___________________________________

___________________________________

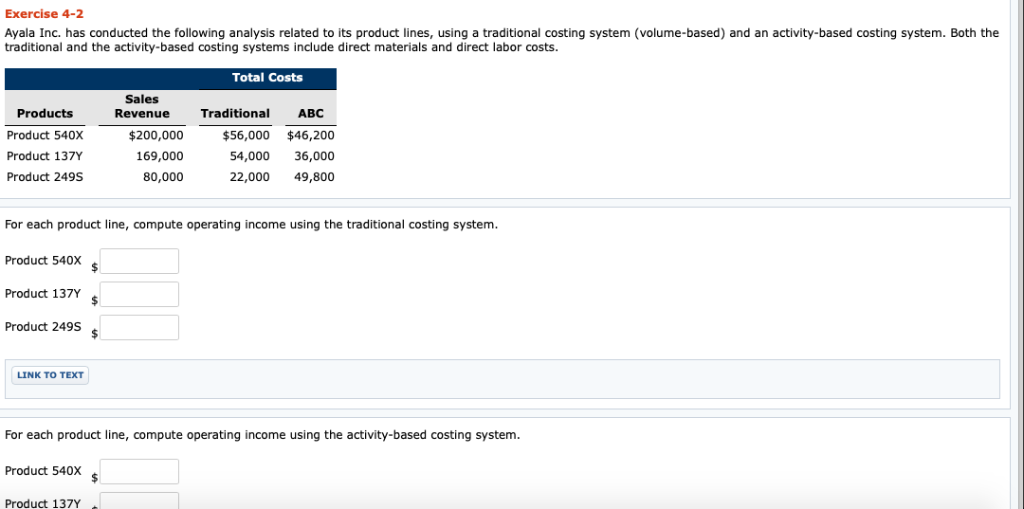

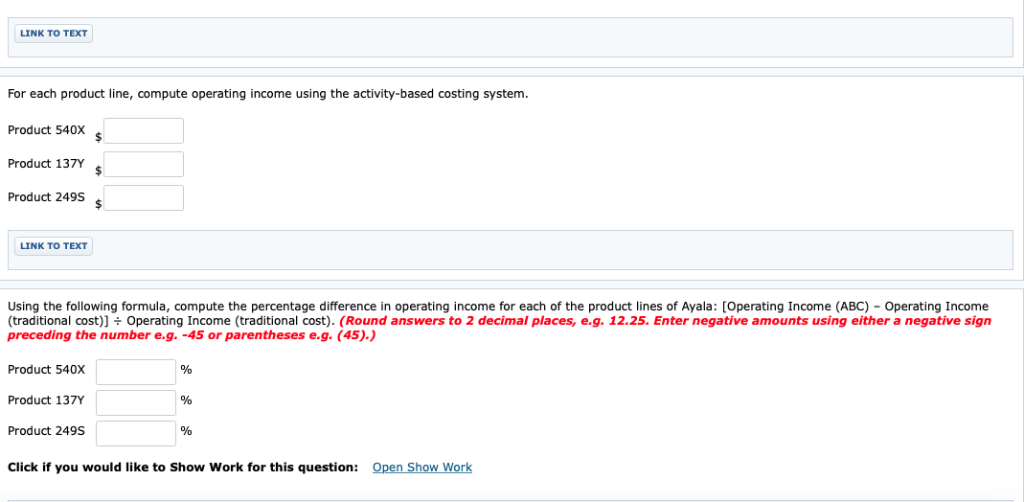

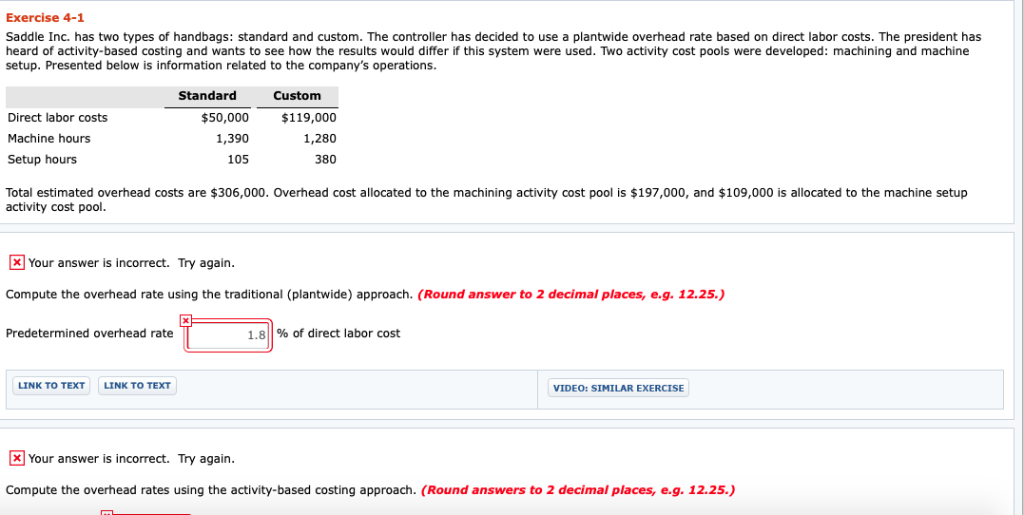

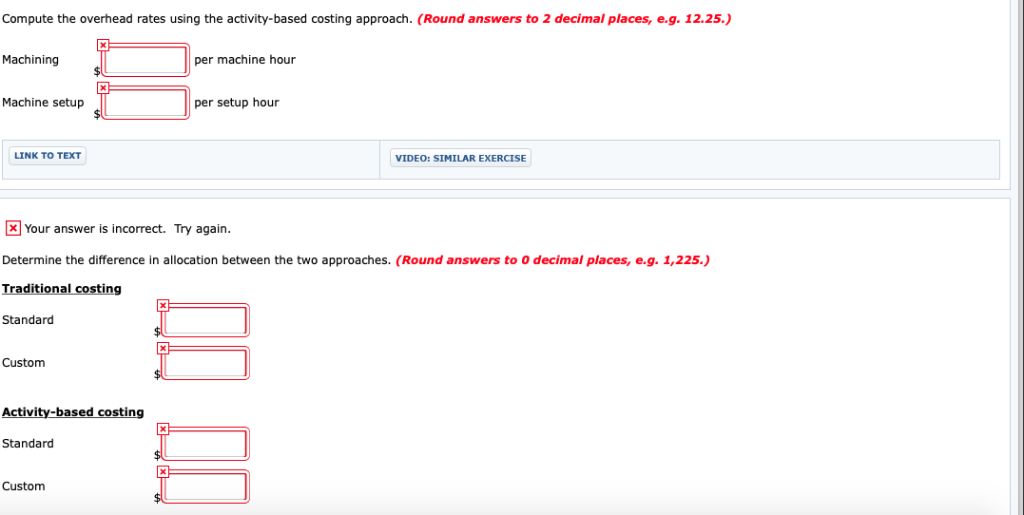

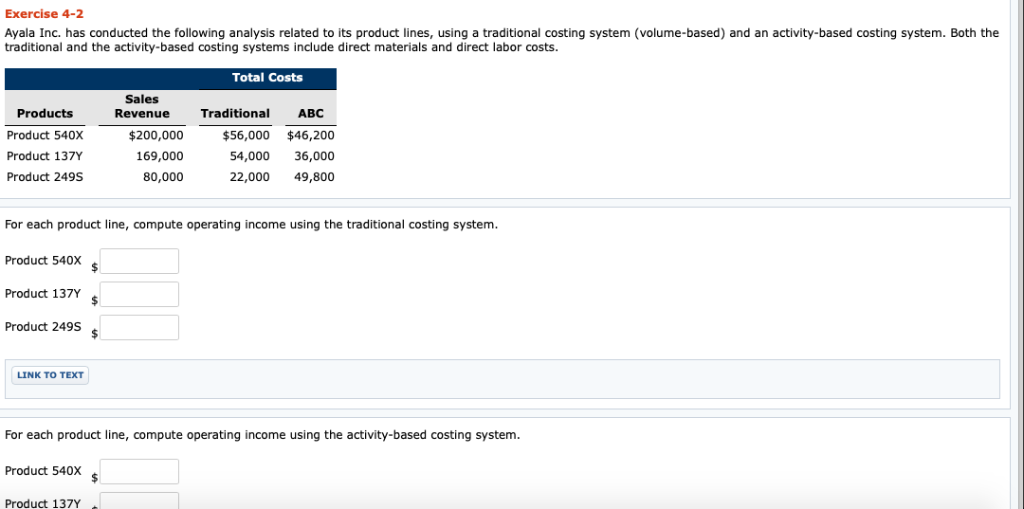

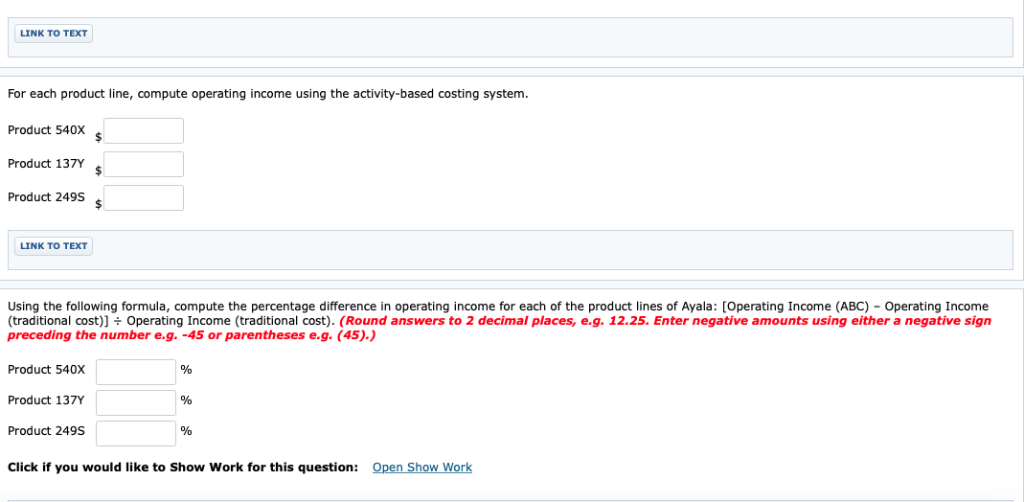

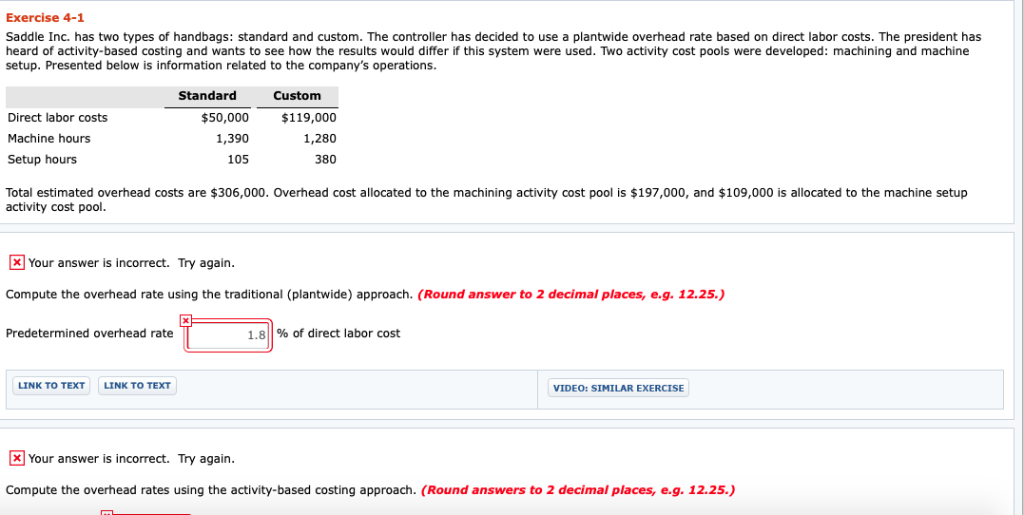

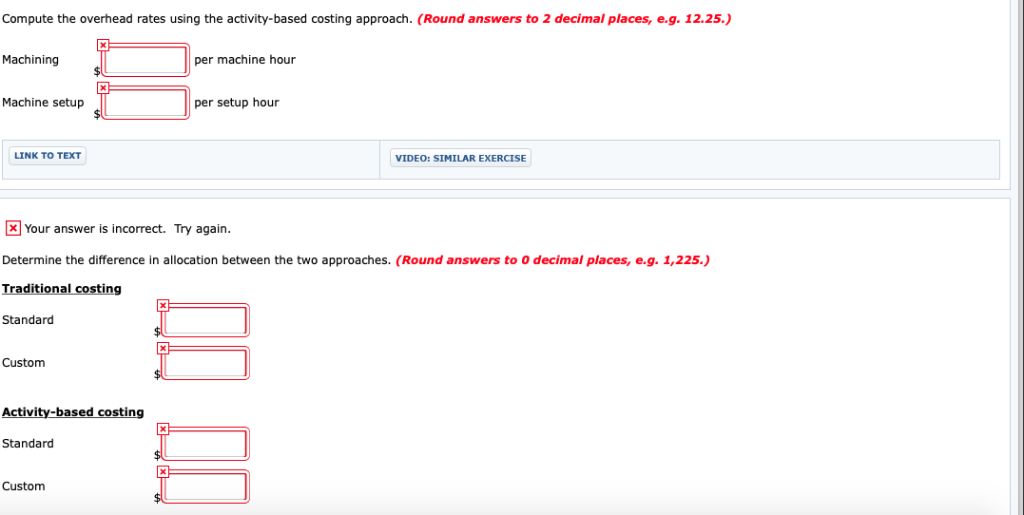

Exercise 4-1 Saddle Inc. has two types of handbags: standard and custom. The controller has decided to use a plantwide overhead rate based on direct labor costs. The president has heard of activity-based costing and wants to see how the results would differ if this system were used. Two activity cost pools were developed: machining and machine setup. Presented below is information related to the company's operations. Standard Custom Direct labor costs Machine hours Setup hours 50,000$119,000 1,280 380 1,390 105 Total estimated overhead costs are $306,000. Overhead cost allocated to the machining activity cost pool is $197,000, and $109,000 is allocated to the machine setup activity cost pool. Your answer is incorrect. Try again. Compute the overhead rate using the traditional (plantwide) approach. (Round answer to 2 decimal places, e.g.12.25.) Predetermined overhead rate 1.81 % of direct labor cost LINK TO TEXT LINK TO TEXT VIDEO: SIMILAR EXERCISE Your answer is incorrect. Try again. Compute the overhead rates using the activity-based costing approach. (Round answers to 2 decimal places, e.g.12.25. Compute the overhead rates using the activity-based costing approach. (Round answers to 2 decimal places, e.g. 12.25.) Machining per machine hour Machine setup per setup hour LINK TO TEX VIDEO: SIMILAR EXERCISE Your answer is incorrect. Try again. Determine the difference in allocation between the two approaches. (Round answers to O decimal places, e.g. 1,225.) Traditional costing Standard Custom Activity-based costing Standard Custom Exercise 4-2 Ayala Inc. has conducted the following analysis related to its product lines, using a traditional costing system (volume-based) and an activity-based costing system. Both the traditional and the activity-based costing systems include direct materials and direct labor costs. Total Costs Sales Revenue Products Product 540X Product 137Y Product 249S Traditional ABC $200,000 169,000 80,000 56,000 $46,200 54,000 36,000 22,000 49,800 For each product line, compute operating income using the traditional costing system Product 540X s Product 137Y Product 249S LINK TO TEXT For each product line, compute operating income using the activity-based costing system Product 540X Product 137Y LINK TO TEXT For each product line, compute operating income using the activity-based costing system. Product 540x s Product 137Y Product 249S LINK TO TEXT Using the following formula, compute the percentage difference in operating income for each of the product lines of Ayala: [Operating Income (ABC) Operating Income (traditional cost)] Operating Income (traditional cost). (Round answers to 2 decimal places, e.g. 12.25. Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45) Product 540x Product 137Y Product 249S Click if you would like to Show Work for this question: Open Show Work

___________________________________

___________________________________