Answered step by step

Verified Expert Solution

Question

1 Approved Answer

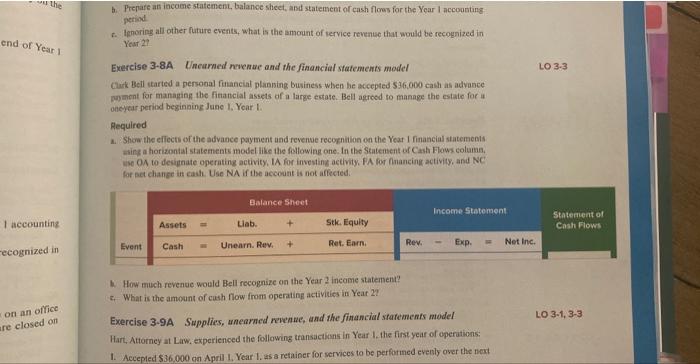

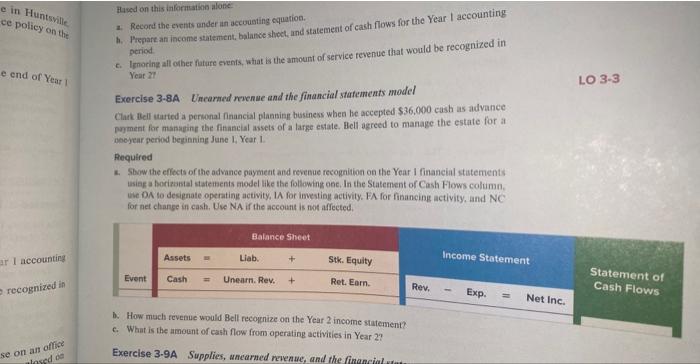

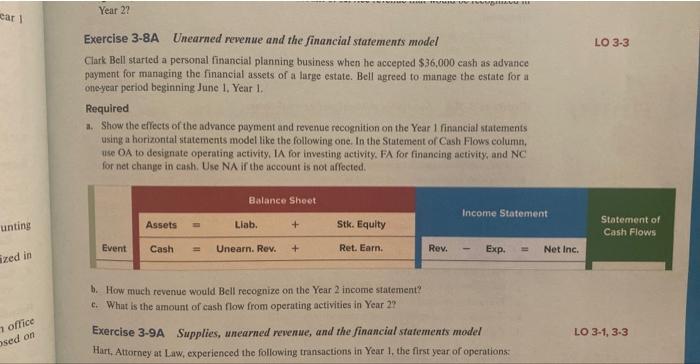

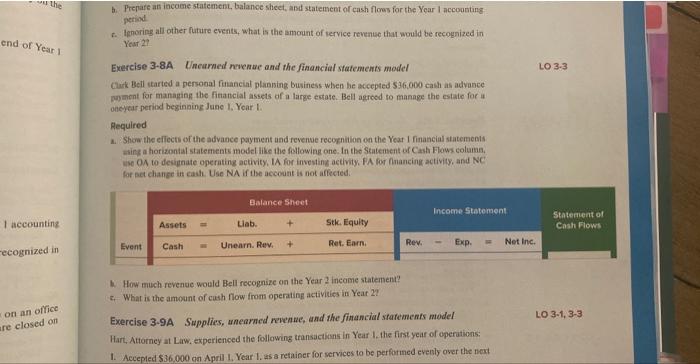

Exercise 3-8A b. Prepare an income statement, balance sheet, and statement of cash flows for the Year 1 accoanting period. c. Ifooring all other future

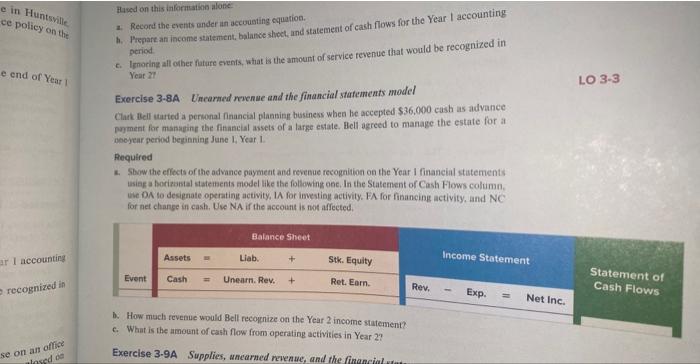

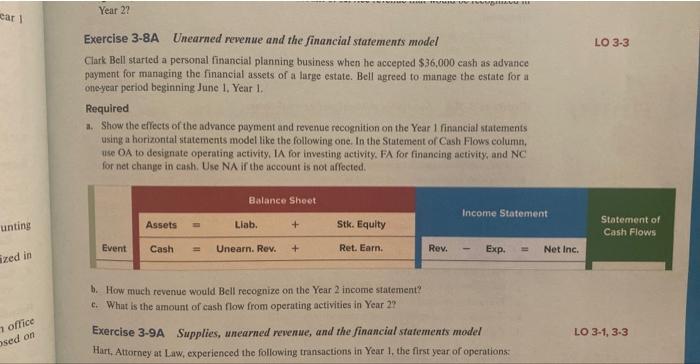

Exercise 3-8A

b. Prepare an income statement, balance sheet, and statement of cash flows for the Year 1 accoanting period. c. Ifooring all other future events, what is the amount of vervice revense that would be recognized in Exercise 3-8A Lneurned nvenue and the financial statements model LO 3.3 Cark Beil tarted a personal financial planising business when be accepted $36,000 cash as advance manent for managing the financial assets of a large ectate. Bell agreed to manage the estate for u oncyear periad beginning June 1. Year 1 . Required 4. Show the effects of the advance payment und revenve recoenition on the Yeat I financial statemens asing a horizontal statements model like the fellowing one. In the Statement of Cash Flows column, ise ON to designate operating activity, IA for investing activity. PA for Hnancing activity, and NC: for ad change in cash. Use NA if the accoant is not affected. 1 accounting recognized in 4. How much revende would Bell recognize on the Year 2 income statement? . What is the amount of cush flow from operating activities in Yeat 2? Exercise 3-9A Supplies, unearned revenue, and the financial statements model Lo 31,33 Hart, Attorney at Law, experienced the following transactions in Year 1. the firstyear of operations: 1. Accepted $36,000 on April L. Year I, as a retainer for services to be performed evenly over the ned 2. Record the events ander an accounting equation. h. Prepare an income seatement, balanse shoet, and statement of cash flows for the Year I accounting period c. Ignoring all other fature events, what is the amount of service fevenue that would be recognized in Yeat Xl Exercise 3-8A. Vincarned ruenue and the financial stafements model Clark Bell tarted a perional financial planning business when he accepted $36,000 cash as advance pyment for manseine the financial assets of a large estate. Bell agreed to manage the estate for a oncyear period beeinning June Li, Year 1 . Required 4. Show the effects of the advance payment and revenue recognition on the Year I financial stutements usiag a horizassal statements model like the following oec. In the Statement of Cash Flows column, we DA to designate operating activity, 1A for imesting activity. FA for finaneing activity, and NC for net change in cash. Use NA if the account is not affected. D. How much tevenue would Bell recognize on the Year 2 income statement? c. What is the amosnt of cash flow from operating activities in Year 2? Exercise 3-8A Unearned revenue and the financial statements model LO 33 Clark Bell started a personal financial planning business when he accepted $36,000 cash as advance payment for managing the finaneial assets of a large estate. Bell agreed to manage the estate for a oneyear period beginning June 1. Year 1. Required a. Show the effects of the advance payment and revenue recoenition on the Year 1 financial statements using a horizontal statements model like the following one. In the Statement of Cash Flows column, ase OA to designate operating activity, IA for investing activity. FA for financing activity, and NC for net change in eanh. Use NA if the account is not affected. b. How much revenue would Bell recognize on the Year 2 income statement? c. What is the amount of cash flow from operating activities in Year 2? Exercise 3-9A Supplies, unearned revenue, and the financial statements model LO 3-1, 3.3 Hart, Attorney at Law, experienced the following transactions in Year 1 , the first year of operations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started