Question

Exercise 3-7 Preparing adjusting entries LO P1. A. wages of $6,000 are earned by workers but not paid as of December 31, 2017. B. Depreciation

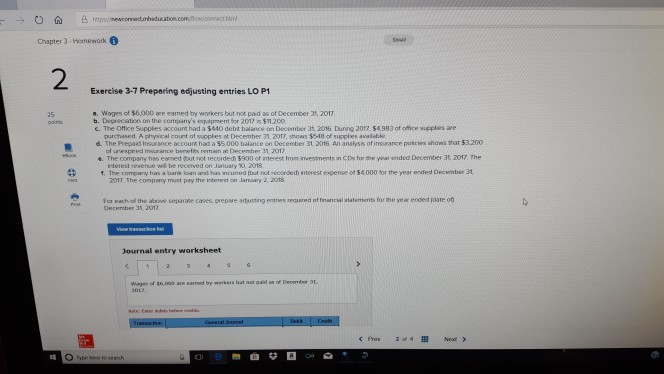

Exercise 3-7 Preparing adjusting entries LO P1. A. wages of $6,000 are earned by workers but not paid as of December 31, 2017. B. Depreciation on the company's equipment for 2017 is $11,200. C. The office supplies account had a $440 debit balance on December 31, 2016. During 2017, $4,983 of office supplies are purchased. A physical count of supplies at December 31st, 2017, shows $548 of supplies available. D. The prepaid Insurance account had a $5,000 balance on December 31, 2016. An Analysis of insurance policies shows that t $3200 of unexpired insurance benefits remain at December 31, 2017. E. The company has earned (but not recorded) $900 of interest from Investments in CDs for the year ended December 31, 2017. The interest Revenue will be received on January 10, 2018. F. The company has a bank loan and has incurred (but not recorded) interest expense of $4,000 for the year ended December 31, 2017. The company must pay the interest on January 2, 2018. ** For each of the above separate cases, prepare adjusting entries required of financial statements for the year ended (date of) December 31, 2017.

hum Chapter 3 -Homework 2 Exercise 3-7 Preparing edjusting entries LO P1 a. Wages of $6,000 re eamed by workers but not paid as of December 31, 2017 b. Deprecation on the compamy'seqapment for 2012 $11.20o c. The Office Supples accounn had a $440 debt balance an December 31 2016 Dunng 2017, $4983 of office supplies are d. The Prepaid Insurance account had a $5,000 balance on December 31 2016 An analyss of insurance pokces shdws that $3.200 .. The company has ered tut rot recorded S 900 of merest hon nesments n CDs foth" yea, ended December 3, 20" The . The cnmpany has a harik loan and has incured (tbut not necordedi merest expense iof $4000 for the year ended Dncembir 31 prchased A physical court of wrpie, December 3t at, shows SMB of suspi es avalable of unexpeed irsurance benelts remein at Decembe 31, 201 rterest revenue wil be recerved or,January , 2018 201T. The compamy must pay the Interest on Janary 2, 2018 or each of the dbove separane cases, prepare adjusing entries seqired nf fiencial siafsmmbs for the year ended idate ot Journal entry worksheet of g5,poo are

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started