | | Note payable | | 99,100 | | 99,100 | | Noncontrolling interest in Shipley Company | | 0 | | 38,194 | | Common stock | | 295,900 | | 295,900 | | Other contributed capital | | 179,490 | | 179,490 | | Retained earnings | | 67,270 | | 67,270 | | Total | | $684,240 | | $800,004 | On the date of acquisition, the stockholders equity section of Shipley Companys balance sheet was as follows: | Common stock | | $93,130 | | Other contributed capital | | 92,240 | | Retained earnings | | 53,100 | | Total | | $238,470 | | | | |

| | (a) Prepare the investment elimination entry made to complete a consolidated balance sheet workpaper. Any difference between book value and the value implied by the purchase price relates to subsidiary land. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) | Account Titles and Explanation | Debit | Credit | | | | | | | | | | | | | | | | | | | | | | | | | | | |

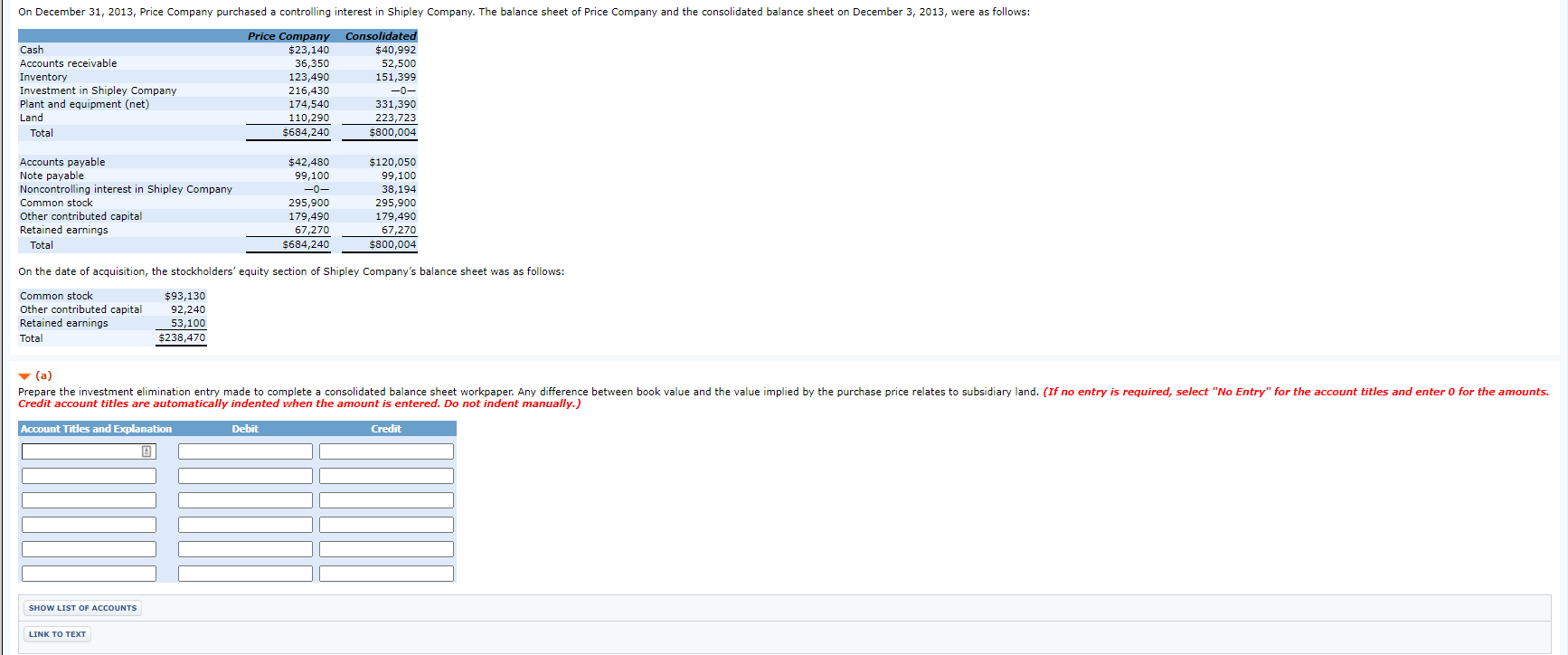

On December 31, 2013, Price Company purchased a controlling interest in Shipley Company. The balance sheet of Price Company and the consolidated balance sheet on December 3, 2013, were as follows: Cash Accounts receivable Inventory Investment in Shipley Company Plant and equipment (net) Price Company $23,140 36,350 123,490 216,430 174,540 110,290 $684,240 Consolidated $40,992 52,500 151,399 -0- 331,390 223,723 $800,004 Land Total Accounts payable Note payable Noncontrolling interest in Shipley Company Common stock Other contributed capital Retained earnings Total $42,480 99, 100 -O- 295,900 179,490 67,270 $684,240 $120,050 99,100 38,194 295,900 179,490 67,270 $800,004 On the date of acquisition, the stockholders' equity section of Shipley Company's balance sheet was as follows: Common stock Other contributed capital Retained earnings Total $93,130 92,240 53,100 $238,470 (a) (a Prepare the investment elimination entry made to complete a consolidated balance sheet workpaper. Any difference between book value and the value implied by the purchase price relates to subsidiary land. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit D SHOW LIST OF ACCOUNTS LINK TO TEXT