Answered step by step

Verified Expert Solution

Question

1 Approved Answer

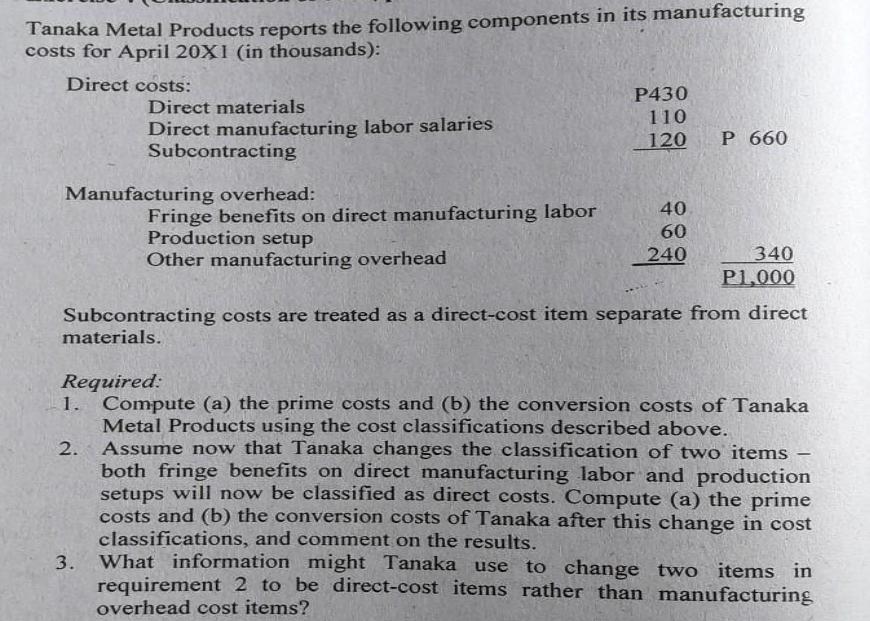

Tanaka Metal Products reports the following components in its manufacturing costs for April 20X1 (in thousands): Direct costs: P430 110 Direct materials Direct manufacturing

Tanaka Metal Products reports the following components in its manufacturing costs for April 20X1 (in thousands): Direct costs: P430 110 Direct materials Direct manufacturing labor salaries Subcontracting 120 660 Manufacturing overhead: 40 Fringe benefits on direct manufacturing labor Production setup Other manufacturing overhead 60 240 340 P1,000 Subcontracting costs are treated as a direct-cost item separate from direct materials. Required: 1. Compute (a) the prime costs and (b) the conversion costs of Tanaka Metal Products using the cost classifications described above. Assume now that Tanaka changes the classification of two items both fringe benefits on direct manufacturing labor and production setups will now be classified as direct costs. Compute (a) the prime costs and (b) the conversion costs of Tanaka after this change in cost classifications, and comment on the results. What information might Tanaka use to change two items in 2. - 3. requirement 2 to be direct-cost items rather than manufacturing overhead cost items?

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 a Prime costs Direct Materials Direct Manufacturing Labor Subcontracting P 430 P 110 P 120 P 66...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6361023cd4e5f_235246.pdf

180 KBs PDF File

6361023cd4e5f_235246.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started